ETFs play leading role as investment platforms slash costs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Exchange traded funds, centre stage in a price war that has sharply reduced the cost of investment vehicles, appear to be playing a leading role in another revolution that is slashing the cost of investing — the proliferation of low or no-fee online platforms and apps.

A recent survey by PwC of industry participants representing around 80 per cent of global ETF assets found that online platforms were now forecast to be the primary source of future ETF demand.

And that surge in expected demand from online platforms is partly because they are a natural home for ETFs, according to Marie Coady, PwC global ETF leader.

“ETFs provide an attractive investment option for platforms . . . offering benefits including lower costs, increased transparency and the ability to trade instantly,” she said.

ETFs are, for example, the only vehicle offered by UK start-up InvestEngine, which offers a free self-directed investment platform as well as a low-cost managed portfolio business. However, the three-year-old platform is capitalising on a trend towards greater uptake of ETFs which has also been detected by longer-standing online brokerages.

Scalable Capital, a €6bn digital investment platform available in several European countries which, along with other so-called neobrokers, has helped to turbocharge ETF investment in Germany, offers access to a broad range of securities. However, Erik Podzuweit, co-founder and co-chief executive, said investors on its online brokerage service mainly come for ETFs.

Also reacting to the rise in interest in ETFs is Hargreaves Lansdown, a stalwart of the UK investment scene which has just announced that it will launch research on ETFs.

Emma Wall, head of investment analytics and research at Hargreaves Lansdown, said it had always offered ETFs but had not offered ETF research before because until recently there had been relatively little interest in the products on its platform.

“In the past few years we’ve seen growing demand for ETFs,” she said, adding that at the vanguard of this change in investment behaviour were younger investors who tended to trade more frequently but who typically invested in a broader range of instruments than their older counterparts.

Part of the appeal of ETFs is their cheaper cost.

Not only have there been successive records set for flows into exchange traded funds, which tend to charge lower fees than their mutual fund peers, but also a relentless price war between competing providers that shows no sign of abating. The price cutting suggests providers know that costs are increasingly important to consumers.

Now platforms are also beginning to respond to that price consciousness. As Dzmitry Lipski, head of funds research at the UK’s Interactive Investor platform, said: “Thanks to their [mainly] passive structure, ETFs [tend to be] much cheaper to run and so ongoing charges tend to be less . . . but fund costs are only part of the story.”

AJ Bell, one of the UK’s largest investment platforms, is the latest to unveil a series of cuts to annual charges, foreign exchange and exit fees as well as launching a simplified trading app called Dodl that will charge no trading fees, putting it in direct competition with investment and trading start-ups.

While it is not possible to say whether ETF investors are driving the move to lower platform costs, they will certainly be able to benefit from them. The demand from online platforms or apps for ETFs is expected to be even stronger in the US where the PwC report found 96 per cent of respondents thought they would be a significant source of demand, vs 76 per cent for Europe.

In Podzuweit’s view, the rise in popularity of ETFs can be traced to the aftermath of the financial crisis, which he said fostered a distrust of traditional distribution channels that in Germany were controlled by banks.

“People were saying: ‘Oh, my bank has never told me about ETFs’,” Podzuweit said, adding that the fact that banks had not promoted them had actually increased their appeal. “ETFs became the first financial product that wasn’t sold, it was bought.”

Platform and app fees

Investment platform costs can be hard to assess and compare. Some platforms charge a one-off fee when you open your account. Many make a regular monthly, quarterly or annual charge. Then, potentially, you could expect dealing costs, other charges such as for regular investments or dividend reinvestment and possibly an exit fee.

Platform fees can also differ depending on whether you decide to invest a large or small amount. Some platforms might charge a higher annual fee, but trading costs can be negligible or even free.

However, even completely no-fee apps and platforms that claim to make no charges at all may not necessarily be the cheapest option. Many countries, including the US and Germany, for example, currently allow a payment for order flow model (PFOF) which could mean that the online brokers are not incentivised to find the best execution prices with the tightest spreads.

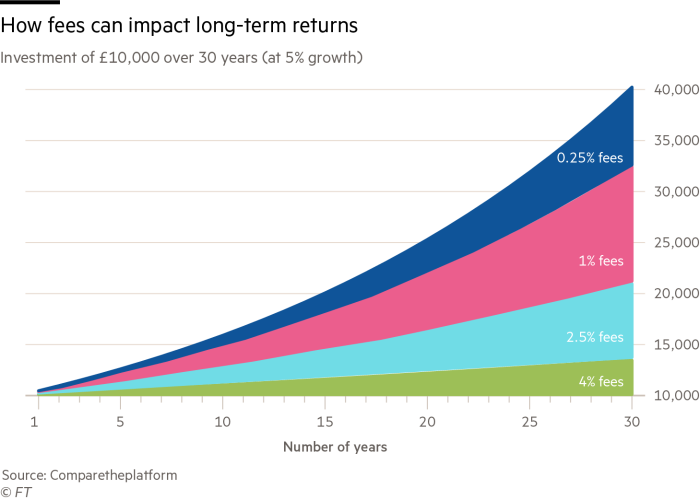

Services such as the UK’s CompareThePlatform price-comparison website can help to steer investors through available choices, but in the end investors need to educate themselves about the additional costs on top of fund ownership.

“The main lesson that I always say to people is lower your costs and look at asset allocation, making sure you’ve diversified around the world and diversified through sectors,” said Bella Caridade-Ferreira, chief executive of Fundscape and driving force behind CompareThePlatform. After that, she said, another tip would be to trade infrequently.

Comments