China’s renminbi on course for record six-month run

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

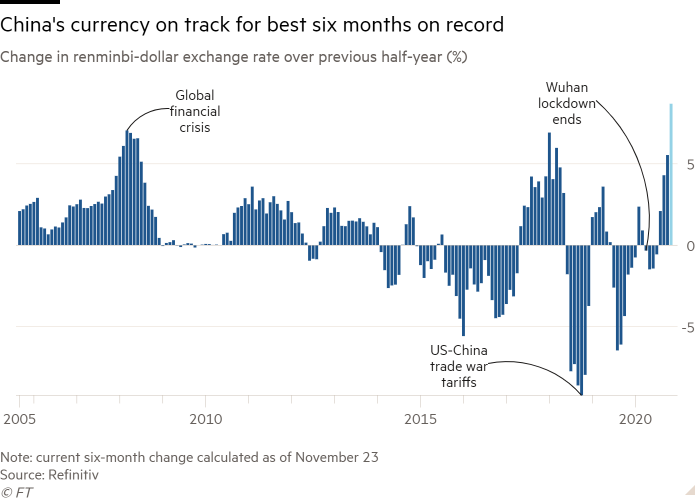

China’s currency is set to record its best six months against the dollar on record as the country’s containment of coronavirus and economic recovery provide a competitive advantage investors expect will last well into 2021.

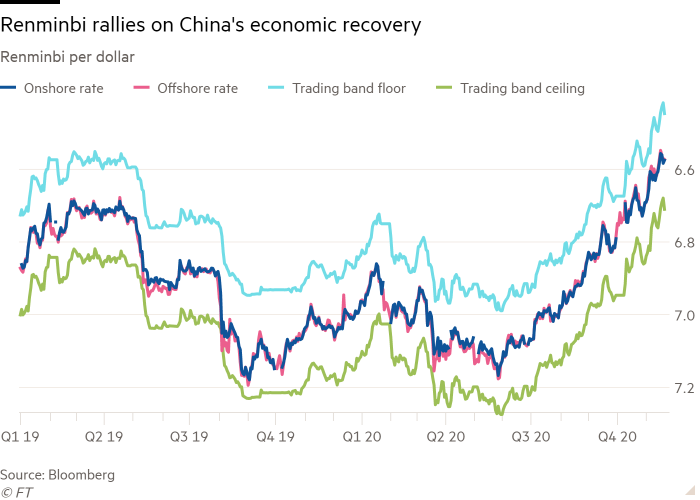

The rise of the renminbi, which was under pressure earlier this year, underscores a reversal of fortunes as China shifted from being the centre of the pandemic to having it largely under control as cases surge in the US and Europe.

Investors and analysts said China’s handling of the health crisis and subsequent economic recovery had laid the groundwork for a rally in renminbi-denominated bonds and stocks which has accelerated in the wake of the US presidential election.

“There is an appetite for China assets all over the world and I think that will continue,” said Paul Sandhu, head of multi-asset quant solutions at BNP Paribas Asset Management.

While positive news on coronavirus vaccines has boosted global investor appetite for even risky assets, he said, “if you don’t need the vaccine to recover you’re going to be in a better position”.

The onshore-traded renminbi has strengthened 8.4 per cent against the greenback since the start of June to Rmb6.585. If the currency holds on to those gains until the end of November, it would top the 7.1 per cent climb in the six months to the end of March 2008, during the global financial crisis.

The currency is up more than 5.7 per cent in 2020.

China’s onshore markets have sucked in tens of billions of dollars worth of foreign investment this year as stocks have rallied on the back of its economic recovery, ensuring strong demand for the renminbi needed to snap up shares in Shanghai and Shenzhen.

Bond yields higher than those available in developed markets have spurred demand from active debt investors, alongside substantial passive fund flows, said Sylvia Sheng, a global multi-asset strategist at JPMorgan Asset Management.

“On the other side of the equation . . . there’s cyclical pressure on the US dollar as well,” she said, pointing to vast monetary easing by the US Federal Reserve this year that has pushed the greenback lower.

Easing by the Fed has also widened the spread between yields on US and Chinese government debt, with those on the countries’ 10-year bonds now at about 0.87 and 3.27 per cent, respectively.

Ms Sheng said the country’s onshore bond yields would likely remain attractive for global investors, which expect the Fed to keep interest rates at record lows at least through to the end of 2021 while China is able to avoid such intense monetary stimulus.

Mansoor Mohi-uddin, chief economist at Bank of Singapore, said Joe Biden’s victory over Donald Trump in the US presidential election had further bolstered confidence in China’s currency.

“Investors expect the Biden administration will not undertake the same volatile tariff policies,” which had weighed on China’s currency during Mr Trump’s term, he said.

But some investors have been hedging their renminbi exposure in recent weeks, said BNP’s Mr Sandhu. He noted implied three-month volatility, a measure of how much investors think the currency could move, for the less regulated offshore renminbi was now higher than that of any other Asian currency.

“Not to say that the [currency’s] momentum isn’t telling us it’s going to appreciate further,” he added. “But just because of the speed of appreciation, investors are getting a little bit nervous.”

Comments