US retail investors drive summer surge in stocks

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Record levels of stock buying by retail investors have helped to keep US equities marching higher through the summer months, and been the “dominant force” powering a relentless rally in the market, according to analysts at JPMorgan.

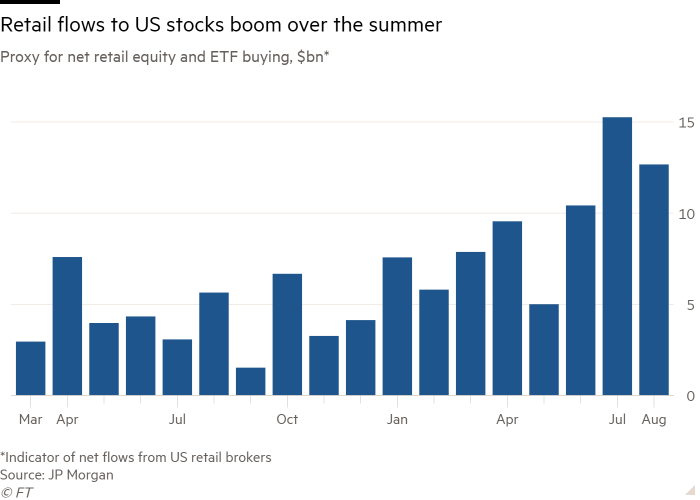

US retail investors’ net purchases of stocks and exchange traded funds surged to record levels during the summer, after posting substantial inflows throughout the year, according to a measure calculated by the bank to focus on retail activity.

The S&P 500 index of blue-chip US stocks is up 20 per cent so far this year. “As long as this retail flow continues, the equity market will keep going up,” said Nikolaos Panigirtzoglou, cross-asset research analyst at JPMorgan.

“If that flow stops and we start seeing material outflows — from equity ETFs in particular — then we should start getting worried about the equity market because it would mean that the attitude of retail investors towards equity markets is changing,” he said.

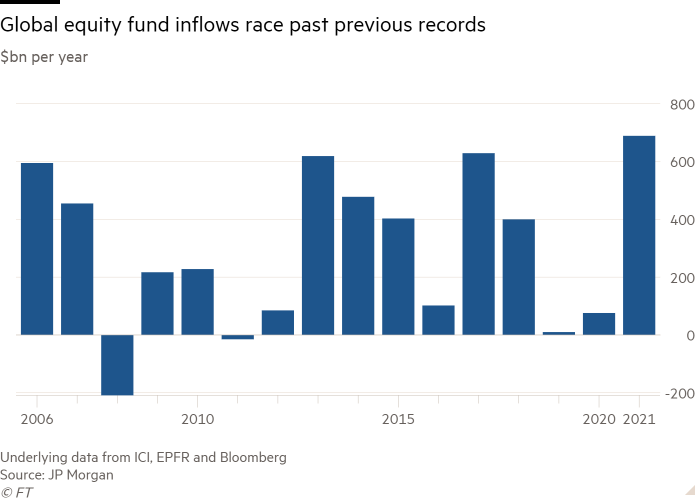

Global equity fund inflows, which analysts view as another indicator of retail buying, have pushed past $689bn so far this year, smashing the previous annual record set in 2017.

Retail investors grabbed widespread attention early this year when thousands of traders, organised on the social media platform Reddit, pumped up the prices of historically unloved stocks, such as the video game retailer GameStop and cinema chain AMC Entertainment, generating spectacular rallies.

The frenzy of buying and selling around these so-called meme stocks prompted a spike in the volume of retail trades, but the net amount of cash flowing into the markets from retail investors reached its peak during the summer boom, according to JPMorgan’s data.

“If anything, that retail flow has been accelerating recently. It looks more like a melt-up,” said Panigirtzoglou. “The problem with melt-ups is that they don’t continue forever.”

Comments