Online streaming looks to Asia for steady flow of subscribers

Simply sign up to the Technology myFT Digest -- delivered directly to your inbox.

The pandemic has provided a captive audience for the digital entertainment industry, with locked-down consumers stuck indoors, glued to screens as much for distraction as for news of the outside world.

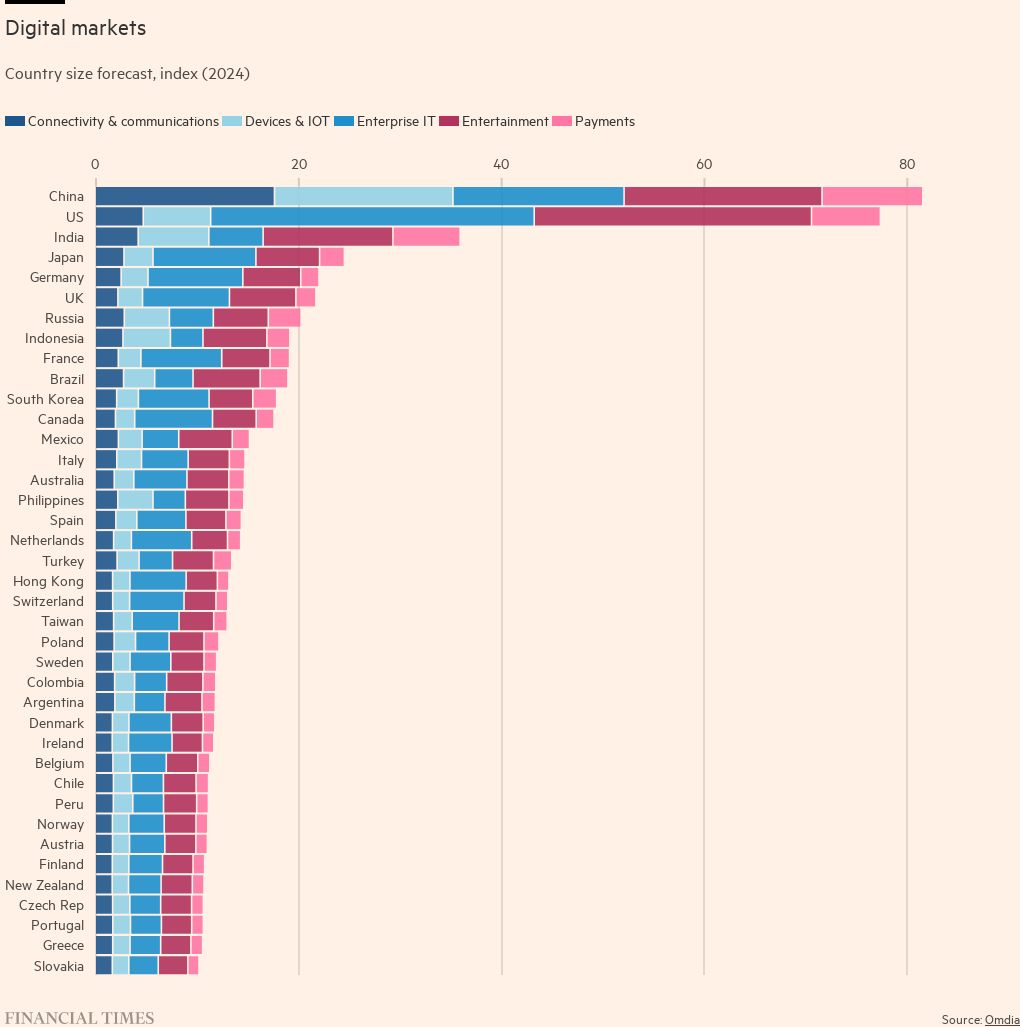

Surging digital demand has been well-documented in the US and other developed nations. But Asia offers a rich seam of growth possibilities for social media and video streaming services over the next four years.

Emerging markets — including India, China and Indonesia — have billions of customers hungry for content, according to data from Omdia, a technology consultancy.

There are, however, a variety of obstacles to turning that demand into rising revenues.

The Next Tech Growth Markets for Facebook and Video Subscription Services

FACEBOOK: COUNTRIES TO WATCH 2020-2024

INDIA Facebook’s $5.7bn investment in India’s Jio Platforms in 2020 signals its confidence in India’s rapid adoption of digital technologies.

PHILIPPINES A high propensity for social media use, coupled with growing internet penetration, is expected to drive growth in Facebook’s audience in the Philippines.

