Swelling US stock valuations leave some investors uneasy

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

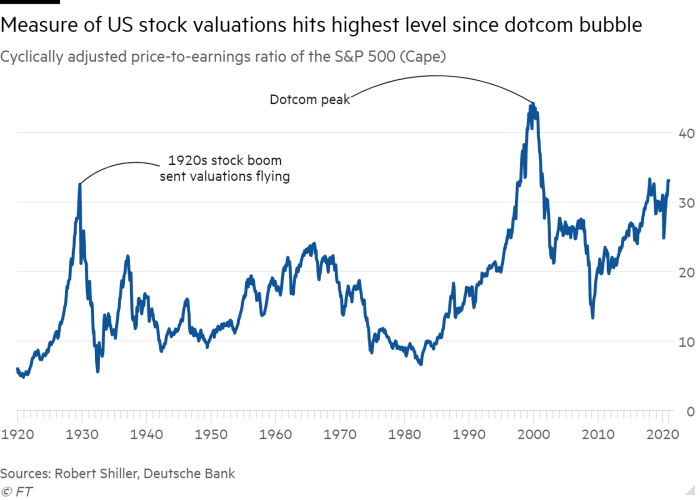

US stocks are expensive. So expensive by one measure, in fact, that only the dotcom boom saw higher valuations.

Since the election of Joe Biden as US president and the emergence of Covid-19 vaccine breakthroughs, the roughly $41tn market has soared, pulling benchmark stocks indices up to record levels.

But the degree to which stocks prices have peeled away from corporate earnings is the metric that is leaving some investors uneasy. The cyclically adjusted price-to-earnings ratio of the S&P 500, developed by economist Robert Shiller and known as the Cape ratio, climbed to 33.4 at the start of December, according to Deutsche Bank. That puts it above the level of September 1929, on the eve of the Great Depression, and makes the measure nearly double its historic average of 17.

Only during the technology bubble at the turn of the millennium, when the ratio rose as high as 44.2 in December 1999, did it exceeds current levels.

“There are great expectations built into this market,” said David Donabedian, CIO at CIBC Private Wealth Management. “We are in the seventh inning of Federal Reserve-supported equity markets, ” he said, adding that while the short term outlook remains positive, the Cape ratio is a warning call for the longer term.

Valuations of US stocks have surged as the Federal Reserve and central banks around the globe unleashed a supercharged effort to minimise the financial and economic fallout from the pandemic. The Fed in March cut rates close to zero and in April it pledged to buy government bonds in unlimited amounts, pushing yields on long-term debt down to historic lows.

“Low interest rates and easing monetary policies are the single biggest factors for equity outperformance,” said Mr Donabedian.

Technology stocks have surged 36 per cent this year, outpacing the broader market’s 14 per cent gain. The biggest tech companies — including Apple, Microsoft, Amazon, Google-owner Alphabet and Facebook — now account for 22 per cent of the S&P 500, up from just under 17 per cent at the end of last year.

Above average readings of the Cape ratio will not surprise investors. It has been pointed to by pessimistic money managers for a decade as one reason why stocks have become untethered from corporate earnings. Deutsche Bank noted that since 1991, beyond a period during the financial crisis, the Cape ratio has been above its long-term average. Despite that, the S&P 500 has notched a total return of more than 1,700 per cent in the years since.

Comments