Fall in tech stocks in 2022 helps fuel recovery for short sellers

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

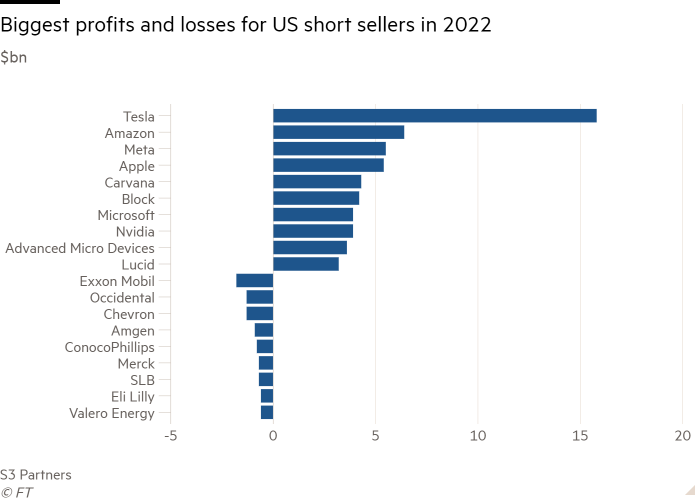

Last year’s big drop in the share price of Tesla, Amazon, Apple and Facebook owner Meta has helped deliver bumper profits for investors betting against US stock markets in a sharp reversal of their recent fortunes.

Short sellers — investors who believe an asset is overvalued and its price will fall — lost about $572bn in US markets between 2019 and 2021, crushed by low interest rates and a rapid asset price recovery from the outbreak of Covid-19. But last year produced aggregate profits from the strategy of $300bn, according to S3 Partners, a specialist New York-based consultancy that tracks short positions, with tech stocks providing much of the boost.

The revival of the strategy suggests stockpicking investors could reap outsized returns in the coming years now that individual companies and sectors are plotting more diversified paths in markets rather than wafting higher in unison.

“Shorting in the information technology sector was like [shooting] fish in a barrel with 70 per cent of all the constituents in the sector having a down year and $9 out of every $10 shorted delivering a profitable trade,” said Ihor Dusaniwsky, managing director at S3, whose analysis on short selling stretches back to 2018.

Tesla’s share price dropped 65 per cent in 2022, providing the biggest payout of last year for short sellers with mark-to-market profits of $15.8bn. Tesla bears feasted while Elon Musk sold almost $23bn of his holdings in the electric-car maker to fund his takeover of Twitter — a deal that itself resulted in losses of more than $500mn for short sellers in the social media stock last year after the board sued Musk to adhere to his original $44bn offer. “Twitter shorts got clobbered by Elon Musk’s purchase,” said Dusaniwsky.

Tech stocks put in an almost universally dire performance in 2022, with the Nasdaq Composite index falling by a third. By contrast, betting against oil stocks like ExxonMobil, Occidental, Chevron, Marathon and ConocoPhillips resulted in losses as oil prices rose in response to Russia’s invasion of Ukraine. But other sectors generated winners and losers, making it trickier for investors to pick the right short bets, Dusaniwsky noted.

Securities lending — a practice where investors can temporarily transfer stocks, bonds and exchange traded funds — is the bedrock of short selling, and it was in high demand in 2022.

Large institutional investors that agreed to lend out assets to short sellers and other market participants drew in global revenues of $12.5bn in 2022, an increase of 14.8 per cent on the previous year, according to S&P Global Market Intelligence.

Investors raised almost $4.8bn by lending out US stocks last year with the near 20 per cent decline in the S&P 500 encouraging short selling activity, most notably in the software and electric vehicles sectors.

Matt Chessum, securities finance director at S&P Global Market Intelligence, said worries about the impact of increased financing costs on demand for electric vehicles encouraged short sellers to bet against EV companies including Tesla, Lucid and Fisker.

“Lucid is likely to be the highest securities lending generating stock of 2022 at $267.6mn. Fisker generated around $74.2mn in securities lending revenues last year,” said Chessum. Lucid shares fell 82 per cent last year while Fisker dropped 54 per cent.

The collapse in prices for cryptocurrencies including Bitcoin also led short sellers to seek targets in the US software sector with Marathon Digital, MicroStrategy and Riot Blockchain, now renamed Riot Platforms, seeing significant percentages of their shares out on loan.

Nasdaq-listed Beyond Meat also provided rich pickings for short sellers after slashing its annual sales forecast for 2022, which led to an 81 per cent drop last year in the market value of the plant-based food provider.

“Beyond Meat was one of most popular stocks for borrowers, generating securities lending revenues of $195.3mn last year,” said Chessum.

Lending of exchange traded funds has accelerated over the past decade as these highly liquid index tracking vehicles have become widely adopted by US investors. Securities lending revenues from ETFs reached $847mn in 2022, up 34 per cent on the previous year.

BlackRock’s European-listed MSCI China ETF delivered securities lending revenues of $13.9mn last year as disruption to economic activity resulting from the country’s zero-Covid policies provided short sellers with a clear justification to target Chinese stocks.

Fixed-income markets delivered significant losses in 2022, which also resulted in some notable developments for securities lending activities associated with government and corporate bonds. Borrowing fees for both government and corporate bonds rose markedly last year, a reflection of liquidity problems in some parts of these markets.

The increase in fees helped to push up revenues from securities lending earned from government bonds and corporate bonds to $1.8bn and $963mn respectively.

Borrowing demand for UK gilts increased significantly during the crisis that destabilised parts of the country’s pension sector last year. UK government bonds generated $182.4mn for lenders in 2022, an increase of 45 per cent on the previous year.

Defined benefit pension schemes rushed to borrow gilts to ease collateral strains following the UK government’s disastrous “mini-Budget”. The episode “demonstrated the value of securities lending to broader financial market stability by easing some of the pressure points”, said Chessum.

Comments