Peru unrest threatens copper supply

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

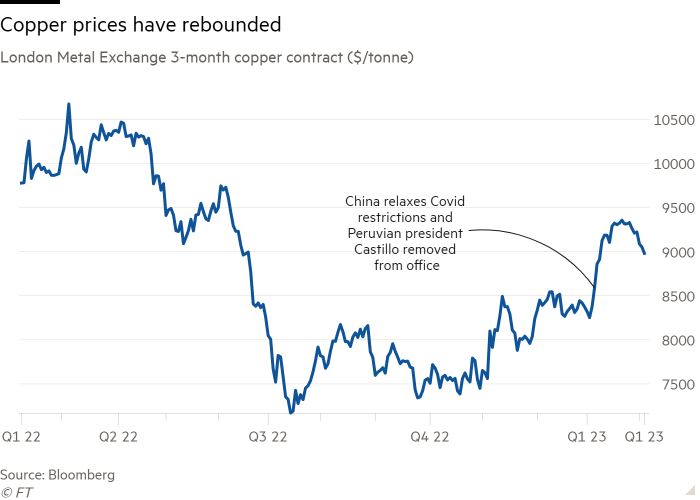

Widespread anti-government protests are disrupting copper output in Peru, the world’s second-biggest producer, triggering predictions of a further surge in prices for the metal which has already rocketed in recent months as China’s resource-hungry economy reopens.

Demonstrators demanding early elections and the resignation of President Dina Boluarte have thrown up roadblocks across the country and attacked mines, causing production slowdowns and closures in the Latin American nation’s copper operations, which account for about 10 per cent of global supply.

Prices of copper, which is used in everything from electricity cables to electric cars, have rallied more than 20 per cent to just below $9,000 per tonne in about three months, as the abrupt end to draconian Covid restrictions in China boosted demand. Although the rally has stalled over the past two weeks, analysts said supply snags in Peru could provide fresh upward impetus.

“The situation is making a turn for the worse, with production losses to start rapidly mounting,” said Erik Heimlich, head of base metals supply at CRU, a consultancy. “The supply disruptions out of Peru are simply another driver of higher copper prices as China reopens its economy.”

Michael Widmer, commodity strategist at Bank of America, said the latest flare-up in Peru’s longstanding issues with the mining industry made it more likely that “you have some volatility in the system” that could take copper prices as high as $12,000 per tonne.

A political crisis that has long been percolating — Peru has had six presidents since 2018 — is now boiling over following leftist president Pedro Castillo’s removal from office on December 7 after attempting to close congress and rule by decree. Boluarte, who served as his vice-president, was sworn in hours later.

Much of the unrest has been focused in the copper-rich south, where Castillo — viewed as a champion for the rights of indigenous and rural communities — remains popular for his rhetoric against large-scale natural resources companies. Peru is also a large producer of gold, zinc and tin. Peruvian miner Buenaventura suspended operations at its Julcani silver mine on Monday after protesters broke in.

“Mines, especially in the south of Peru are running out of supplies such as explosives and steel, or unable to refresh their workforce,” Raúl Jacob, chief financial officer of the Southern Peru Copper Corporation and until last week president of the country’s mining association, told the FT. “Peru is exporting less than it was two or three months ago.”

Key mines have had to suspend operations. Glencore’s Antapaccay mine, which produced 170,000 tonnes of copper concentrate in 2021, temporarily suspended operations after it was attacked by protesters in late January. Last Wednesday the massive Las Bambas mine, run by China’s MMG and responsible for nearly 2 per cent of global production, halted output without a restart date because of transport disruption hitting critical supplies.

Freeport-McMoRan, which operates Cerro Verde, Peru’s largest copper mine, said in an earnings call two weeks ago that it had reduced ore extraction by 10-15 per cent at the site to about 350,000 tonnes per day in a bid to conserve supplies critical to keeping operations running.

Global copper supply in 2022 suffered a disruption rate — the amount of supply lost versus forecasts — of 6.3 per cent, compared with the usual average of 4-5 per cent, according to Trafigura, a commodity trading house. The rate was almost 12 per cent in Peru.

On Tuesday, Moody’s switched its outlook on Peru’s sovereign debt from stable to negative, though it affirmed the country’s investment grade rating. The agency said the sustained unrest would affect investor confidence, undermine growth, and complicate fiscal management. Economists have forecast that the economy could enter a recession in the final quarter of the year.

Lawmakers on Friday shelved a bill to bring elections forward from 2026 to late this year, with factional infighting making a consensus elusive and a quick resolution for Peru’s mining industry unlikely.

Agricultural businesses have also been hurt by the protests, with the country’s leading industry association estimating that $300mn in exports have been lost since protests began in December. Peru is a major exporter of grapes and blueberries.

Comments