Crypto vs gold: the search for an investment bolt hole

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Crypto assets are no longer on the fringe of the financial system. So says the IMF, which pointed out in a recent blog that the likes of bitcoin have matured from an obscure asset class with few users to an integral part of the digital asset revolution.

Millions of investors have been swept up by the enthusiasm for crypto, not least many retail savers lured by its surging prices. Some claim that in the post-pandemic world bitcoin could even displace gold as investors’ asset of choice to address extreme risks, price instability and geopolitical turmoil of the kind exemplified by Russia’s invasion of Ukraine. As Tyler Winklevoss, a tech entrepreneur, put it: “Our basic thesis for bitcoin is that it is better than gold.”

Yet investors should be wary of such assertions given gold’s pedigree going back thousands of years. The comparison is easily made but, as I will argue, not necessarily justified. And the question cannot be resolved by mere financial calculus. Historical and cultural factors will play a part in perceptions of the relative merits of the two assets.

Gold, after all, has been a symbol throughout the ages of power, wealth, permanence and beauty. In the ancient world Greeks felt it recalled the radiance of the gods, while the three kings brought gold, along with frankincense and myrrh, to Christ in the manger. For many in the modern world the yellow metal continues to be the ultimate object of capitalist accumulation.

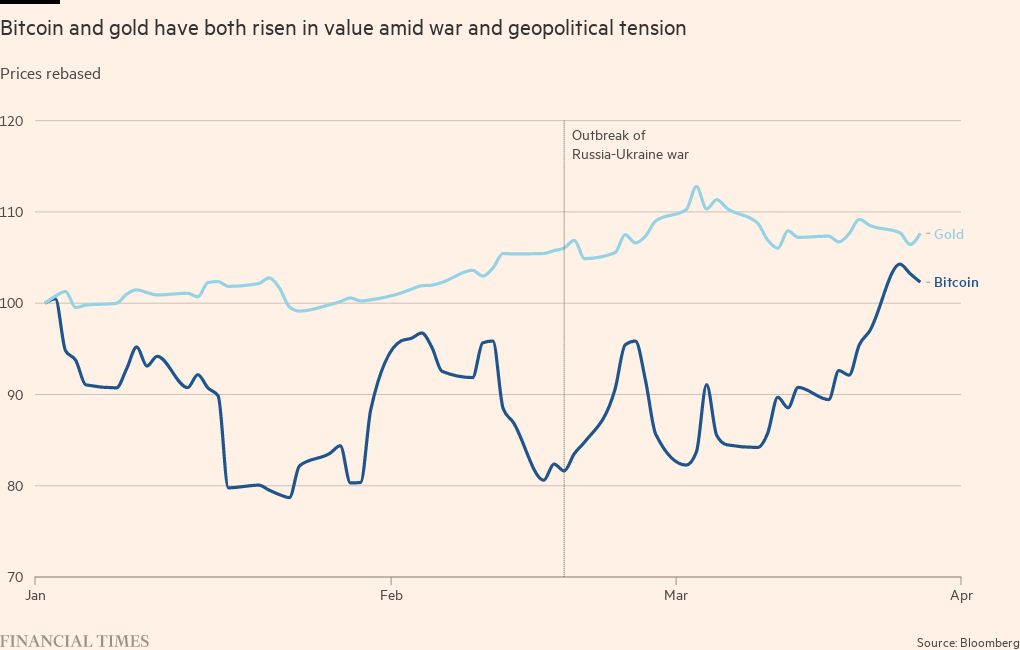

Moreover, any claim bitcoin might have to be a geopolitical hedge has been severely dented by its performance at the start of the war in Ukraine. Against a background of plunging markets gold strengthened while bitcoin fell. Today, the gold price is close to its all-time high in August 2020, while bitcoin is well below its record high last November. So much for the great crypto store of value.

Yet for Russians and Ukrainians, paradoxically, bitcoin and other cryptocurrencies have served as a genuine store of value against their plunging domestic fiat currencies — currencies unbacked by real assets such as gold or commodities — and allowed them to bypass their fragile conventional financial systems.

