Prepare the understudies: views from the top

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Recent speculation over whether Mark Carney’s tenure as Bank of England governor would be cut short highlighted the importance of “key person risk”, often exemplified at companies where unexpected chief executive departures leave dangerous vacuums.

How should boards prepare for leadership change and balance thoroughness of succession planning with the danger of lining up too many squabbling heirs apparent?

Below is the edited transcript of a debate conducted among the FT City Network, a panel of chairmen and chief executives who are among London’s top financiers and business leaders.

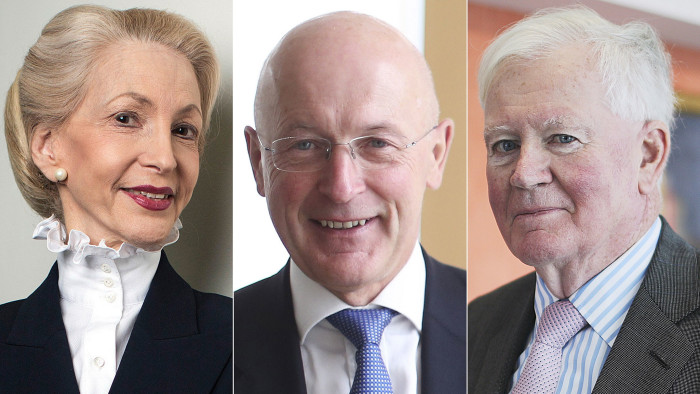

Among them is Sir Win Bischoff, the former chairman of Lloyds Bank, who in 2011 had to make an unexpected succession plan, barely six months after his newly appointed chief executive had begun in the job. In the event, António Horta-Osório took two months’ medical leave on the grounds of exhaustion and returned to work. Lloyds shareholders again expressed concern about “key man risk” this summer, after tabloid reports of his extramarital affair.

At Royal Bank of Scotland, Sir Philip Hampton oversaw the 2013 ousting of former investment banker Stephen Hester, under pressure from RBS’s majority shareholder, the UK government. At BT, Sir Mike Rake was also stripped of his chief executive by the government, when Ian Livingston was made trade minister in 2013.

Sir Win Bischoff , Financial Reporting Council/JPMorgan

A change at the top always presents risks. The best boards plan well ahead to reduce — if not eliminate — those risks by developing internal talent, having a good knowledge of external availability and [weighing] the timing of any change. Some talented disappointed candidates will be tempted by headhunters to leave. That, however, provides great opportunities for those more junior to advance more rapidly.

Sir Philip Hampton , GlaxoSmithKline

There are two key issues. The first is the simple “red bus” moment [when someone is suddenly incapacitated by accident or illness] from an unplanned departure, caused by key people being poached, falling ill or worse. The main thing is to try to have outline agreement within the board on likely timeframes for individuals, so their ambitions can be matched as far as possible with the company’s needs. Internal options risk [desperately competitive] Hunger Games behaviour among candidates. The best way to address this is for everyone to know that poor behaviour is terminal to chances of progression.

Jean-Pierre Mustier , UniCredit

With the median chief executive tenure for the S&P 500 being around six years, time is short to identify, train and test internal candidates. Hence succession planning should be one of the key priorities of a chief executive from his first day in the job, for him to choose in his management team key individuals who could step up into his job over time. At least it was for me. The key issue will be to develop their leadership qualities and emotional intelligence. An external candidate solution [is] always risky.

Ruby McGregor-Smith , Mitie

I took the view as I step down from a chief executive role after a decade that a decade is enough for a chief executive of a listed stock. The board knew this last year so we could start proper planning then. Deadlines work as everyone can work towards them.

Lady Barbara Judge , IoD

Succession planning is one of the most important components of modern corporate governance. Even where there is no expectation that a key person will leave anytime soon, boards should be thinking years ahead as to who would be an appropriate successor. Obviously it would be better to keep the process discreet, but boards understand that rumours will spread. Sometimes this provides healthy competition.

Samir Desai , Funding Circle

Successful teams, in sport, business, politics or elsewhere, are not reliant on a single person. Boards should promote a strong leadership team to protect the business against an executive’s departure, particularly in founder-managed businesses, to ensure continuity for customers and employees.

Sir Mike Rake , BT

Having experienced the sudden loss of a chief executive, made a minister by the government, the following is clear: first, it is important to have a medium term development plan for high potential executives. Second, it is essential in parallel to have a plan for unexpected events, differentiating between a holding [and] a permanent appointment. Third, it is wise to have senior members of management below the chief executive level to be given an opportunity for external mentoring/board/ shareholder exposure as this will always benefit individuals as well as the company and gives more choice. Last, it is useful to have an ongoing desk review of potential candidates employed elsewhere.

John McFarlane , Barclays

The principle for senior appointments is to ensure that the best individual in the world available to the organisation should be appointed. Insiders have the benefit of knowledge of the company and therefore have a head start in key requirements. Of course, the merit of outsiders is importing a different perspective and skills. The mission internally is to broaden them earlier in their careers, otherwise they end up as senior specialists. I believe particularly in benchmarking internal talent against global benchmarks, as a check and balance against internal rating bias.

David Roberts , Nationwide

I am a strong believer in rigorous assessment of candidates by chief executive and board, supported by external benchmarking to avoid internal bias. Essential is a very clear understanding that any form of destructive or overly competitive behaviour is a sure fire route to disqualification.

David Morgan , JC Flowers

[Before Jack Welch left, GE made sure it had] at least three internal chief executive succession candidates available when it [became] time for change. Once the decision on the new chief executive is made, the unsuccessful internal succession candidates leave. A united top team, led by a focused, undistracted chief executive, [is] very valuable.

Comments