Investors pump record sums into leveraged ETFs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Investors have poured record sums into high-risk leveraged funds this year in spite of the collapse in financial markets.

The funds, designed to magnify any market gains, also deepen any losses if asset prices fall, meaning many investors are likely to have been left badly out of pocket as stock markets have tumbled this year.

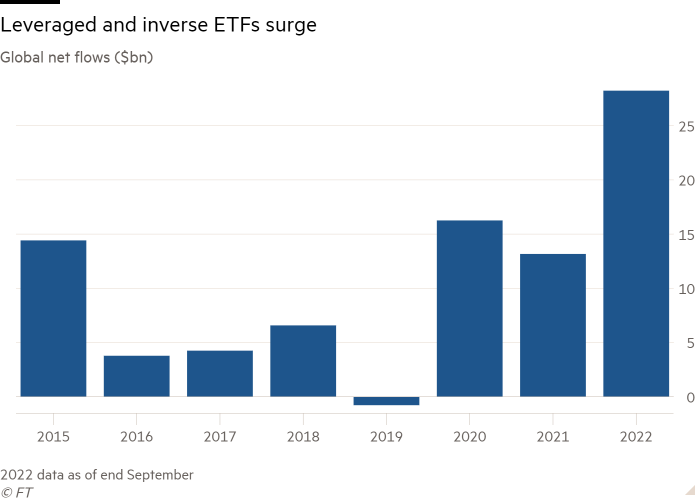

Globally, investors pumped a net $28.3bn into leveraged and inverse exchange traded funds in the first nine months of the year, according to data from Morningstar Direct, equivalent to 5.4 per cent of all purchases of ETFs.

This is more than double 2021’s full-year tally of $13.2bn, which accounted for just 1.1 per cent of last year’s bumper ETF flows, and comfortably above the full-year record of $17bn set in 2008.

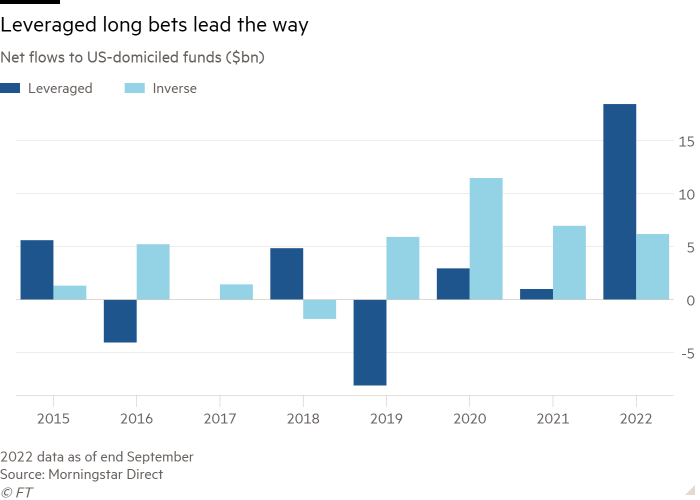

Morningstar does not have a global breakdown of the asset split between leveraged long funds — designed to deliver a multiple of any daily rise by a stock or a basket of stocks, but potentially ruinous if prices fall sharply — and inverse ones, which are a bet on falling prices.

However, its data for the US show that the vast majority of money has been siphoned into leveraged long vehicles, which attracted $18.5bn in the calendar year to the end of September, 4.6 per cent of all flows to US ETFs, three times the $6.2bn netted by inverse funds.

The resultant value destruction is evident in some vehicles. Direxion’s Daily Semiconductor Bull 3x Shares (SOXL), has been the second-most popular leveraged or inverse ETF in the world this year, taking in a net $6.3bn in the first nine months, according to Morningstar. Yet, as of the end of September, its total assets had dwindled to just $3.1bn.

Similarly, the MicroSectors Solactive FANG & Innovation 3x Leveraged exchange traded note (BULZ) had net inflows of $504mn over the period, while its market capitalisation fell to $208mn.

“There are clearly those with a bullish sentiment out there,” said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar.

“There is an argument that the tech bubble has burst and we are down to more realistic valuations, and that there is some value out there. A targeted rebound bet may be sensible within that context,” said Lamont, even if he personally found it “difficult to be overly optimistic in the current environment” given the backdrop of rapid rises in interest rates by historical standards.

Leveraged and inverse products can be extremely risky. In 2018 Credit Suisse’s $1.6bn short volatility XIV ETN was killed off after collapsing 90 per cent in one day.

More recently, in March 2020, WisdomTree had to close its three times leveraged oil products after their value was wiped out by Covid-induced market volatility.

Nevertheless Nate Geraci, president of The ETF Store, a Kansas-based investment adviser, attributed the sharp pick-up in usage of leveraged and inverse funds to this year’s rise in market volatility.

“When markets turn particularly volatile — as they have in 2022 — the daily moves in leveraged ETFs are even more pronounced and attract tactical traders seeking a convenient way to quickly capitalise,” he said.

Although Geraci said that “the vast majority of investors shouldn’t touch leveraged ETFs with a ten-foot pole”, he said they could be useful products for more sophisticated traders seeking to take advantage of sharp market swings.

“[The year] 2022 has provided the perfect environment for enticing traders to use these high-octane tools — which is why we’re seeing record flows,” he added.

Deborah Fuhr, chief executive of ETFGI, a London-based consultancy, said that last year, when markets were rising, people were happy to buy mainstream equity products, but that this year’s more challenging environment had led some investors to seek alternatives.

She also attributed the jump in trading to rapid expansion in the availability of single-stock leveraged and inverse ETFs.

These vehicles — based on the movements of individual stock prices, rather than baskets of securities, rendering them more risky still — have been permitted in Europe since 2018 but were only approved by regulators in the US in July.

“These products are new and are [based] on securities that many people will know,” such as Apple and Tesla, Fuhr said. “Many people tend to have some money that they will try out on new things.”

But Fuhr said that the US Securities and Exchange Commission, the financial regulator, was becoming “concerned about them”, potentially casting a cloud over their future.

Some popular inverse products have delivered strong returns during 2022’s bear market, however.

Although these ETFs are not designed to be held for extended periods, anyone who has had the ProShares UltraPro Short QQQ ETF (SQQQ) since the start of the year would have seen a 103 per cent return, as of November 9.

The fund — which seeks to deliver a daily return, before fees and expenses, that corresponds to three times the inverse of the technology-heavy Nasdaq 100 index — saw net inflows of $610mn in the first nine months of the year.

Likewise, the ProShares UltraPro Short S&P 500 (SPXU), which has similar exposure to the broader US stock market, has taken in $537mn and returned 51 per cent over the same period.

Click here to visit the ETF Hub

Comments