US junk bond market loses steam on mounting inflation jitters

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The US junk bond market has begun wavering on rising inflation worries, raising the risk that the powerful rally since the depths of the pandemic in the debt issued by the riskiest corporate borrowers may be coming to an end.

The high-yield bond market has been a shelter for investors seeking to avoid the volatility in stocks and government bonds this year, but these riskier assets have now begun flashing signs of caution.

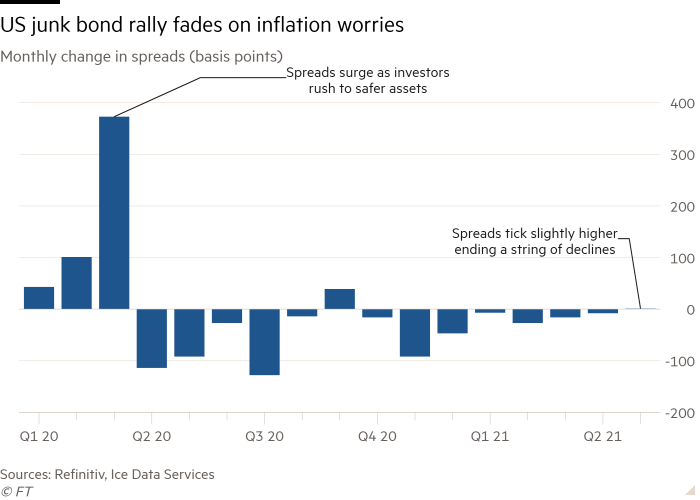

The additional yield above Treasuries investors can earn for holding junk bonds issued in the US market was essentially flat in May, marking only the second time in 14 months so-called spreads have not narrowed, according to Ice Data Services. The spread rose as high as of 3.42 percentage points earlier in May before easing to 3.29 points on Friday. It had been as low as 3.21 points in early April.

Spreads had declined sharply since the pandemic peak of near 11 percentage points reached in March 2020, as investors piled into the asset class in part owing to historic stimulus measures from global central banks and the prospect of higher economic growth as vaccine rollouts take hold.

Junk bonds are now losing momentum on fears that the reopening of the US economy could push inflation sharply higher, prompting the Federal Reserve to withdraw its support for markets.

“I think people are getting nervous there could be a taper tantrum,” said Peter Tchir, global macro strategist at Academy Securities, referring to the market ructions in 2013 caused by then-Fed chair Ben Bernanke hinting the central bank would begin reining in a bond-buying programme put in place during the 2008-09 financial crisis.

In a sign of the rising angst, investors have pulled $5.6bn from mutual and exchange traded funds that buy US high-yield bonds over the past six weeks, according to data from EPFR Global, erasing inflows into the asset class from the beginning of November when successful vaccines against Covid-19 were announced, boosting markets.

“The fund outflows show some concern in the market,” said Rhys Davies, a high yield portfolio manager at Invesco. “Up until now high yield markets have been willing to take the more optimistic view. Some inflation is fine, but too much is when we start to worry.”

High-yield bonds are seen as more insulated from rising inflation than other fixed-income assets, since more rapid price growth typically lifts revenues and makes it relatively less expensive to service debt that they have already taken on. If a period of higher inflation is also accompanied by higher growth, riskier companies are usually more likely to survive — and repay creditors, analysts say.

Invesco’s Davies pointed to robust issuance of junk debt as a good sign that trepidation has yet to take hold throughout the market. US dollar high-yield bond issuance has reached over $270bn this year, according to data from Refinitiv, already surpassing 2020s record breaking first half of the year.

However, there are signs of investor appetite dwindling. Business services company Conduent this week pulled its proposed $1.5bn debt deal across bonds and loans, in part blaming “market conditions”, according to a regulatory filing.

“Like investors in other markets, high yield investors are hanging on every possible sign of a change in Fed monetary policy, which has been holding yields down to lower levels than we would see in the absence of historically aggressive market intervention,” said Marty Fridson, chief investment officer of Lehmann Livian Fridson Advisors LLC.

Comments