Is it time to reform inheritance tax?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It has been dubbed Britain’s most hated tax — yet it is one that is rarely much of a burden to the well-advised wealthy. The UK’s complex inheritance tax (IHT) system has long been a political lightning rod, but this has not deterred chancellor Phillip Hammond from ordering a comprehensive review of how it works.

This weekend, the independent Office of Tax Simplification has launched a wide-ranging consultation intended to let the general public and professional advisers have their say about whether the current system is fit for purpose.

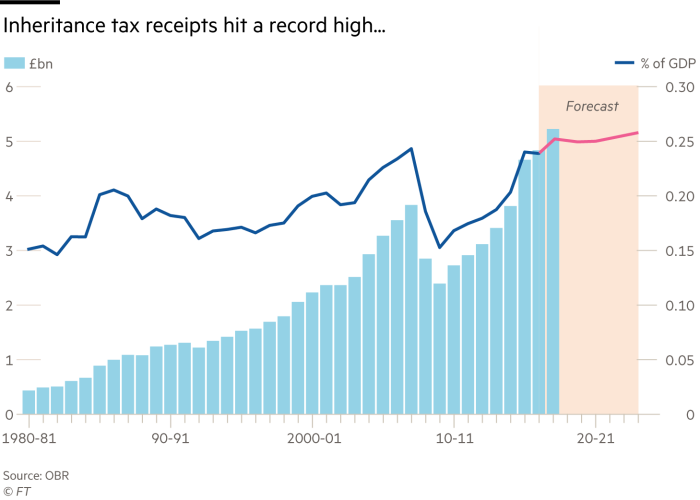

Days after inheritance tax receipts were revealed to have hit a record £5.2bn, many have gripes about the current system. Soaring property prices in the UK have dragged more estates into the IHT net. A tax that arouses strong emotions, IHT has generated longstanding complaints that it amounts to the double taxation of assets from which HM Treasury has already taken its share. However, the tax is levied on less than five per cent of estates in the UK.

With the consultation set to report back in time for the autumn Budget, some advisers already fear that Mr Hammond’s desire to make the system fairer and less complex could end up removing valuable aspects of tax planning that wealthy families commonly use to mitigate their IHT liability.

Leaving a legacy

The chancellor formally asked the Office for Tax Simplification to review the inheritance tax system in February.

In a letter to the OTS, Mr Hammond acknowledged that the tax was “particularly complex” and asked to hear any proposals it could come up with to ensure that IHT was “fit for purpose” and would make “the experience of those who interact with it as smooth as possible”.

Launching its formal call for evidence this weekend, Paul Morton, tax director at the OTS, says he wants to hear the experiences of individuals and professionals in relation to how IHT currently works — or doesn’t.

“We have already had more reaction to our IHT review than any other work we have undertaken and are expecting to receive many more responses from professionals and individual taxpayers than ever before,” he says.

“There are a couple of specific areas of IHT which tend to generate high levels of public complaints, such as the residence nil-rate band and the gifting rules, and we are going to look closely at whether those complaints are due to the complexity of those rules.”

The review covers three broad areas.

First, practical issues including the process of submitting inheritance tax forms and the administration and guidance surrounding these.

Second, the complexity of the current rules and how they are perceived by taxpayers, professionals and industry bodies. This will cover the various IHT reliefs, including those for businesses, farming businesses and charitable giving, plus current gifting rules that enable families to mitigate their final tax liability by passing on wealth while they are still alive.

Third, the scale and impact of “distortions to taxpayers’ decisions, investments, asset prices or the timing of transactions” because of IHT rules, including relevant aspects of the taxation of trusts.

The OTS wants to consider the “user experience” of the IHT system as well as the complexity of the legislation itself. For the first time in its history, the call for evidence has been extended to individual taxpayers and a specially designed 10-minute online survey has been produced to capture their feedback.

“We want to look at the technical and administrative issues surrounding the regime, such as the process of submitting returns and paying the tax due, as well as the practical issues surrounding routine estate planning,” Mr Morton says.

“The groups we hope to hear from are broadly those who have first-hand experience of administering an estate or those concerned about a future IHT liability,” he adds.

This might include those who are thinking about how IHT may affect their own estate or anyone thinking about an estate that they may inherit.

The OTS hopes to hear from individuals who have been an executor and did not use an adviser.

