Accountancy online course attracts global learners

Simply sign up to the Business education myFT Digest -- delivered directly to your inbox.

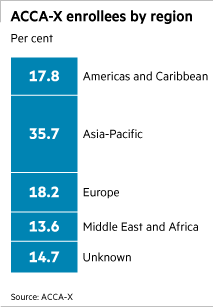

A year after its launch, the Association of Chartered Certified Accountants’ online-only X programme has enrolled more than 100,000 people from 230 countries. But the success of these vocational courses — which offer a combination of free and “affordable” modules as part of a “try before you buy” approach to entice more students — will be judged on how many graduates secure careers in the accountancy profession.

ACCA, the global professional body that supports 178,000 members and more than 400,000 students, launched free introductory and intermediate courses in financial and management accounting in July. Three additional modules for the diploma in accounting and business were then introduced in October, costing $89 each. Exams are an additional cost that varies by country, but most are less than $145 each.

Fatima Patel, a student based in Harare, had been struggling to balance ACCA’s classes with other commitments and decided to exchange the classroom for the X programme’s online modules. “Not only do I get to work at my own time and pace, the content is incredibly relevant and precise. I will definitely be taking the paid-for courses,” the 19-year-old says.

Ms Patel also notes that quality ranked as highly as convenience in her decision. “It is fairly easy to access classroom-based training in Harare but the quality leaves much to be desired,” she says, adding that the combined cost of internet access and the paid-for course is still cheaper than attending a college or hiring a tutor.

ACCA tried to find a price for its X programme that was affordable to a large global audience. Yet some still find the $89 cost a barrier. Mir Akib, a 21-year-old from Bangladesh, reports an excellent experience with the free courses but could not afford the paid-for units.

“The price is little bit high for some poor students like me. If it was $50 it would be affordable for me and some other students I know,” he says.

Of the more than 100,000 enrolments to the X courses so far, 1,000 are for the paid-for modules. More than 1,500 ACCA exams have been taken by learners on the X programme. The completion rate for the free courses is in line with that of other free Moocs (massive open online courses), which is just 4 per cent, according to a study by Harvard Business Review in September. However, Mark Kenhard, product manager of the programme, says while he does not yet have the data, he anticipates a higher completion rate for the paid-for courses as they tend to elicit a “higher level of commitment” from learners.

The programme’s success will inevitably turn on whether it delivers credentials that lead to careers in accountancy. Jeremy Black, partner in the professional services practice at Deloitte, says while the courses are a useful tool for teaching technical aspects of a role, when assessing job applicants there is no comparison between the X courses and a professional course such as the UK’s ACA. The ACA is a three-year programme that includes face-to-face learning and on-the-job training, and requires students to sit about 15 exams.

“They’re not just about technical accounting but about ethics that people need to have as part of what they do. I suppose in theory you could teach that online but you’d perhaps have to do other things as well,” says Mr Black.

However, the big accountancy firms are looking closely at how they can integrate ACCA-X into their internal training programmes. Tom Hartgill, who leads learning and development at professional services company PwC, says while the courses are unlikely to replace its structured graduate training programmes, they “may be suitable for those in non-finance roles who would benefit from a base level of finance knowledge, and potentially for individuals looking for a change of career path into finance”.

Deloitte had the option of going fully online with its own internal training programmes, but it favours a mix of online and classroom-based learning. ACCA is working on a business-to-business model where external providers combine the X courses with face-to-face learning.

“The main reason for that is the research tells us that pass rates for exams are higher if you’re using blended learning rather than if you’re simply studying alone,” says Mr Kenhard.

ACCA-X is trying to take financial literacy to a wider audience. In South Africa, for example, it has teamed up with the regional Gauteng City government to provide financial literacy training to 250 disadvantaged children a year, providing them with free tablets.

In Zimbabwe it has struck a deal to help train about 3,800 unqualified government accounting clerks. The country’s largest mobile network provider, Econet Wireless, has agreed not to charge users for data when they access the mobile version of the course from July. Mr Kenhard says more initiatives are on their way for later this year.

Comments