Beyond The Baer Faxt: art-world insider Josh Baer goes global

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

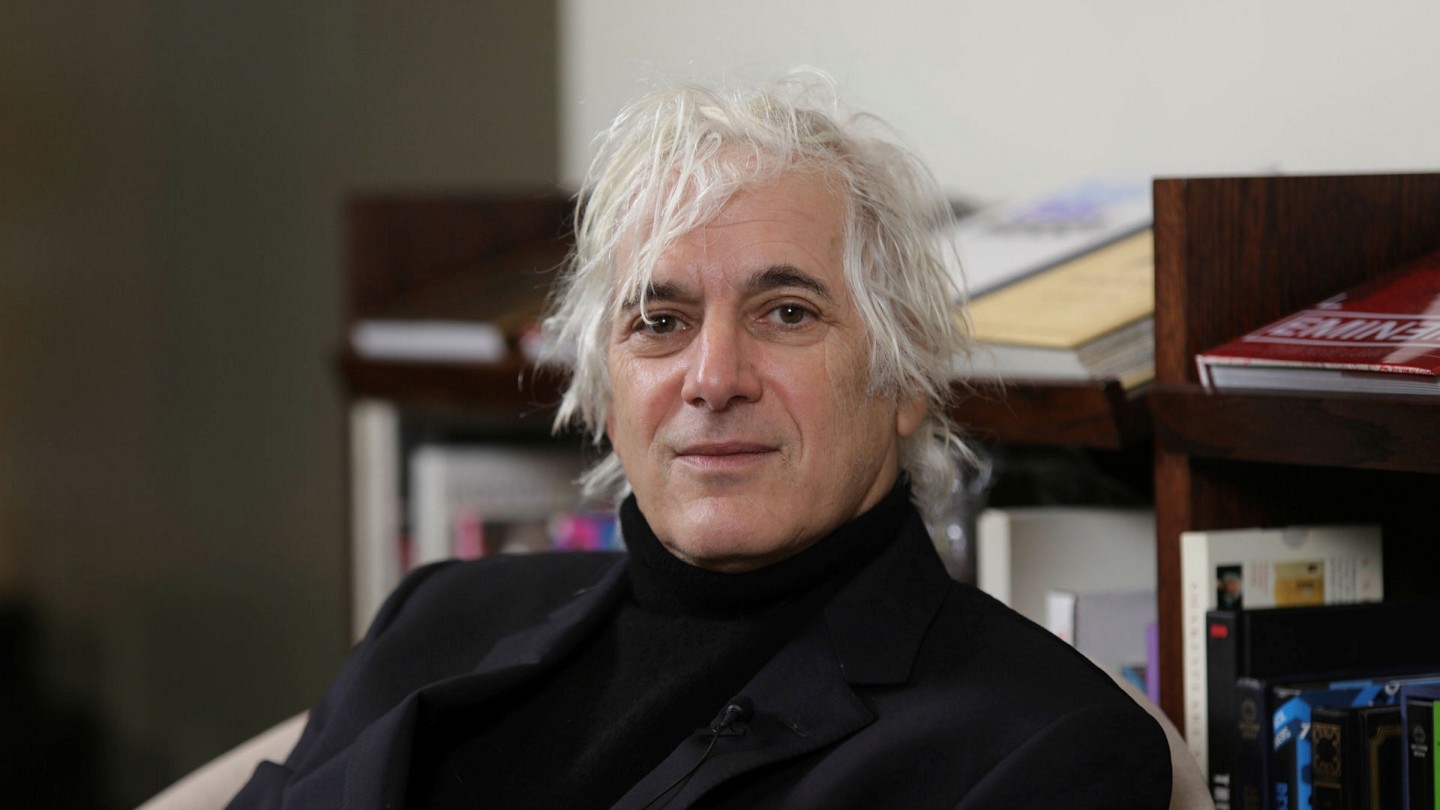

In one of Eric Fischl’s “Art Fair Paintings” from 2014 the figure of Josh Baer is unmistakable. Amid the montages of gallerists and collectors, curators and celebrities, Baer, with his shock of white hair, is shown engaged in the same activity as most of Fischl’s other fair-going characters — looking at his phone rather than at the work on show. It’s an arch view of the contemporary art market, but it also highlights Baer’s central role within it as both a sought-after adviser and the founder of The Baer Faxt newsletter — an insider round-up of auction results, gallery openings and artist signings that he has published weekly since 1994.

Today its 7,000-plus subscriber base includes most of the art world’s biggest players, from gallerists Larry Gagosian and David Zwirner to Christies chair Marc Porter. Zwirner underlines its importance to insiders: “It’s something we would all have a hard time living without.”

Now Baer is expanding his reach. “I got to a point where I could just sort of coast,” he says over the phone in his broad New York accent. “The newsletter was getting a little less interesting but people would still subscribe. You know, I’m 66 now. I thought, ‘Do I want to just play out the string, or do I try to make it more interesting?’”