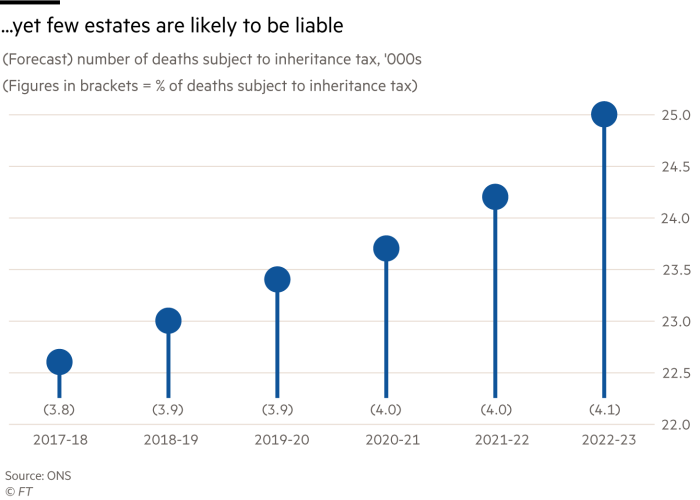

“We are concerned about the process which leads to an enormous number of people having to fill out forms unnecessarily,” adds Mr Morton. “Less than 5 per cent of deaths result in tax being paid — it brings in less than 1 per cent of total tax revenue. But many more people have to fill in these forms following the death of a family member, at what is usually a difficult time. We are going to look at whether this could be simplified so it is less arduous.”

Mr Morton says he suspects there may be many individuals who worry about future IHT bills without knowing much about how the system operates.

“For example, we suspect there are lots of elderly people who are needlessly worried that they may lose their home when their spouse dies,” he says.

The OTS review will also consider quirks within the current system which enable the wealthiest legitimately to reduce their liability — such as the IHT exemption on certain Aim shares when held for a qualifying period.

The call for evidence is the first stage in the consultation and will close on June 8. The final report is expected in the autumn, but there is no guarantee that what the OTS recommends will result in changes to tax policy.

Behind the scenes, advisers feel it would be politically foolhardy for the chancellor to tinker with IHT rules in a way that could force the wealthiest to pay more, but they see the review as a sign of intent that could increase pressure for future reform.

A taxing topic

The current inheritance tax system is resented by many individuals and industry professionals alike.

While the values of homes and investments have soared over the past decade, the nil-rate band — above which inheritance tax is paid — has remained at £325,000 per person since 2009-10. As a result, an increasing number of families have become liable to pay it.

The number of estates affected by IHT increased by nearly 60 per cent over the six tax years to 2016-17, and the amount of money raised by the tax swelled from around £2.4bn to £4.8bn over the same period.

HMRC’s latest monthly data show this figure hit a record £5.2bn in the past tax year, and despite the impact of a new allowance for family homes, and official forecasts expect the tax take to rise further in future years (see graphic).

However, IHT represents a relatively small part of overall taxation. That £5.2bn figure is a tiny percentage of the £177bn of income tax that was paid by more than 30m individual taxpayers in 2016/17. Annually, the number of estates that actually pay IHT are fewer than 25,000 — less than 5 per cent of the total.

“IHT can in principle be defended on the basis that it is progressive — it is only wealthier individuals, or their heirs, who are affected by it,” says Dominic Lawrence, a partner in the international private client team at Charles Russell Speechlys, a law firm. “However, to some extent this ignores the fact that for the very wealthy there is greater scope to avoid the tax than there is for the mass affluent.”

Trust structures have long been used by wealthy families to shield their estates from the tax man’s clutches, although the rules are becoming more complex. Yet one reason that the tax is politically toxic is that it affects those who are not rich enough to give away many assets while they are still alive. For this reason, IHT was once described as a “voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue”.

Ripe for reform

Most industry professionals believe that a review of the IHT system is long overdue.

“There are two serious problems with the system as it stands,” says Sarah Coles, personal finance analyst at Hargreaves Lansdown. “First, the sheer complexity of the process after someone dies, and second, the way in which the rules force people to manage their finances in a way they otherwise wouldn’t while they are alive.”

Even administering an incredibly simple estate, in which one spouse or civil partner passes everything to the other, and there is no IHT to pay, can involve hours of complex paperwork, racking up significant fees from professionals, including lawyers and estate agents.

“More complex estates can become so complicated that they take months to settle, during which time, the trustees can rack up major expenses and put a serious dent in the estate,” says Ms Coles.

Sean McCann, chartered financial planner at NFU Mutual, adds that families who attempt to tackle probate themselves rather than using a professional adviser may be unaware of some of the exemptions and reliefs that can be claimed.

“Executors who ‘DIY’ probate often think they are saving on legal costs — but in fact many end up being taxed more,” says Alison Morris, a partner at Wilsons, a legal firm. “Now that it is possible to apply for probate online, more individuals are applying without fully understanding the complex procedures around executing wills.”

Some advisers believe the myriad allowances and reliefs allowed under the current system should be simplified — for example, combining the various individual gift allowances into one larger annual allowance.

“The complexity of IHT has come around after years of tinkering with the system,” says Adrian Lowcock, investment director at Architas.

