Investors pull near record sums from corporate bond ETFs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

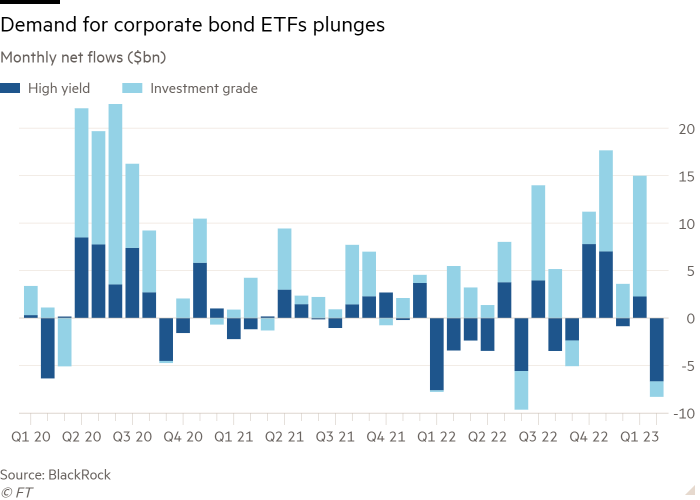

Investors pulled near-record sums from corporate bond exchange traded funds in February as robust US economic and inflation data fuelled expectations for further rate hikes.

Investment-grade and high-yield corporate bond ETFs suffered a combined net outflow of $8.3bn in February, according to data from BlackRock, the second-largest exodus on record, exceeded only by an isolated spike in June last year, when $9.7bn was pulled from the sector.

February’s selling was not far off the combined $10.2bn pulled from corporate bond ETFs in February and March 2020, when markets were pummelled by the onset of the Covid crisis.

Investors instead sought refuge in government bond ETFs — largely US Treasury funds — which sucked in a net $10.9bn.

“We came into February with risk on and with credit and high yield in particular in high demand,” said Todd Rosenbluth, head of research at VettaFi, a New York-based consultancy, after corporate bond ETFs took in $15bn in January.

“In the US, investors came in with optimism that the Federal Reserve would stop raising interest rates,” Rosenbluth said. But he added that the strength of US economic data means “there is an expectation that rate rises are going to continue in the coming months, and therefore there has been a flight to quality, in particular short-duration Treasury products”.

Markets are now pricing in a peak for US interest rates of about 5.5 per cent, 50 basis points higher than at the start of February, while two-year Treasury yields rose 61bp to 4.82 per cent in February, and have since surged above 5 per cent for the first time since 2007.

Against the backdrop, Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region, said “credit flow momentum unwound in February”, as spreads widened, with “the higher the duration sensitivity, the more the hit”.

VettaFi’s data showed the bulk of the selling pressure was absorbed by the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which bled $5.1bn, its sister investment grade fund (LQD), which lost $4.6bn, and the SPDR Bloomberg High Yield Bond ETF (JNK), with $2.2bn of net selling.

Investors instead piled into shorter duration ETFs, according to VettaFi’s numbers, with the iShares Short Treasury Bond ETF (SHV) attracting $4.5bn in February, and the iShares 0-3 Month Treasury Bond ETF (SGOV) pulling in $1.6bn.

The pattern was “reminiscent of March of 2020 when the global economy went sharply down because of Covid”, Rosenbluth said. “The iShares fixed income suite of products are widely used by institutional investors and short-term traders. They can quickly pivot towards or away from ETFs.”

Chedid believed the trend might have longer to run, with BlackRock’s in-house view being “overweight short duration but more cautious about longer”.

Nevertheless, Chedid said there were bright spots even outside of short duration, with investment grade ETFs listed in the Emea region attracting $1bn and high yield $200mn, although emerging market debt ETFs lost $1.5bn.

Overall, net flows to the global ETF industry slowed for the fourth straight month in February to $22.5bn, from $62.6bn in January.

Equity inflows slumped from $33.3bn to $8.5bn, with ETFs investing in the US stock market being hit by outright selling. Outflows of $5.5bn in February, coming on top of $1.7bn in January, meant US equity ETFs saw two consecutive months of selling for the first time since March 2018, BlackRock said.

For the second straight month US investors were more enamoured by European equity markets, with US-listed funds accounting for the bulk of the $13.6bn of ETF money that has flowed into European equities so far this year.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

“We are certainly seeing more interest in international and in particular European equities,” said Rosenbluth of US investors, as evidenced by $2.1bn being pumped into the JPMorgan BetaBuilders Europe ETF (BBEU).

“The concerns about energy prices have moderated and the [previously rising] dollar is playing less of a role. Valuations are more attractive [in Europe], the macro environment is improving and I think investors are willing to look outside of the US,” he added.

Chedid was unconvinced this was the start of a longer-term trend, however.

“US investors have been a significant buyer of European equities in January and February,” he said. “European equities have been outperforming, so from a performance perspective it makes sense. [But] if we base our analysis on history, the money that is coming in is not very sticky.”

Within equities, cheaper “value” ETFs were in demand, with the $1.1bn of inflows representing the fifth successive positive month.

“Value tends to do well in the early stages of the economic cycle, if investors take the view that early cycle indicators are coming up,” but “also when inflation is higher”, Chedid said.

This time around “it’s more to do with it being an inflation hedge,” he added.

Comments