Crypto at war

At the same time a new use has emerged for crypto: the government of Ukraine has raised more than $100mn in crypto donations from around the world to fund its defences. For good measure, Ukrainian refugees have discovered that converting their money into crypto on a phone or hardwire device offers a more readily portable currency than gold.

What cannot be denied about crypto’s short history is that it radiates a buzz based on the potential of blockchain technology — distributed databases — to transform the financial services industry through so-called decentralised finance (DeFi).

This innovative potential helps explain the recent interest of Silicon Valley venture capitalists such as Andreessen Horowitz, which have been launching crypto funds. Such valley folk aim to back a digital technology revolution that potentially disrupts a range of industries from banking to gaming to telecoms.

From the central bankers’ perspective there is also a negative buzz arising from the interconnectedness between crypto and conventional markets that could permit the transmission of destabilising shocks. And then there is the risk of crime, including money laundering.

In reality, bitcoin and the yellow metal have much in common, most notably in having little or no fundamental value and generating no income stream. What value they have stems from the shared belief by a sufficient number of people that they are valuable.

An important reason that investors flock both to bitcoin and gold is their innate scarcity. The total above-ground stock of gold is not much more than 200,000 metric tonnes, says the World Gold Council. And this is very large relative to the amount of new gold that can be mined and refined in a year. It is very costly to increase the stock, in marked contrast to fiat currencies where the marginal cost of producing additional paper claims is extremely low.

That makes gold particularly attractive in a period when governments have been engaging in fiscal pump priming in response to the 2007-09 financial crisis and Covid-19, and central banks have been printing money furiously. The attraction is all the greater when yields on index-linked gilts, a less speculative hedge against inflation, are negative and guarantee a loss to investors if held to maturity.

The same logic applies to bitcoin, claim crypto fans. It offers scarcity through the technological device of a public, decentralised ledger — blockchain — that tracks a fixed supply of 21mn bitcoins. That is the amount promised on the foundation of bitcoin in 2008 by the shadowy and possibly fictional inventor Satoshi Nakamoto.

The cost, waste and environmental damage in extracting gold from the ground or of minting bitcoins is socially inefficient.

With gold the problem is regular cyanide spills and the hard labour involved. With bitcoin arises because thousands of computers called “miners” — modern day alchemists — join a lottery to crack a mathematical puzzle. The winner updates the blockchain and takes newly-minted coins as a reward. Globally, this process consumes electricity on the same scale as many advanced countries.

A financial characteristic shared by the two assets is that the opportunity cost of holding them — the income investors forgo by not holding income-producing assets — declines when interest rates are low or negative. From this point of view, crypto assets have grown in a perfect environment although they have so far failed to develop gold’s wide range of related investments, from funds to mining stocks.

Bitcoin started during the financial crisis when conventional assets were tarnished in the debacle. The central banks’ asset purchasing programmes, known as quantitative easing, then delivered ultra-low or negative interest rates. That powered stellar growth of crypto assets from nothing to a market value of nearly $3tn in November 2021, says the IMF That represented around one per cent of global financial assets, on Bank of England data.

Many investors thought that, with rising inflation, bonds would lose their “safe” asset status as a hedge against equity risk while bitcoin, like gold, would offer diversification and a hedge against inflation.

‘Fortune favours the brave’?

Gold and bitcoin enthusiasts often hold their beliefs with a similar religious intensity which finds expression in abusive anathemas pronounced on those who question the fundamental value of these assets. It is no coincidence that such passionate conviction is often a feature of bubbles, of which more in a while.

Take this advertisement for crypto.com, an app-based crypto exchange. It stars Hollywood actor Matt Damon who intones: “History is filled with almosts — with those who almost adventured, who almost achieved . . . Then, there are others — the ones who embrace the moment and commit . . . Fortune favours the brave.”

One final similarity lies in the capacity of both these volatile assets to inflict damage. From its $3tn November peak last year the bitcoin market capitalisation fell to $2tn this January, implying an extraordinary capital loss for its supporters, says the IMF blog. This is one of many episodes of volatility that makes gold look tame.

