Sterling traders brace for volatility as EU-UK deal hangs in balance

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

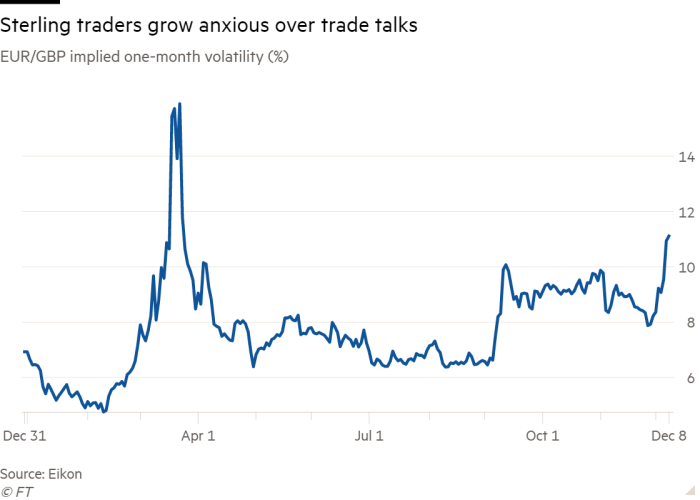

Traders are bracing for big swings in the value of the pound as UK-EU trade talks go down to the wire, with implied volatility hitting its highest level since the coronavirus crisis tore through markets earlier this year.

Sterling’s expected volatility over the next four weeks has reached a mark not seen since the aftermath of the March sell-off — having risen by nearly a third over the past week for both the dollar and euro exchange rates.

“Volatility going higher makes sense as negotiations sit on a knife edge,” said Ian Tew, a sterling trader at Barclays. The next few days will be critical, he added, with markets sensitive to headlines and set up for “a decent-sized move for sterling”.

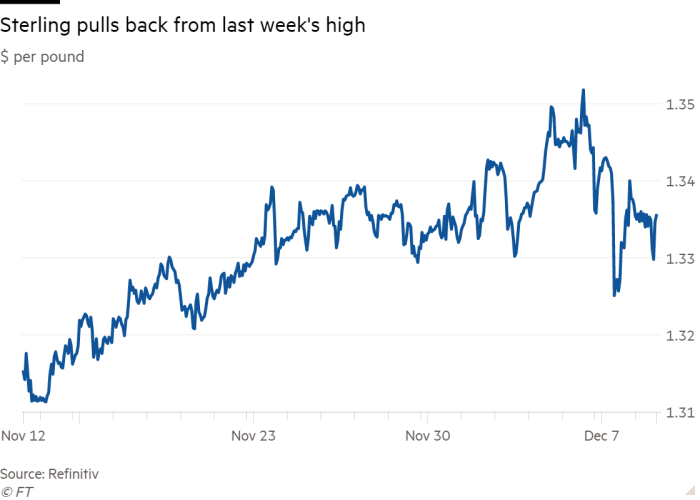

That marks a sharp turnround from last week, when the pound touched its strongest level since May 2018 against the dollar after weeks of growing optimism that a deal could be struck.

But a lack of progress over the weekend and tough words from both sides has sent the pound down around 0.7 per cent in just two days to trade a bit above $1.33, from above $1.35 at the end of last week.

The pound was also down about 0.8 per cent against the euro by Tuesday afternoon, which if it does not improve in the coming days would mark its worst weekly performance since September.

In recent weeks, investors raised their bets on a positive outcome to the talks, but the lack of progress has punctured some of the optimism and forced investors into buying contracts that protect them from large exchange rate shifts — driving up the implied volatility measure.

Bets that pay out if sterling depreciates have also increased. Options markets indicate that buying protection against a weaker pound has become about 50 per cent more expensive than those that pay out if sterling rises.

Kamakshya Trivedi, co-head of global FX, rates and EM strategy at Goldman Sachs said rising volatility and increased caution about further sterling gains reflected rising nervousness about the outcome, especially because many investors had expected an agreement to be reached ahead of the EU summit on Thursday.

“A deal could still come together in the coming days if political interventions are successful, but it might take a little more brinkmanship to make compromises palatable on all sides — something that is likely to keep [sterling] markets on edge,” he added.

Traders have also built up record positions in futures contracts to bet on or hedge against moves in UK interest rates, as tension rises that Britain may leave the Brexit transition period without a trade deal.

Open positions in UK rate futures surged to 4.9m contracts, worth a notional total of £2.5tn, at ICE Futures Europe, the main derivatives exchange in London.

Additional reporting by Philip Stafford

Comments