Water funds dilute the environmental message

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investing in water sounds like it should be right up sustainable investors’ street. Help the planet, improve access to sanitation, tick off a United Nations’ sustainable development goal: job done.

In reality, investing in water in an environmentally-friendly way is not as simple as it might seem.

There’s no shortage of water funds — both active and passive. And some managers talk up their alignment with the UN goal of ensuring clean water and sanitation for all.

But water funds tend to be packed with utilities. And, while there may be a decent investment case for holding them, it’s not obvious that they are saving the planet.

It’s a good time for sustainable investors to take stock. The UN is holding a Water Conference next month to see how progress is going on its 10-year plan to tackle the global water crisis. We are halfway through a so-called “water action decade”, during which companies and governments are supposed to be addressing access to water and sanitation that has been made worse by climate change and population growth.

Water scarcity already affects four in 10 people, according to the WHO, while 80 per cent of wastewater flows back into the ecosystem without being treated or reused. Even in high-income countries, it’s 30 per cent.

But despite all the water funds out there, the UN says its progress on water-related goals and targets “remains alarmingly off track, jeopardising the entire sustainable development agenda”.

Some big investors are trying to rally round ahead of the conference. In an open letter published last week, a group of institutions called on governments to set more ambitious short-term water targets and implement water disclosure requirements.

There is a good investment case for this: water investments have been popular among sustainable investors. Having greater disclosure around risk and clear targets should help them find better opportunities.

It has also been hard to ignore the economic problems that water shortages can pose. Europe’s drought last summer affected nuclear power plants that require water to cool down, with France’s EDF warning it might have to reduce output just when the continent’s energy supply was already under pressure due to Russia’s invasion of Ukraine.

Low river levels on the Rhine had knock-on effects on trade. Droughts along the Colorado river led to calls for various US states to agree on cutting their water usage.

The investors who penned the open letter — including BNP Paribas Asset Management, Eden Tree Investment Management and Quilter Cheviot — said they were taking action by engaging companies to use water sustainably. They also said they saw reducing their exposure to water risk as a “core fiduciary duty” and that they were looking to benefit from the “opportunities associated with the transition to a water secure economy”.

What are the options for retail investors when it comes to water? There are a number of exchange traded funds. The Nasdaq OMX Global Water Strategy index, for example, was created in 2011, along with a US-focused counterpart.

There are also actively managed funds. Dominic Rowles, an ESG analyst at Hargreaves Lansdown, recommends Regnan Sustainable Water & Waste fund which has American Waterworks as a top holding and is expected to benefit from a trend for US states to outsource their water supply to private companies.

Justin Winter, co-manager of Impax’s water strategy, divides water opportunities into four: utilities, distribution and infrastructure, treatment and efficiency. French-listed Veolia is an example of a water utility company, which brings some earnings stability. Sabesp, a Brazilian sanitation company that provides water and sewage services, is another holding.

Other holdings are less obvious. Cintas, a uniform rental business, is a holding at Impax because it washes clothes efficiently, at scale, reducing water and energy usage — unlike home washing which can be energy inefficient.

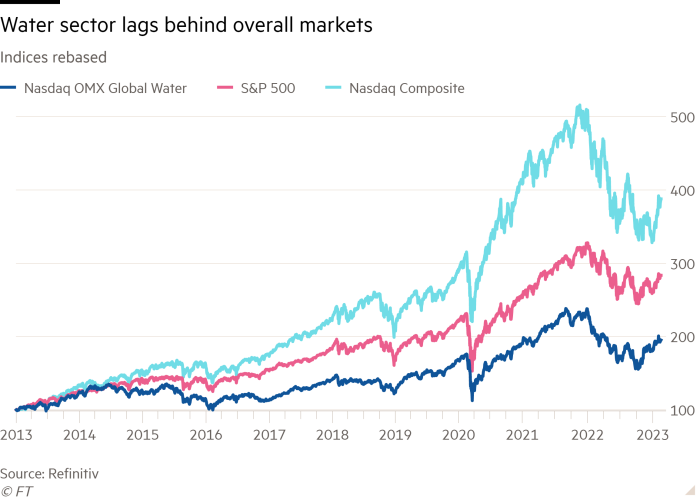

Unfortunately for investors, the water sector has missed out on much of the stock market performance of the past decade. Water indices and funds are packed with industrials and utilities and are short on the tech companies that drove the recent bull market.

But with the tech boom in retreat in the face of higher interest rates, investment strategies are changing. And government backing for water investment is growing. Investors expect the recent Inflation Reduction Act in the US to boost water infrastructure investments. Suddenly, those utility companies look like a decent way to add stability to a portfolio.

From a sustainable point of view, however, it remains dubious whether many water funds really address the UN goal of clean water and sanitation for all.

At best, they are tamely addressing it for the developed world, by buying utilities with stable returns. Or backing companies with little to do with water sustainability. Morningstar Sustainalytics cites the example of US-based Waters Corp, a top 10 holding of the Nasdaq ETF. Despite its name it is not a water company, but a maker of laboratory equipment and software, and, says Morningstar, has no impact on water-related sustainability themes.

In fairness, water funds are not necessarily marketed as sustainable. Nor are all water fund investors pursuing sustainable investment strategies. Rene Reyna, head of thematic ETF strategy at Invesco, which has a couple of water ETFs based on the Nasdaq indices, says that many investors see water as a portfolio diversifier.

Ultimately, it’s questionable whether buying a water fund is a good idea for sustainable investors worried about the water crisis. A different option is to buy broader sustainable investment funds holding water stocks. The Impax Environmental Markets fund, for example, holds Veolia as one of its top 10 holdings and is listed on platform Interactive Investor’s ACE list of the strongest 40 sustainable funds.

Real change may come from professional investors putting pressure on companies better to address their water risk — just as they have done with carbon emissions.

BNP Paribas, for example, has started using its voting power as a shareholder to oppose the election of board members for companies that lack transparency on their water use.

Robert-Alexandre Poujade, a biodiversity and water analyst at BNP Paribas, says the open letter on water is a wake-up call for investors: “Has water risk been readdressed in portfolios? Yes, partially; but not enough,” he says.

Some hope that next month’s meeting will lead to an agreement similar to last year’s UN resolution on reducing plastic pollution by 2024.

If investors take more interest in water risk at the companies they hold, that will probably have more overall impact than investing in a water fund. Often, companies with positive climate change solutions aren’t the larger listed companies that are seen as safe for retail investors. And water funds tend to be full of larger, listed, safe-looking companies.

If institutional investors use their clout to push for greater disclosure of water risk and usage that will help. Meanwhile, retail investors interested in sustainability, should consider what makes most sense in their overall portfolio and focus on broader sustainable funds, rather than buying something just because it has “water” in the title.

Alice Ross is an FT contributor. Her book, “Investing to Save the Planet”, is published by Penguin Business. Twitter: @aliceemross

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Comments