US stocks are not cheap yet

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The market took a breather yesterday. Stocks and rates were stable. Unhedged does not expect the calm to last. Email me: robert.armstrong@ft.com.

Valuation

Here’s a nice dumb question: shouldn’t the US stock market be cheaper?

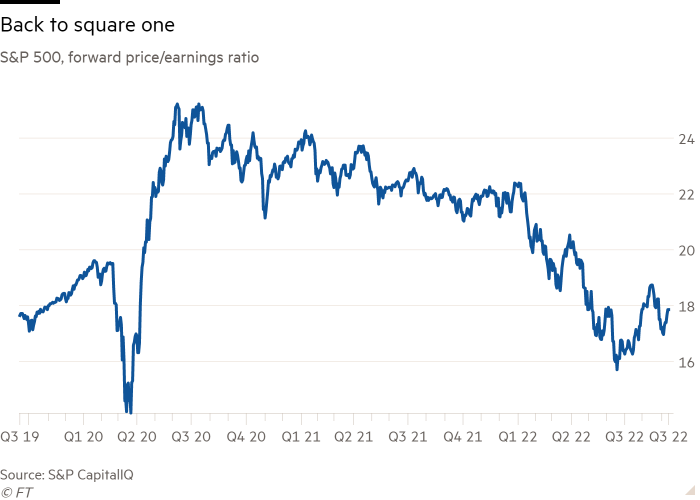

Here is a chart of the forward price/earnings ratio of the S&P 500 since before the crisis. You will notice that, on this metric, the market became 20 per cent cheaper during this year’s sell-off. The market P/E has gone from 22 to 18 (Most observers seem to think forward earnings estimates need to come down a bit, so this chart may exaggerate the decline in valuations a bit).

But the relevant comparison, it seems to me, is not with last year but with the pre-pandemic period. Valuations now are right back where they were in late 2019. The environment was vastly different then. CPI inflation was about 2 per cent; now it’s about 8. Ten-year rates were two per cent, not today’s three and a half. Short rates were on the floor then; now the curve is inverted. A policy-driven recession was not in the cards then. It certainly is now.

All these contrasts should argue for a lower market multiple today than in 2019. Unhedged does not think that there is a simple and determinate relationship between interest rates and stock valuations, but there is a relationship. And inflation, with its accompanying volatility and uncertainty, should compress multiples.

The decline in valuation we have seen has been unevenly distributed. Looking over the companies in the S&P 500 that have had the largest decline on their P/E ratios this year, the list is dominated by cyclical companies (energy groups, chipmakers) which are following their normal late-cycle pattern, and tech companies (Netflix, Tesla) which are giving back some of their wild pandemic appreciation. Investors still face high valuations, by historical standards, in sectors such as retail and consumer goods. The likes of Walmart and Coca-Cola are as pricey as they were last year.

One might point to American stocks’ relative global appeal. Where else are the world’s savings going to flow, when there is economic trouble everywhere, bonds are exposed to rising rates, and inflation is eroding the value of cash? Perhaps TINA (there is no alternative) logic rides again. But with the three-month Treasury bill paying over 3 per cent, alternatives are emerging.

Markets don’t go down because they are expensive and they don’t rise because they are cheap. But long-term returns and valuations are firmly linked. From that point of view, the current market is not particularly appealing.

Sentiment revisited

Back in prelapsarian days — that is, Monday — Unhedged noted the odd juxtaposition between terrible investor sentiment indicators and a market that continues to act hopeful. The AAII investor survey is extraordinarily bearish, historically a decent predictor of good returns to come. But the options market (Vix, skew) don’t reflect an investor rush to hedge the downside. Until yesterday’s bloodletting, stock market action did not look too bad. Even now the market remains solidly above the June lows. Valuations are not washed out (see above). Spreads on junks bonds, from BB down to CCC, are below their highs for the cycle. This is peak fear?

And is peak fear consistent with a 4 per cent loss in a single day? It seems there were some reserves of positive sentiment left to be drained when the CPI number hit on Tuesday morning.

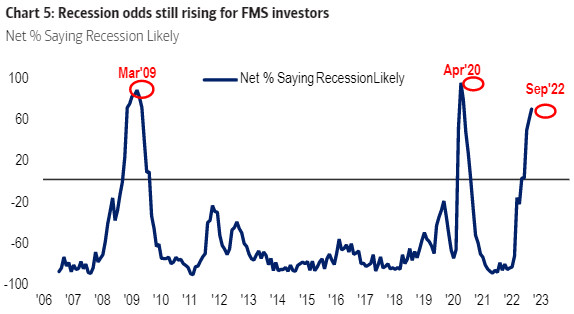

I put this puzzle to Michael Hartnett of Bank of America, whose team conducts BofA’s much-read Global Fund Manager Survey, which is the source of deeply bearish sentiment indicators like this:

And like this:

Hartnett, it turns out, is well aware of the apparent contradiction that bugs Unhedged. He describes investors as “bearishly optimistic”: holding the belief that “[a] bear move will ultimately lead to a Fed pivot, and as a consequence everyone says they are really bearish, but nobody has really sold.” Yes, there will be downside, but it must lead to upside.

In addition,

The DNA of the market, the market’s belief deep down, has not changed. The Fed will always fold, the market only goes up, and tech will always lead the market . . . there are three things that drive markets — positioning, policy, and profits. It is true that, often, abysmal sentiment will coincide with the lows. But the great great lows also coincide with everyone giving up on the economy to the extent that the Fed has to cut rates . . . if the sentiment was max bearish, and payrolls were down, and the Fed said “we’re done”, you’d know what to do . . . what people are finding very difficult to gauge is the economy

The reason the economy is so hard to gauge? Inflation. “No one has traded inflation since the 70s. Nobody knows how to trade inflation. That’s a big factor behind the disconnect.”

This last point about inflation strikes me as particularly important. The most salient feature of the current economy is something almost no one working today has any professional experience with. This is confusing, and almost certainly introduces noise and anxiety into the outlook. As Patrick Kaser, a portfolio manager at Brandywine, put it to me: “I’d like to see what those sentiment surveys said in Spring of 1981.” (The AAII only goes back to 1987).

It makes sense that sentiment indicators would be useful signals. Be greedy when others are fearful, and so on. But for the duration of this inflation panic, I’m going to be handling them very cautiously.

One good read

A reader wrote to ask if the Fed might blink in the face of a brutal sell-off or recession. Tough question. The best answer I could come up with was that the central bank certainly have this incident in mind.

Comments