Investors stand by big yen short despite BoJ intervention

Simply sign up to the Foreign exchange myFT Digest -- delivered directly to your inbox.

The Bank of Japan’s intervention to prop up the yen this week comes as hedge funds and asset managers have built up large short positions against the currency. With billions of dollars on the line, many say they are staying put for now.

The yen has fallen victim to the remarkably strong dollar this year, reaching its weakest level against the US currency in 24 years on Thursday just before the BoJ’s move. It has been losing value since the start of the year, a move that accelerated after the Federal Reserve signalled its intention to implement rate rises at one of the fastest clips in years.

That weakness has attracted bets from investors wagering the yen still has further to go. And despite the BoJ’s attempt to strengthen the currency, investors and analysts said they do not expect a massive unwinding of the short positions any time soon.

While the intervention might bolster the yen in the very short term, they argued the only way it will appreciate meaningfully for a sustained period of time is if Japan’s central bank raises rates or if the Fed starts loosening monetary policy. Neither outcome is widely expected.

The $1.2tn of foreign currency reserves that the BoJ holds is likely to provide a buffer. But investors stressed those reserves are limited and provide only a temporary solution.

“The BoJ may succeed in dislodging some quantity of short interest in the short term, but longer term it is not a sustainable policy,” said David Rossmiller, head of portfolio management at Bessemer Trust. “It is not going to squeeze the shorts out.”

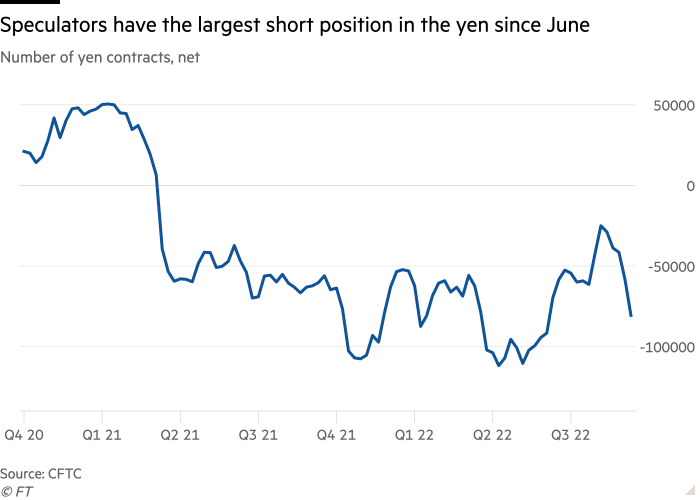

Speculators have a net short position worth roughly $7bn against the yen, according to data from the Commodity Futures Trading Commission — the largest since early June.

“It doesn’t change anything because the core reason why the yen has been weak is the Bank of Japan’s monetary stance, and that hasn’t changed, despite interest rates going up materially in the rest of the world,” said a hedge fund trader who has shorted the currency.

Mazen Issa, a strategist at TD Securities, said: “Doing foreign exchange intervention unilaterally is a losing proposition. The Fed is raising rates, so there is a finite amount of intervention you can be doing. You’re fighting the market.”

The dollar has this year risen to its strongest level in decades as the Fed embarked on its monetary tightening campaign. The dollar index, which measures the greenback against a basket of six rivals, hit a fresh 20-year high on Wednesday after the US central bank raised interest rates by 0.75 percentage points for the third time in a row.

Higher interest rates on US Treasuries have attracted foreign investors, also bolstering the dollar. Currencies around the world have borne the brunt of the soaring buck — but Japan has been particularly hard hit because its central bank has held interest rates in negative territory since the great financial crisis.

Sam Lynton-Brown, head of global macro strategy at BNP Paribas, said: “Our view is [the dollar versus the yen] is going to remain elevated up until the point that US yields begin to fall back or . . . the market materially price[s] in a possible normalisation of monetary policy in Japan.”

Karl Schamotta, chief market strategist at Corpay, said: “Even with massive foreign exchange reserves at their disposal, Japanese authorities cannot reverse the tide. Fundamental performance gaps are driving interest rate differentials wider, and the yen is falling for good reason.”

However, some analysts predict the BoJ will do more to arrest the sliding yen, viewing this week’s intervention as the first of multiple steps.

The wild card would be if the BoJ raises rates. Betting it will do so has been such a bad wager that it has become known as the “widow maker” trade. But the currency intervention was unexpected, raising the prospect of another unforeseen move.

Shahab Jalinoos, global head of foreign exchange strategy at Credit Suisse, said that if this week’s gambit by the BoJ does not have the intended effect, “then the odds rise . . . that at one of the next BoJ meetings, monetary policy would have to change”.

Comments