INDONESIA Indonesia’s large, increasingly mobile-connected population means the country will rise to become Facebook’s third-largest market by users in 2024.

UK Although many younger consumers are turning away from Facebook, it remains popular with the UK’s highly connected older population.

VIDEO SUBSCRIPTION: COUNTRIES TO WATCH 2020-2024

INDIA India is the third largest online video market in the world — and one of the fastest growing. Subscriber numbers were up 25 per cent in 2021, to a total of 79m.

CHINA The growth rate for the world’s largest online market is slowing but, at 11 per cent, it new subscribers in 2021 are equivalent to the entire UK market: 43m.

US Despite fears of maturity and saturation of online video services, the US is still growing at a pace: 12 per cent to 355m subscriptions in 2021.

INDONESIA While Indonesia is ranked only the 16th largest market for streaming video, at 14m subscriptions in 2021, it is the fastest-growing market globally, up 45 per cent year-on-year.

Source: FT-Omdia Digital Economies Index

Social media

Meta (formerly Facebook) said that, in the past quarter, it reached 2.9bn monthly users globally — a 7 per cent year-on-year increase. That has reinforced the growth potential identified by Omdia data, despite fears in some quarters that its appeal is limited among younger users.

Most promise is offered by its photo app Instagram and its messaging service WhatsApp, which is proving popular in emerging markets including India. Omdia points to Facebook’s $5.7bn investment in India’s Jio Platforms in 2020 as evidence of its interest in the country, and forecasts further growth in markets such as Indonesia — which its analysts estimate will become the third-largest market, by users, by 2024.

Facebook’s name change to Meta also reflects its efforts to build a lead in the metaverse — a broad term for digital worlds populated by avatars that include social spaces, gaming arenas and more.

“The metaverse is the next evolution of the internet,” says Cathy Hackl, chief metaverse officer of consultancy Futures Intelligence Group. “It’s happening around us. It’s like our digital lives are finally catching up to our physical ones.”

Online video

The other large social network factored in to Omdia’s research is YouTube. Alphabet’s video streaming platform saw advertising revenue grow 30 per cent during 2020, driven in large part by ecommerce in the form of direct-response video ads.

While the platform hosts a growing amount of premium content from big-name studios, it also remains an avenue for amateurs to publish their content. “YouTube is not just a place to stream hand-me-down culture, but a site of novel cultural production of its own right,” writes David Arditi, a professor of sociology at the University of Texas at Arlington, in his book Streaming Culture.

Amateur content has proved to be a particularly potent tool for the platform, says Matthew Bailey, principal analyst for media and entertainment at Omdia. “The ability for any individual to produce, publish, and monetise video content on YouTube continues to be a major draw,” he says.

India, the world’s second most populous nation, is YouTube’s largest market, with 366m monthly active users (the platform has been banned in China for more than a decade). Omdia expects the US to remain YouTube’s second-largest market in 2024, but to account for more than 50 per cent of its revenue.

Video subscription

The battle for the online video subscription market has grown hotter during the pandemic: as of the first half of 2021, there were more than 5,500 online video services globally, with hundreds alone in markets such as the UK.

That said, fears of a saturation point seem to be premature in the US. It is forecast to see 12 per cent growth in 2021, bringing subscriptions to 355m. China’s forecast growth rate for video is 11 per cent — a deceleration, but a real-terms growth of 43m subscriptions. However, both are expected to be outshone by the Indian market, the third-largest in the world, with an estimated 25 per cent increase in 2021, reaching a total of 79m subscriptions.

For market leaders Netflix and Amazon Prime, after a decade with limited competition, the 2020s are likely to be tougher, says Tony Gunnarsson, principal analyst at Omdia’s TV, advertising and online unit. Brands including Disney+, HBO Max and Discovery+ are vying to attract users. “It is likely that services that are promoted by mobile or broadband operators will take preference in household self-bundles, particularly if sold at a discount,” says Gunnarsson.

The future of digital entertainment

The battle for consumers’ eyeballs and thumbs is only going to grow more intense, according to Bailey, as the line is blurred between video services, social platforms, games and other content. “Unfortunately, not all services and platforms are going to survive in this context, no matter how good their content may be,” he warns.

The growth of metaverses adds to the complication, he says: “Standing out and getting in front of consumer eyeballs — whether that is through a smartphone, smart TV, or even a VR headset — will be just as important in this brave new world of media.”

Comments