The $5tn club: Merger mania sweeps asset management industry

Simply sign up to the Fund management myFT Digest -- delivered directly to your inbox.

Ten titans that each oversee more than $5tn will emerge as the asset management industry’s dominant players by the end of the decade as size becomes a critical driver of success for investment companies globally.

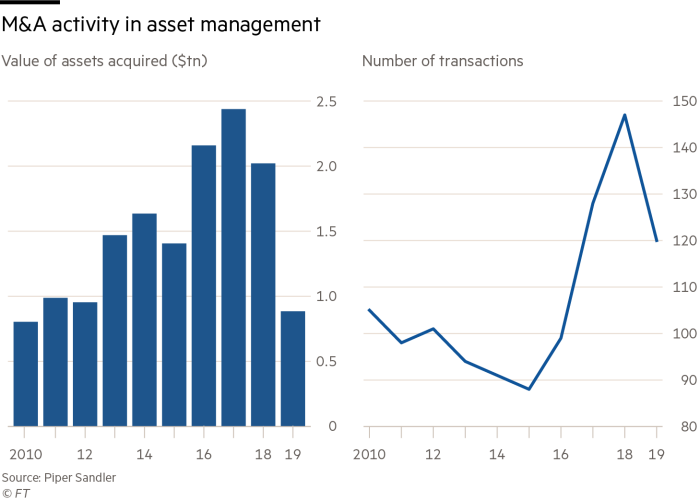

Only half of the fund industry’s current asset management companies will still exist by 2030 following a massive escalation in mergers and acquisitions activity, according to Piper Sandler, a Minneapolis-based investment bank, which has advised on more than 80 asset management deals worth more than $50bn.

“The survivors will need to be effective dealmakers. They will use M&A to build on their strengths, fix weaknesses and ultimately to propel growth,” said Aaron Dorr, head of the asset management investment group at Piper Sandler.

The upswing in M&A activity is being driven by deep structural challenges including demographic shifts, downward pressure on fees and revenues, and ever-increasing costs due to technology spending and changing regulatory requirements.

Speculation and gossip about which asset manager might be the next to be acquired have reached a feverish pitch after the activist investor Nelson Peltz’s Trian hedge fund established stakes of nearly 10 per cent in both Invesco and Janus Henderson.

In an interview on CNBC television this week, Mr Peltz said the asset management industry “needs scale”. “I’m hoping that Invesco will be the prime mover in doing that,” he said.

Other senior Wall Street leaders have also made unusually frank public statements about their desire to pursue fund management deals.

Jamie Dimon, chief executive of JPMorgan Chase, said last month that his bank was “very interested” in buying an asset manager, adding that his door was “wide open” for deal partners.

David Solomon, chief executive of Goldman Sachs, said last month that organic growth was the priority for its asset management business but he would “take a very hard look” if a suitable acquisition opportunity appeared.

“The marriage season is heating up. The asset management industry is now gripped by merger mania. The question is whether any of the deals will deliver for shareholders,” said Amin Rajan, chief executive of Create Research, the consultancy.

In an interview with Bloomberg this week, Stephen Bird, the new chief executive at Standard Life Aberdeen, said he was “thinking of acquisitions” which could include buying an exchange traded fund business.

Analysts immediately highlighted the possibility of a deal with Lyxor, the €150bn French asset manager and the third-largest ETF provider in Europe. Lyxor has been the subject of takeover speculation for more than a year.

“With Lyxor reportedly for sale, this might suggest Standard Life Aberdeen is a potential buyer,” said Tom Mills, an analyst at Jefferies.

Many fund managers have been forced to consider dealmaking in a bid to shore up profits. Profit margins — operating profits as a percentage of net revenues — have remained flat even though client assets overseen by the asset management industry have doubled in size since the end of 2008 from $39tn to $89tn by December 2019, according to Boston Consulting Group.

Pressures on profits for traditional active managers are expected to increase further as their high fees and inconsistent performance fuels an ongoing shift by investors into low-cost trackers.

An analysis by Piper Sandler shows that more than a fifth of actively managed US funds sold to retail investors had registered five consecutive years of net outflows by the end of 2019. Only 11 per cent of actively managed US funds saw positive inflows over the same five-year period.

Larger groups, however, appear better equipped to deal with the headwinds facing the industry, including a hit to profits.

“The big [actively managed] funds are getting bigger as the smaller funds try to hold on to their assets. Larger managers with a broader product suite are better equipped to offset outflows from those strategies with inflows elsewhere,” said Piper Sandler’s Mr Dorr.

“Scale matters. Managers are finding that scale is no longer a lofty ambition but a requirement. M&A has become the most direct route to achieve scale.”

The pressing need for fund companies to build larger, more efficient businesses has been highlighted this year by Franklin Templeton’s $6.5bn acquisition of Legg Mason and Morgan Stanley’s $7bn deal for rival Eaton Vance.

Banks with existing asset management or wealth management capabilities that also have excess capital are well placed to pursue deals, according to Morgan Stanley. It highlights State Street, BNY Mellon and Mediobanca, as well as JPMorgan and Goldman as potential predators. Traditional asset managers including T Rowe Price and Waddell & Reed also have excess capital, while both Amundi and Schroders have already demonstrated their appetite for deals.

“Asset management is the second-most fragmented industry globally after capital goods. The top 10 firms have a combined market share of just 35 per cent. In more concentrated industries, the top dozen or so players typically command 75 per cent market share,” said Michael Cyprys, an analyst with Morgan Stanley in New York.

Potential targets that have niche product or distribution capabilities that would be attractive to a buyer include BrightSphere, Virtus, WisdomTree, Ashmore and Man Group, the world’s largest listed hedge fund manager, said Morgan Stanley.

Shares in BrightSphere, a $180bn New York-listed multi-boutique, jumped this week on reports that it is exploring the sale of its private equity affiliate Landmark for $1bn.

“The $1bn price tag reported for Landmark is clearly above expectations,” said Christopher Harris a senior analyst at Wells Fargo.

Other players caught up in talk of deal activity include Bank of Montreal (BMO), which is examining strategic options for its $273bn asset management division. BMO, which bought London-based F&C Asset Management for £708m 2014, could reduce the footprint of its business outside of its home market in Canada, according to company observers.

Wells Fargo is also exploring a sale of its $578bn asset management business in a push by chief executive Charles Scharf to restore the troubled San Francisco-based bank to health.

The Los Angeles-based private equity group Ares Management last month proposed a takeover of AMP, the A$200bn (US$145bn) wealth and asset manager. Terms of the offer were not disclosed but AMP shares have since risen 35 per cent, valuing the company at close to A$6bn. Citigroup has suggested that Macquarie, which has excess capital, might also table a higher rival bid.

Despite the prospect of unprecedented dealmaking in the fund industry, Mr Cyprys cautions that building scale via M&A is no guarantee of success.

“Shareholders this far have not rewarded scale driven acquisitions given their lacklustre track record. Perhaps the biggest challenge for any large scale M&A deals is ensuring that any combination improves the top-line revenue trajectory,” he said.

Comments