By selling a minority stake in his business — for an undisclosed sum — to investment bank LionTree and Virtru Investment Partners, the family office of MoMA board member Glenn Fuhrman, Baer has launched a “product portfolio known as The Baer Faxt+”. As well as the newsletter, it includes an auction database (detailing buyers and underbidders as well as prices), souped-up subscriber content (video podcasts with curators and artists) and a new on-demand advisory service.

The latter is the art-world equivalent, says Baer, of Doctor on Demand, supplying on-call advice to “people who don’t need a full-time adviser walking around every fair with them”. Priced at $3,000 per year (compared with the $40,000-$500,000 Baer suggests it would otherwise cost to “access a world-class art adviser”), it is aimed at collectors at both ends of the market: “People who know a lot about art and want to know why this Richter abstract is better than that Richter abstract, but also the people who ask, ‘Who’s Gerhard Richter?’”

Baer grew up in New York’s art world — his mother, Jo Baer is a painter today represented by Pace gallery. “As a kid, Robert Smithson or Clement Greenberg would come over to the house for dinner, or we’d go to see a show with Jasper Johns,” he says. “I was at the centre of the art world looking out — although, certainly, my becoming an art dealer was not something that my mother embraced. To her, art dealers were generally bad.”

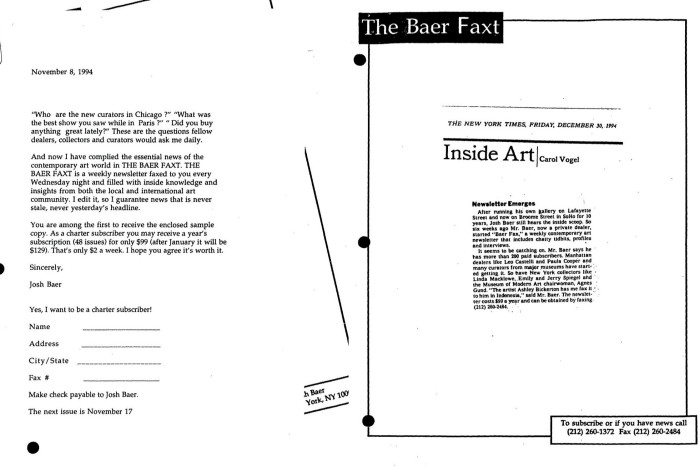

After studying maths and computer science at university, Baer was drawn back to the New York art scene in 1979 and cut his teeth as the director of the artist-run, non-profit space White Columns. He followed with an eponymous SoHo gallery, representing artists such as Nancy Spero and Lorna Simpson. After the art market crash of the mid-1990s, however, came a career low point — “I went out of business and was deeply in debt,” he says, which prompted him to start compiling The Baer Faxt, for which a standard subscription is $375 a year.

His very first subscriber was Zwirner, who became friends with Baer when the gallerist moved to New York in 1990. “You would sit around on Thursdays and wait for that fax to come through. He was filling a void. I still read The Baer Faxt to know what my competitors are doing.”

The Baer Faxt knowledge helps Baer as an adviser. Over the past 27 years he has facilitated more than $500mn in transactions. “I don’t take a scattershot approach,” he says, so he engages less often but more successfully. He has facilitated Basquiat sales and one particularly memorable deal for his client, tennis player John McEnroe.

“I’ve been super-involved with African-American art for at least 30 years and I said to John, ‘Do you know this artist named Mark Bradford? Because I’ve found something; you have to come see it,’” says Baer of the monumental 12ft by 35ft abstract canvas that McEnroe bought in 2014 and sold at Phillips in 2018. “It made a record price of just over $12mn and went to The Broad museum in Los Angeles. I would say that was a pretty great home run: acquiring it, living with it, selling it in a smart way and having it wind up in an institution with a multiple-x return.”

Not that Baer necessarily considers making a good return his strong point. “Now, with all the NFTs and the speculative thing, people can make a lot of money buying and selling art, but I’m not too good at that,” he says. “There are other people who have better commercial sense, who can really smell a market and time it.”

In his expanded advisory capacity, he has aligned himself with a roster of peers: Liz Sterling and Rick Wester in New York, Xiaoming Zhang in Shanghai (the Chinese-language version of The Baer Faxt has around 3,000 subscribers) and Kami Gahiga in London. Their collective experience spans auction houses, private collections and institutions including the Guggenheim.

Curiously, Baer himself says he is not a collector. “But I do own art,” he adds. “The difference is that I don’t care if the value goes to zero. Every so often I find something that I really love.” Recently this has included a photographic work by American sculptor Charles Ray — “I bought it emotionally” — and a portrait by young Ghanaian painter Amoako Boafo, a piece he compares in price with a house in the Hamptons. “It’s work that could actually go down to $1,000,” he muses. “It’s hanging in my living room.”

Comments