Methodology: Top 401 investment advisers 2016

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

We aim to provide a list of elite professionals who specialise in advising on US employers’ defined contribution (DC) plans

The Financial Times and Ignites Research, the FT’s sister company, contacted large US brokerages, independent advisers and other wealth managers to identify qualified applicants. Our partner, Broadridge Financial Solutions, provided data that helped identify advisers specialising in serving DC plans, including 401(k) pensions and other DC accounts.

Applicants were required to advise at least $50m in DC plan assets and have at least 20 per cent of their client assets in DC plans.

The qualifying advisers completed a questionnaire about the nature of their practice, their investment recommendations and more. We added that information to our own research.

The formula the FT uses to grade advisers is based on seven factors and calculates a numeric score for each adviser. The factors were:

• DC assets under management, which signals experience.

• Growth rate in DC plan business measured by changes in both DC plan clients and assets. Growth is a proxy for performance as well as for client retention and ability to draw new business.

• Specialisation in the DC business, which is measured by what percentage of the overall assets managed by the adviser are in DC plans and how that concentration has changed.

• Years of experience advising DC plans, which indicates experience of managing DC plan assets through different economic and market environments.

• Industry certifications, which show the technical knowledge that is important in the complicated DC plan industry.

• Participation rate in DC plans advised. This looks at effectiveness by measuring approximately what portion of employees are participating on average.

• Compliance record, because a string of client complaints can signal problems.

The elite professionals

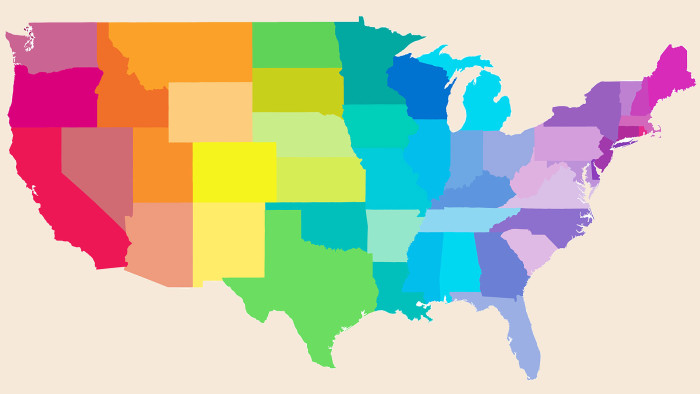

A-Z of the FT’s top advisers state by state

DC plan assets under management (AUM) accounted for about 50 per cent of each adviser’s score on average.

Around a third of the score is based on the concentration of the adviser’s overall business in serving DC plans, combined with the growth in the adviser’s DC business.

Because each adviser takes a different approach to their practices, we present the FT 401 unranked.

Comments