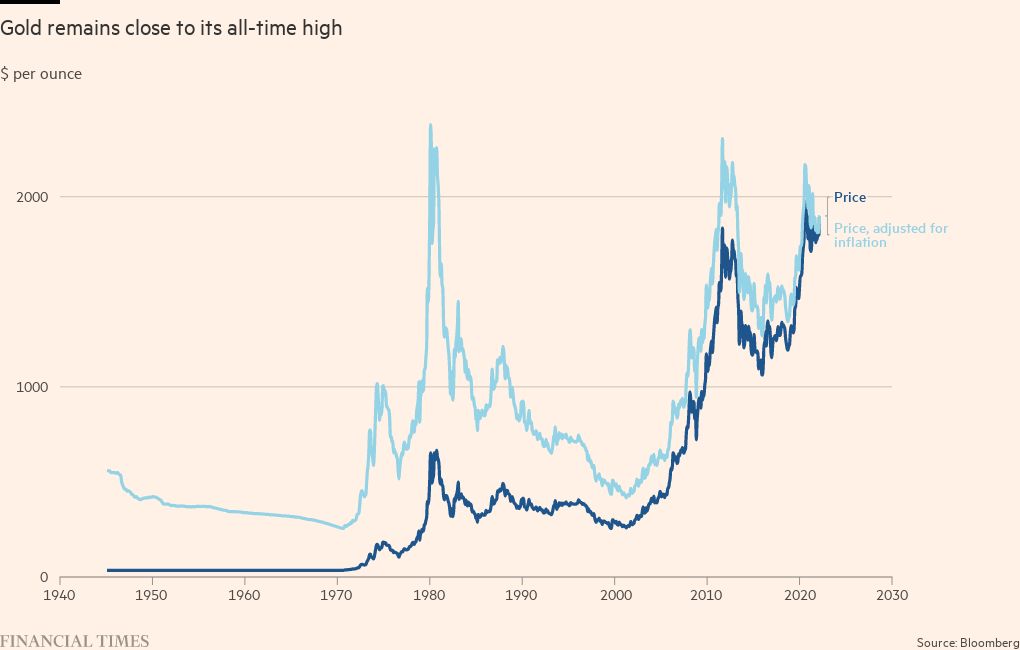

Gold bugs tend to argue that any volatility in their precious metal is unimportant because it holds its value in the long run. Yet the reality is more complicated. In inflationary periods gold does indeed perform well (as it also does in deflationary periods). Between August 1971 and January 1980 it saw a near 20-fold increase to a peak of $843, on London Bullion Market Association figures. From a low point in July 1999 it managed an eight-fold increase to $2,062 at the next peak in August 2020 with most of the appreciation occurring after the central banks started pursuing ultra-loose monetary policy.

Yet for anyone who bought at $843 in 1980 it took until January 2008 to recover to that same level. And in the period from January 1980 to a low point for the decade in February 1985 they would have sustained a capital loss of more than 66 per cent.

While he was a market strategist some years ago at Société Générale Dylan Grice conducted a study looking at gold across the centuries. This led him to conclude: “A 15th-century gold bug who’d stored all his wealth in bullion, bequeathed it to his children and required them to do the same would be more than a little miffed when gazing down from his celestial place of rest to see the real wealth of his lineage decline by nearly 90 per cent over the next 500 years.”

Observe, too, that the damage bullion does is not confined to financial losses. This can operate at a macroeconomic level through the so-called resource curse. The first and most spectacular example was Spain after the discovery of the Americas. At the start of the 16th century Spain was one of the richest and institutionally most advanced countries of Western Europe.

Initially the influx of gold and silver from Spain’s American empire produced an economic boom. Yet because this transatlantic treasure caused price levels to soar, Spain experienced a phenomenal appreciation in its real exchange rate after adjusting for inflation. The resulting loss of competitiveness ensured that from 1600 onwards the country endured a centuries long decline that turned it into a political and economic backwater.

Then there is the human damage wrought by gold as exemplified by the myth of King Midas or Shakespeare’s Timon of Athens whose blistering tirade against the corrupting power of the yellow metal echoes down the ages.

