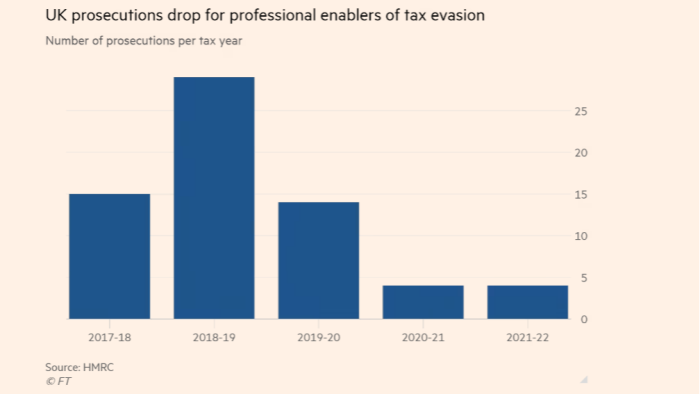

Economics class: UK prosecutions of tax evasion enablers drop by 80 per cent

Fiscal policy

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article picked by a teacher with suggested questions is part of the Financial Times free schools access programme. Details/registration here.

Specification:

Fiscal policy, withdrawals and injections from the circular flow of income, opportunity cost, government failure

Click on the article below to read and then answer the questions:

UK prosecutions of tax evasion enablers drop by 80 per cent

Briefly outline the role of HM Revenue & Customs

Distinguish between i) tax evasion; and ii) tax avoidance

Explain what is meant by the tax gap

Analyse the economic costs associated with tax evasion

Gavin Clarke, Emmanuel College

Comments