ETF ownership of Tesla climbed to 7% after it joined S&P 500

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit the FT’s ETF Hub for news and analysis, investor education and tools to help you select the right ETFs.

ETF ownership of Tesla rose to about 7 per cent of its market capitalisation last year, after it was added to the S&P 500 and its weighting increased on other popular indices.

Assets invested in Tesla through exchange traded funds rose to $48.5bn by the end of December with 518 ETFs holding Tesla shares, data from TrackInsight show.

“Indices’ importance in the overall marketplace has grown,” said Ben Johnson, director of global ETFs and passive strategies research at Morningstar.

“Why Tesla comes up and why we keep referring back to it is because I think it’s, by many measures, the most prominent example to date of index manufacturers’ influence on the direction of billions of dollars of investors’ capital worldwide.”

Tesla’s shares reached a record high in December, when investors rushed to buy them ahead of its inclusion in the S&P 500 index.

Johnson said that the decision to include a company in the S&P 500 index, which is “probably the most widely followed benchmark on the planet” with trillions of dollars tracking the index, can have a huge impact on individual companies.

However not every index that includes Tesla among its constituents weights it only according to its market capitalisation. Tesla, which became a household name with its high-end electric vehicles, is sometimes awarded a higher weighting in indices that track companies according to their environmental, social and governance (ESG) ratings.

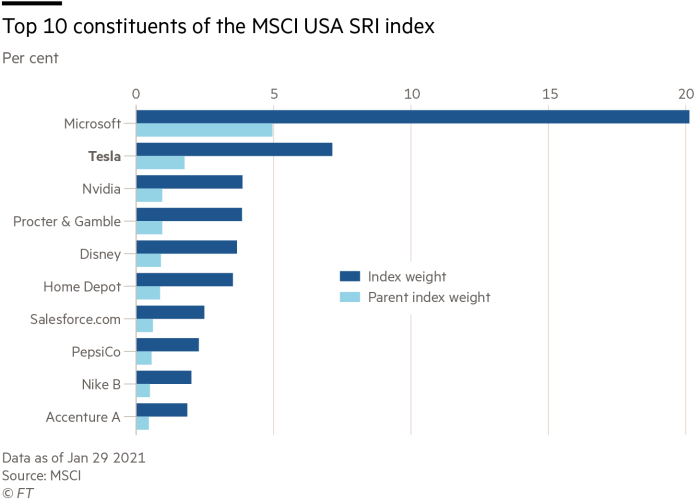

The MSCI USA SRI index, for instance, is based on the MSCI USA but to satisfy its socially responsible investment aims it includes only 130 companies compared to the 620 constituents in its parent index.

The two indices also give their constituents vastly different weightings — Microsoft, for example, has the largest weighting in the MSCI USA SRI of 20 per cent compared to only around 5 per cent in the MSCI USA.

Tesla’s weighting is also markedly different, accounting for around 7 per cent of the MSCI USA SRI compared to around 1.8 per cent in the MSCI USA.

However that heavier weighting for Tesla is now under scrutiny following its announcement last month that it had made a $1.5bn investment in bitcoin. The news has put pressure on ESG rating agencies and index providers to reconsider their methodology due to the huge environmental impact of bitcoin mining.

“We are learning more than ever about the world around us and we’re recognising the impact of our behaviour,” said James McManus, chief investment officer at Nutmeg, an online investment manager.

“It’s forcing individuals to link some of the factors that they see in their wider life with their investment life and to wonder how much impact they can have by addressing that within their investments,” he added.

MSCI builds the MSCI USA index by choosing the largest companies by market capitalisation in the large and mid-cap segments of the US market, while the SRI version has the same methodology but integrates ESG screenings, said Rumi Mahmood, senior associate in ESG Research at MSCI.

"There's no active decision... it's all rule-based," he added.

However, Johnson said index providers could not pretend that their choices over what companies to include in an index were not active ones. “There is a real element of subjectivity. You have a committee that obviously has certain objectives, but at the end of the day, they are the ones responsible for making the call about which stocks are in and which stocks are out,” Johnson said.

Tesla’s bitcoin investment could determine whether S&P Global decides to include Tesla in its S&P 500 ESG index for the first time when it announces its annual rebalancing of the index at the end of April.

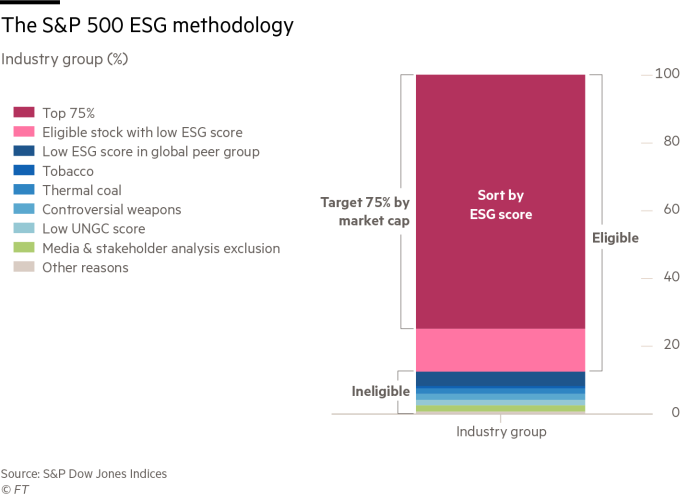

Reid Steadman, head of environmental, social & governance indices at S&P Dow Jones Indices, said that the group was not able to disclose whether Tesla would be included, but added that the overriding goal “is to have a return in line with the parent index, while improving from a sustainability standpoint”.

“So the mechanics of it, in terms of selecting the constituents, is that within a given industry group, we rank the companies by their ESG score, and then we start selecting, from the top down, trying to get as close as possible to the 75 per cent market cap coverage.”

Both MSCI and S&P Global have said that bitcoin exposure would not be reflected in ESG metrics this year, but that it might be a consideration in the future.

Click here to visit the ETF Hub

Comments