Advisers note that many thresholds have not kept pace with inflation. The prime example of this is the nil-rate band, which has been frozen at £325,000 until 2020-21.

Many believe the existing nil-rate band should have been raised to £500,000 rather than introducing an additional “residence nil-rate band” last year. Eventually worth an additional £175,000, this will enable a couple to pass on a family home worth up to £1m tax free to their direct descendants.

“Whilst this has helped [mitigate IHT liability], it has also made IHT more complex,” adds Mr Lowcock.

“Unfortunately, some of the detail is byzantine and has many advisers tearing their hair out with some of its complexities,” says Mike Hodges, partner at Saffrey Champness, the chartered accountant. “A straightforward increase in the nil-rate band would have been a much simpler solution.”

Too much complexity could have the unintended consequence of pushing executors into the hands of advisers, rather than creating a streamlined system which a lay person could navigate with a reasonable degree of confidence.

A gift too far

While individuals and professionals alike agree a review is needed, any simplification also risks reliefs and exemptions being cut or restricted.

One adviser predicts that however politically unpalatable, given the current economic backdrop the chancellor “simply won’t be able to resist making changes to IHT” to increase how much tax the wealthiest families pay.

Gifting money to your heirs while you are still alive forms the central plank of tax planning, but some advisers worry that this could be limited in future.

“The government is more likely to be interested in changes which would increase the amount of IHT raised from the public,” warns Mr Lawrence. “It is possible to imagine changes to the ‘potentially exempt transfer rule’ — that a lifetime gift is free of IHT provided that the donor survives a seven-year run-off period from making the gift. It would be easy for this to be lengthened, for example, to 10 years, to make such gifts by elderly taxpayers less likely to work.”

Ms Coles adds that the current gifting rules can have other unintended consequences: “It encourages people to give away large sums sooner than they might be able to afford — especially if they underestimate their longevity or have expensive care needs later in life,” she says.

There are several anomalies that advisers highlight as being potentially vulnerable.

Mr Hodges believes the review is likely to spark a “debate around the perceived generosity of business property relief” which was “hinted at in the OTS terms of reference”.

This relief was primarily intended to allow individuals to pass family businesses on to heirs without them needing to be broken up to fund IHT. However, BPR can also be claimed on certain shares of companies listed on the Alternative Investment Market (Aim) providing that they have been held for more than two years. Many Aim investment funds are specifically marketed for their IHT-reducing capabilities.

“It is a bit surprising that such shareholders can qualify for this relief and is easy to see this relief being amended to make it more focused on unquoted trading businesses,” adds Mr Lawrence.

He also thinks it is possible that agricultural property relief might be made more focused, for example, by restricting the availability of the relief in relation to certain types of let farmland.

A further anomaly is the tax treatment of pensions. Since pension freedoms were introduced, holders of defined contribution pensions are able to pass them on tax free to their heirs if they die before the age of 75.

Trusts are already a legislative minefield following major changes to taxation in 2006. For many families, the tax savings may not be worth the cost of setting one up.

“Trusts may come with an awful lot of additional administration — and cost,” says Ms Coles. “The taxation is so complex that normally people will have to use a professional adviser or tax accountant to work through it and pay for their services.”

She points out that if you die within seven years of establishing the trust, not only will the trust be brought back into the estate for IHT calculations, but so may any gift in the seven years before the trust was established.

“The whole area needs to be simplified, so that those who simply want to ringfence assets for children under the age of 18, or for the use of an adult child without influence from their spouse, can do so more simply,” says Ms Coles.

Have your say

The OTS online survey is anonymous and should take less than 10 minutes to complete. Suggestions from individual taxpayers will inform the report that is put to government.

To take part, follow the link from the OTS website: gov.uk/ots

Current inheritance tax rules

Inheritance tax is charged at 40 per cent on estates valued at more than £325,000. Anything up to this amount is known as the “nil-rate band” and no IHT is charged on it. An individual’s estate can include property, possessions, money and investments and sometimes include assets held in trust, plus gifts they have made.

Couples can pass all of their tax-free allowance on to their spouse or civil partner upon their death, effectively giving them a combined £650,000 IHT threshold.

However, as house prices have soared in London and the south east, the value of family homes has pushed many estates over the tax-free limit.

The idea of George Osborne, the former chancellor, an additional “residence nil-rate band” was introduced a year ago. Currently worth £100,000 a person, this allowance will gradually rise to £175,000 over the next three years, enabling a couple to pass on a family home worth up to £1m to their direct descendants without incurring IHT liability.

This definition includes children, stepchildren and adopted children — but not siblings, nieces or nephews.

Couples who downsize to a smaller property or sell the family home to finance care home fees can still use the allowance to protect funds from the original sale from incurring IHT when these are passed to direct descendants.

Comments