Tech disrupters deliver on their promise for growth investors

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The secret to rapid growth, it turns out, is predictably simple: tap into a significant trend, and take it very seriously.

Renaud Laplanche, chief executive of Upgrade, the fintech lender that tops the latest FT-Statista ranking of the Americas’ 500 fastest-growing companies, credits product innovation and being consumer-friendly for achieving a compound annual growth rate of 686 per cent between 2016 and 2019.

Upgrade’s flagship product gives consumers a credit line of up to $25,000, which is accessed via a Visa card. Credit card debts turn into instalment plans to be paid over six months or a few years, to help consumers avoid incurring more debt.

“The worst feature about [most] credit cards is they don’t encourage you to pay down your debt,” Laplanche says. “They’d rather you take 25 years to pay off the balance and end up paying three times what you’re initially charged.”

Companies that have thrived in the pandemic have, in many cases, been those whose products were geared towards trends that were largely unexpected — such as large-scale working from home or the accelerated digitalisation of industries.

But the FT-Statista ranking, which captures the fastest-growing companies in the years immediately preceding the pandemic, reveals a remarkable fact: many were already well-placed for the changes that Covid-19 necessitated.

Upgrade, for instance, benefited as customers and retailers moved away from cash and adopted its contactless payments. Goodfood, ranked third, is a publicly listed Canadian meal-kit delivery service that was sending out more than 1m kits a month even before the pandemic: its revenues climbed from $2.1m to $122m between 2016 and 2019. Sprinly, a US-based company that prepares plant-based meals, ranks 15th.

Meanwhile, Alivi, an on-demand, non-emergency medical transport service, increased revenues from $741,000 to more than $31m in the four years before the pandemic, putting it ninth on the ranking.

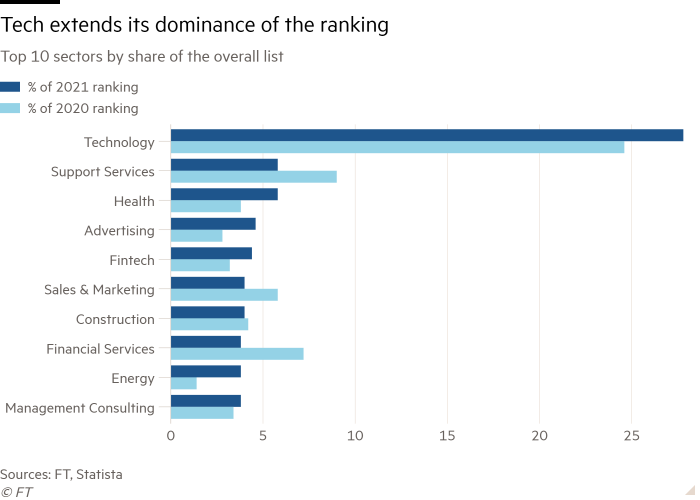

As in last year’s ranking, the technology sector has the greatest representation in the list, providing three out of every 10 companies. But even this understates the role tech is playing as a disrupter.

Technically, only one of the 10 biggest companies on the list by revenue is classified as a technology group: ServiceNow, an IT workflow platform. However, most people would probably put all 10 into that category: Facebook and Netflix, which are listed as media companies; Uber and Lyft, which come under transport; Tesla, which falls into automotive; Wayfair and Mercado-Libre, which are classed as ecommerce; and Square, which is fintech.

For the second year running, New York is home to the most fast-growing companies in the Americas, with 31. San Francisco moves up one place to second, with 19 companies, while Toronto falls to third, with 17. The US accounts for 71 per cent of all companies on the ranking, while South America has a near 15 per cent share, just ahead of Canada’s 13 per cent.

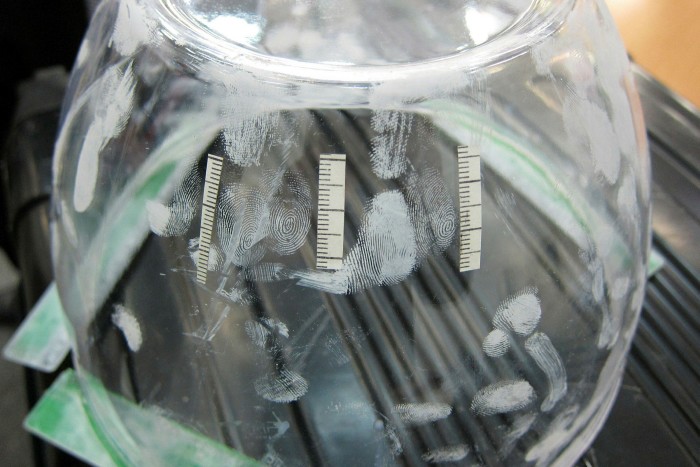

Griaule, a software group based near São Paulo — where 10 companies on the list are based — makes the ranking for the first time, after demand for its biometric recognition technology took its 2016-19 compound annual revenue growth rate to 35 per cent.

Its existence remains something of a novelty to local customers, according to the company, which ranks 364th. “Our clients are not expecting to have this kind of technology in Brazil,” says Thiago Ribeiro, chief marketing officer. “They are very surprised what they can get from a company that is not so far away.”

The highest-ranking technology company is Samsara, a little-known San Francisco logistics start-up whose revenues climbed from less than $0.5m in 2016 to nearly $120m in 2019. This gave it a 2016-19 CAGR of 530 per cent, placing it second on the overall ranking.

Its name comes from Sanskrit for the cycle of life, death and rebirth that Buddhists seek to escape — and the company’s pitch is that, while all life is inevitably sorrowful, as the Buddha once said, business doesn’t have to be.

Samsara’s internet-of-things technology involves equipping factories and fleets with sensors to manage operations. That put the company in prime position during the pandemic, as factories in China shut down and it became essential for businesses to adapt and fine-tune their transportation and warehousing.

But the first months of the pandemic were also a period of chaos, and in May 2020, Samsara was forced to cut 300 employees — nearly a fifth of its headcount — and raise $400m at a discounted valuation of $5.4bn.

At the time, the deal underscored how even the fastest-growing groups were dealing with pandemic-related uncertainties. But, by December, Samsara was back on track, surpassing $300m in run-rate subscription revenue — up more than 80 per cent for the year. It is now planning an initial public offering.

“Supply chains have been digitising for years, and the pandemic turbocharged this transformation,” says Dominic Phillips, chief financial officer.

“While much of the world worked from home, these industries were transporting food across the country, manufacturing PPE and, quite literally, keeping the lights on. As a result, many experienced massive spikes in demand and business tailwinds which have carried over to 2021.”

More stories from this report

At Upgrade, growth also continued into 2020, in part because its customers — with average earnings of more than $100,000 a year — were the types of workers who kept their jobs during the pandemic.

Fast growth is not the preserve of the tech sector, however.

Among the more idiosyncratic companies high in the ranking is Catalyst Experiential, a Pennsylvania-based architecture group that revamps neglected urban spaces, such as abandoned petrol stations, and turns them into, for example, public monuments incorporating digital billboards.

Catalyst placed 14th on the ranking, increasing its revenues from $167,000 in 2016 to nearly $6m in 2019. It, too, adapted during the pandemic last year: billboards on its landmarks displayed coronavirus-related health information aimed at helping the public.

Comments