Liquidity drought in Treasury market accompanies unexpected rally

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The trading climate in the $22tn US government bond market has become less hospitable, adding to choppy moves in securities that act as a foundation of the global financial system.

Liquidity — the ease with which an investor can buy or sell an asset — has deteriorated in recent weeks, data show. That has added to the pressure on regulators to improve a market long viewed as a haven during times of trouble.

But regulators are far from any solution, according to a progress report released this week by a federal working group charged with assessing the structure of the US Treasury bond market.

The report, part of a review commissioned after Treasury markets were thrown into chaos at the start of the coronavirus pandemic, detailed why there have been liquidity problems in recent years. It also outlined some familiar solutions such as increased transparency and oversight and central clearing.

It stopped short of making any policy recommendations and did not suggest a timeline for the work, however.

“The report does not go far enough to support the plumbing of the Treasury market and to assure that liquidity providers will remain trading when conditions become stressed,” said Yesha Yadav, a professor at Vanderbilt Law School who researches Treasury markets regulation.

The report arrived as liquidity conditions have once again worsened. Demand for Treasury debt has risen in recent days, leading to a jump in the price of 30-year bonds to the highest level since July. The price of the benchmark 10-year bond has risen to its highest level since September.

The current rise in prices is counter-intuitive. The Fed last week announced intentions to slow its pandemic-era purchases of Treasuries, which will mean the exit of the market’s biggest buyer. There is also no clear fundamental economic reason why demand for these haven securities should be so high at the moment: October’s US employment report showed strong jobs growth, plus riskier assets such as stocks are booming.

“This seems to be something that has got to be sending sort of a troubling signal to central bankers, because it is not fundamentally driven. There’s clearly some ‘position unwinds’ that are going on as we speak,” said Subadra Rajappa, head of US rates strategy at Société Générale.

This “position unwind” means that speculators are rushing to get out of bets that longer-dated Treasury prices would fall. The trade has been a popular one in recent months, but the relentless move higher in prices has clobbered hedge funds including Rokos Capital Management, Alphadyne Asset Management and Odey Asset Management.

As investors exit these bearish positions, liquidity has been worsening, making the moves even more extreme. JPMorgan Chase research from November 5 showed that market depth, one measure of liquidity, had declined to the lowest levels since summer, when fears about the effect of the Delta variant on the US economy hampered liquidity.

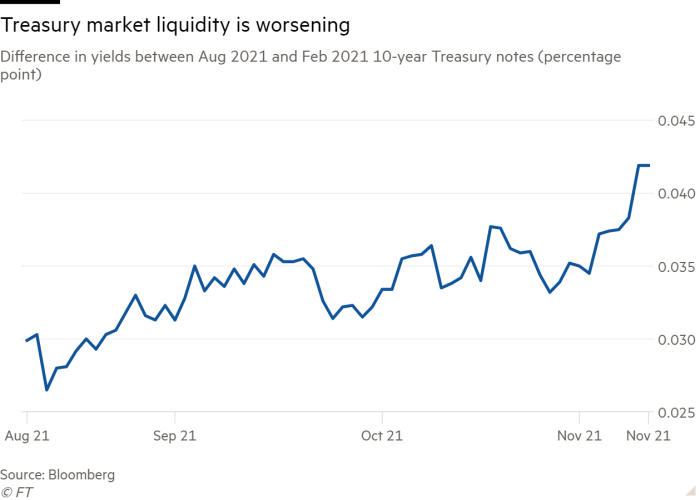

Another way to measure liquidity is to look at the difference in yields between the most recently issued security — the 10-year note issued in August which is typically very liquid — and older securities that are typically traded less. That spread has moved significantly higher for 10-year Treasuries since late October.

Liquidity problems have been a factor in recent price moves, said Kevin McPartland, head of market structure research at Coalition Greenwich. “You could see it all through October. You can even see it today,” he said.

McPartland noted that the ICE BofA Move index, which measures volatility in the Treasury market, remains elevated after last week hitting the highest level since the coronavirus first roiled markets in March 2020.

“There’s more volatility because there’s more uncertainty. And liquidity issues go part and parcel with that,” said Kristina Hooper, chief global market strategist at Invesco US.

Comments