To return to bitcoin and where its investment characteristics differ from gold, there is no escaping that it has outperformed the yellow metal spectacularly over the past 10 years.

Yet as we have seen its claim to be a haven against geopolitical shocks is flimsy, while it remains untested as a hedge against inflation. According to the IMF, bitcoin’s correlation with stocks has turned out to be higher than that between stocks and other assets such as gold, investment grade bonds and major currencies, pointing to more limited risk diversification benefits than perceived before 2020.

In effect, bitcoin behaved increasingly in 2020 and 2021 as a risk-on asset moving in line with big tech stocks. And while it has recently decoupled from big tech it has not, unlike gold, behaved as a risk-off asset since the Ukraine war.

Finance’s ultimate black box

An interesting test of crypto’s haven status will be the behaviour of official reserve managers in central banks. They became net buyers of gold in 2010 as the central banks’ monetary hosepipe was switched on — an interesting vote of no confidence in their monetary policymaking colleagues. If they join the bitcoin party that will provide an imprimatur that should prolong bitcoin’s life.

Either way, bitcoin shows every sign of being a bubble. Britain’s Financial Conduct Authority estimates that 2.3mn adults own crypto assets in the UK. How many of them understand blockchain technology and what it means to own nothing more than non-replicable strings of computer code is quite a question.

Bill Blain, market strategist and head of alternative assets at Shard Capital, argues in a blog that crypto assets are no different from a classic Ponzi scheme where a steady stream of new entrants pays off the older members. It all depends on greater fools joining the rush to participate because prices are rising. He defines the greater fool as the last man to buy tulips in the 17th century Dutch tulip mania, South Sea shares at the peak of the bubble, railways in 1871 and Florida real estate in 1929. Today, the greater fool is wondering whether to buy Tesla and Ethereum.

What so often attracts the greater fool into bubbles are the rare but striking stories of whizzy individual stocks. A recent case in point is Solana, a high-speed blockchain launched in 2020 which, according to financial research firm Autonomous, ended 2021 up 22,000 per cent. This breeds a contagious fear of missing out.

Tales of boiler shop market rigging, pumping and dumping, spoofing and front running by exchanges — classic accompaniments of bubbles — are rife. Crypto has a magnetic allure for conmen, tax evaders, disgruntled spouses and terrorists.

And in the end there remains a fundamental question raised by Robert Aliber, emeritus professor at the University of Chicago: can you trust that “Satoshi Nakamoto” will limit bitcoin issuance after the price has been rigged by the boiler shops?

Bitcoin is surely finance’s ultimate black box — and one not immune to regulatory risk. Central banks worry that crypto will erode their control of the monetary system while undermining financial stability. They are busy developing their own cryptocurrencies and may seek to create an uneven regulatory playing field to their own advantage. Indeed, the biggest warning for crypto investors comes from China, which banned all crypto activity in September 2021 and is now promoting its own central bank digital currency.

In the final analysis, gold is a bubble with only a small fundamental value based on its use as jewellery and a handful of industrial applications. But it is a 6,000 year-plus bubble going back to ancient Egyptian goldsmiths. It is probably the only mania in financial history to have attracted a near-infinite supply of greater fools.

From the Queen of Sheba’s gift of gold to King Solomon, to Aristotle’s concept of moderation known as the Golden Mean, to the Californian gold rush and Wagner’s golden Ring of the Nibelung, it has exercised an enduringly powerful grip on the human psyche.

There can be no denying the astonishing power of blockchain technology, which is here to last. Yet bitcoin is intangible, risky and incomprehensible to most human beings. While it is increasingly gaining acceptance among professional investors, its performance this year makes it hard to believe it can topple gold from its position as the ultimate bolt hole for frightened money.

As for the important cultural dimension of the argument, bitcoin, frankincense and myrrh lacks a certain ring. The supply of greater fools will in due course run out.

Weekly newsletter

For the latest news and views on fintech from the FT’s network of correspondents around the world, sign up to our weekly newsletter #fintechFT

Comments