Traders struggle to transact shares in volatile US stock market

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

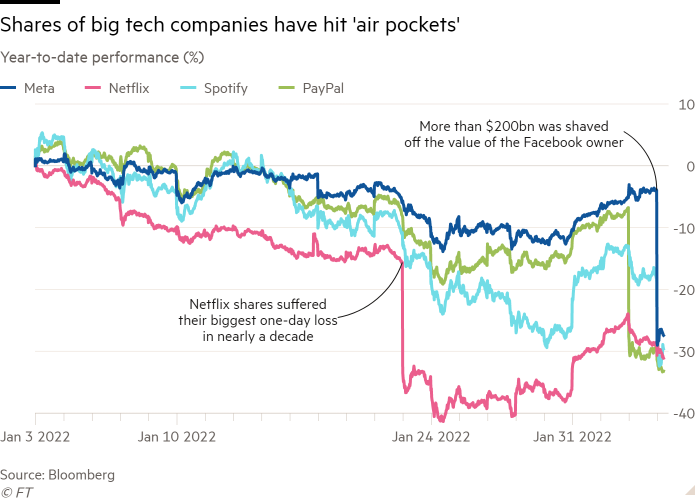

Huge swings in US stocks such as Meta, PayPal and Snap this week reflected surprises in their financial results but also point to what investors say has been a dramatic recent decline in the capacity to transact large batches of shares.

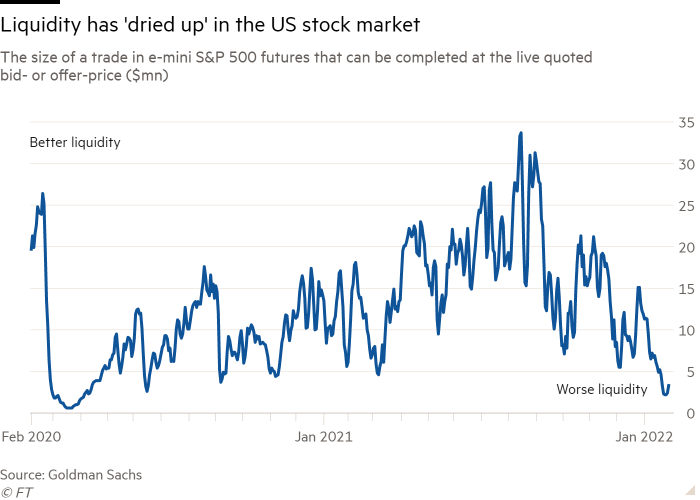

Liquidity — the ability to buy or sell an asset without influencing the price — has been a hallmark of the $51tn US equities market. But over the past two weeks money managers have observed its deterioration, with costs increasing to complete large purchases or sales and prompting some to avoid putting on big trades entirely.

“Intraday liquidity has dried up so much,” said Patrick Murphy, a partner at GTS, a market making group. “I haven’t seen anything like it since March 2020.”

Rocky Fishman, a Goldman Sachs strategist, noted that liquidity had “weakened so substantially” that the difference between the prices at which traders can buy or sell e-mini S&P 500 index futures, one of the most popular tools for betting on the direction of the US stock market, was frequently reaching 50 cents over the past two weeks. That is double the standard 25-cent gap registered in a healthy market.

“Weak liquidity . . . leaves the potential for outsized market moves,” he said.

Those swings have been on display as some of the largest companies in the US reported results, with those falling short of Wall Street estimates plunging in value in magnitudes rarely seen outside of a crisis.

Shares of Facebook owner Meta fell more than a quarter on Thursday, its worst day on record with more than $230bn wiped from its market capitalisation. PayPal plunged almost 25 per cent after it missed forecasts. Last month, Netflix slid by the most in almost a decade.

Shares of the social media company Snap soared by more than half and Amazon rose about 15 per cent in after-hours trading following its quarterly earnings late on Thursday, suggesting sharp rises when exchanges reopened on Friday.

Traders described “air pockets” in the market, when prices shifted rapidly and in one direction. The head of one of the largest trading desks on Wall Street said the so-called block market — where brokers help strike big stock trades that can range in size from tens of millions of dollars to more than $1bn — had “for the most part shut down” during the worst of the market gyrations.

“Because of the heightened level of volatility, the pricing to execute any kind of a trade has gotten so wide that it is very hard to match sellers and buyers because buyers want discounts reflective of the risks,” the person said, referring to the difference between offer and bid prices for certain stocks.

The turbulent conditions come as investors reposition portfolios to adjust to tighter monetary policy from the Federal Reserve, which is seeking to tame inflation and cool a rapidly growing economy.

“You have this intersection of macro and monetary policy at the same time as micro news around earnings,” said Ron Temple, head of US equities at Lazard Asset Management. “On Wall Street the vast majority of traders, strategists and portfolio managers haven’t experienced inflation like this. The volatility is exacerbated by earnings season, but I think it will remain throughout the year as people try to work out where this will settle.”

The uptick in volatility and poor market functioning have prompted many investors to shift to exchange traded funds, where they believe they can purchase or offload large blocks of shares quickly without moving the fund’s price as much as they would if they were trading the stock of a public company.

US-listed ETF trading volumes hit a record on January 24 of $475bn, far above the previous peak set in February 2020 when the coronavirus first rocked US financial markets, according to BlackRock’s iShares unit.

In a sign, however, that the block trading market is not totally closed, Morgan Stanley executed a 40mn share sale in electric utility PG&E for a client on Monday that raised just under $500mn, said a person briefed on the transaction.

High-speed trading firms and traditional brokers have begun to show more appetite to provide liquidity to the market, albeit at very low levels. Traders this week can transact about $3mn worth of e-mini S&P 500 futures at the prevailing market price, according to Goldman data, up from a low of $2.2mn in January but nonetheless a fraction of the average over the past two years.

The persistently weak market conditions have left traders bracing for further volatility.

“The biggest takeaway is how extreme these swings have been,” said Chris Murphy, co-head of derivative strategies at Susquehanna Investment Group. “There is a bit of a feedback loop, as volatility increases liquidity decreases and as liquidity decreases volatility increases.”

Comments