US debt is going to crush us all (and gold is the answer)

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Over in goldbug land...

Want to know why the USA will eventually be stripped as the reserve currency of the world">

— Gold Telegraph (@GoldTelegraph_) August 26, 2018

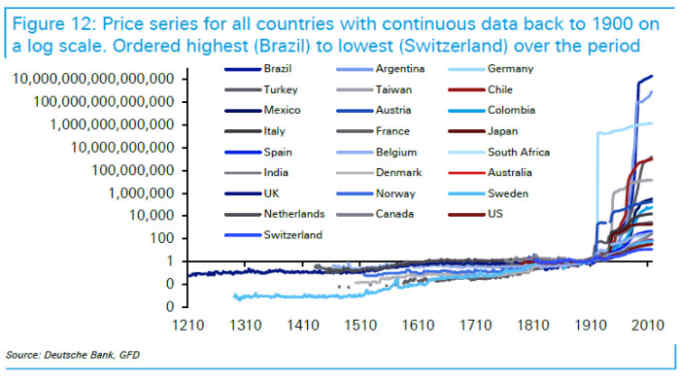

Just take a look at this: pic.twitter.com/fu9iE6jZNx

A blast from the past this week thanks to Gold Telegraph -- a website dedicated to all things that shine -- which caught our eye on Twitter for its bearish take on the US government's finances: debts tend to be balanced with assets, but it seems Gold Telegraph has chosen to exclude one half of the balance sheet this time around.

Goldbugs' fears over the dollar's value are nothing new. Since Nixon removed the greenback from the gold standard in 1971, fans of the shiny metal have been proclaiming the death of a dollar untethered to a substance of real value. Assuming, of course, gold is such a substance.

These fears became acute during the Federal Reserve's post-crisis monetary rescue of the US economy. Take a Google time machine back to the early 2010s and there are no shortage of think pieces and letters, some by esteemed financiers, warning of hyper-inflation, and dollar destruction, if the Fed continued down its money-printing path known as quantitative easing.

Gold's price, in a spectacular way, encapsulated these fears of currency debasement. Here is its price over the past 15 years as the it surfed the financial crisis and its subsequent fall out:

Bitcoin-esque, right? Albeit over a longer time-frame.

In the end hyper-inflation failed to materialise, and the goldbugs' fears over monetary dissolution has reversed into anxiety over the price of their favourite metal.

However some are doubling down though on their predictions of currency wreckage.

A cynical take would be the Gold Telegraph chart was drawn to over-emphasise America's debt burden, and to understate its productive capacity. Perhaps even nudging some terrified investors to move cash from other assets into gold.

Those investors might chose to bury their investment in the garden. Perhaps they could find room on the compost heap for this chart, while they're there.

Comments