Pandemic’s digital push shows future of bond trading

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

An accelerated shift to digital transactions, in all areas of the economy, has been a lasting legacy of the coronavirus pandemic — and the trading of US bonds has proved no exception.

Electronic trading had already been transforming the US government bond market, in the decade that followed the global financial crisis. Tougher capital rules for banks after 2008 opened up one of Wall Street’s more exclusive markets to other computer-orientated dealers, known as principal trading firms. This growing reliance on technology steadily boosted the use of automatic prices — those that are provided and constantly updated through algorithms — and in turn cemented the role of electronic platforms operated by MarketAxess and Tradeweb.

But it took the Covid crisis to up the rate of change. “More platforms are aggregating liquidity and the pace has accelerated since the pandemic,” says Josh Barrickman, head of bond indexing at Vanguard.

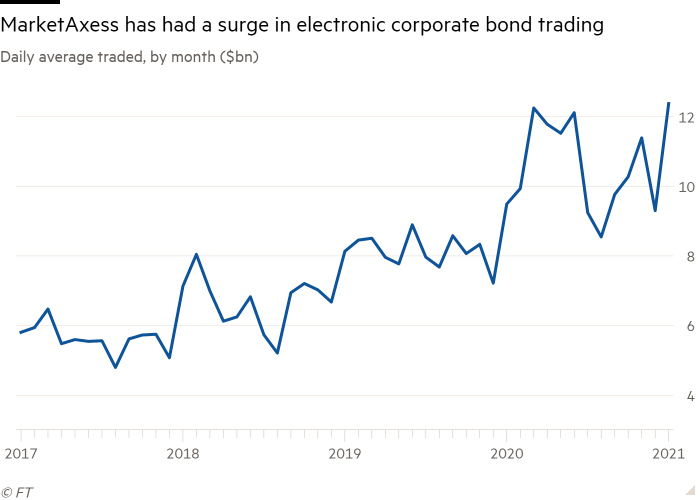

Where the pandemic has truly moved the digital needle is in the corporate bond market — where companies sell vast amounts of their debt to large institutional investors, such as BlackRock, Fidelity and Vanguard.

Electronic transactions in high quality corporate bonds are now accounting for 40 per cent of the total — up from less than 30 per cent in early 2020, and from just one-tenth in 2011, according to Greenwich Associates, a London-based market research company. Around 60 per cent of US government bond trading has been electronic for several years.

“The response to the pandemic has pulled the future forward by five years for the bond market,” says Dan Veiner, global head of fixed income trading at BlackRock. “There has been a surge in electronic trading and the platforms are . . . encouraging more all-to-all trading” — the process whereby both dealers and investors provide prices in one venue, and transact.

This growth in electronic trading of corporate bonds has been nurtured by two important developments: more accurate price data; and strong growth in the number of exchange traded funds that track various bond indices.

“Data has become more reliable and this has improved the quality of prices seen in the market,” says Veiner. “More dealers and investors are using algos or automatic trading systems to transact so-called ‘social size’ trades of up to $5m in the more liquid investment-grade bonds.”

At the height of the pandemic market rout, in March 2020, the US Federal Reserve announced that it would start buying bond ETFs. That helped stem panic selling in corporate debt, as it encouraged investors to sit in or buy. With the Fed’s support, investors have since pumped record amounts of money into bond ETFs over the past year, helping create a much deeper market for trading bonds on electronic platforms.

Strong investor demand for fixed income ETFs helps drive greater electronic trading in the corporate bonds that are bundled together in the index tracking instruments. “We are seeing a tighter integration with ETFs [and bond prices] on trading desks,” explains Barrickman.

One example of the resulting changes in the corporate bond market is how large baskets of bonds are being quickly priced and traded using electronic platforms. Better data, and the ability to find more prices through ETFs, mean that hundreds of bonds can be electronically priced at the same time.

So-called portfolio trades have gained in popularity, as they allow investors to buy or to sell large baskets of bonds, particularly if many of the holdings are available in an existing ETF. Dealers and other market makers are more willing to price these baskets of bonds if they can use the ETFs to help them hedge risk and then unwind their exposure over time.

“Portfolio trades are a balance sheet efficient way for dealers to move large transactions,” says Veiner. “Credit algos, ETFs, and portfolio trading are important tools for efficient risk intermediation.”

As trading in bonds becomes more electronic, the question for market participants is whether the shift provides more resilience during bouts of turmoil — when there is typically less price support from dealers.

“While big banks are instrumental in maintaining liquidity, the market has become more diverse, and what we saw during the pandemic was that electronic systems continued to supply data and [to] function,” says Kevin McPartland, head of research, market structure and technology at Greenwich Associates.

Earlier this year, analysts at Pimco also examined the lessons from the market turmoil of March 2020 and concluded that the episode made a case for reducing some of the regulatory constraints on bank balance sheets and “expanding the footprint of all-to-all trading platforms”.

In the past, banks with large balance sheets had acted as buyers of last resort when investors took flight and dumped bonds. By holding these positions, the big dealers helped stabilise prices and ultimately reaped large gains.

But Pimco concluded that facilitating a more open market, with some regulatory relief, “could foster additional sources of liquidity, less reliance on a handful of banks, and lower costs.” Ultimately, the report said that, in time, the use of trading platforms “could also ease markets’ reliance on the Fed as the liquidity provider of last resort.”

Comments