Crypto swindlers prey on ethnic Chinese women looking for love

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Qiao Er was idly scrolling through Douyin, the Chinese version of TikTok, one hot summer day in the southern Taiwanese port city Kaohsiung, when she came across a profile of a wealthy and attractive Chinese man.

She liked a couple of videos, clips of him playing tennis, cruising around in a Ferrari and feasting on a lobster the size of a child’s bike.

Then, the unexpected happened. A message popped up in Qiao Er’s inbox from the stranger, starting a months-long online romance that would leave her bankrupt and broken-hearted.

All over the Chinese-speaking world, thousands of victims like Qiao Er are losing their life savings to cryptocurrency fraudsters that have nimbly adapted to authorities trying to crack down on the so-called “pig butchering” scam, in which victims are “fattened up” through online romances.

In London, New York and Kaohsiung, the Financial Times spoke to three women who together lost over $2mn in what they said were highly methodical scams.

With an estimated 80mn ethnic Chinese residents outside China, Hong Kong and Macau, including millionaire business owners, scammers have plenty of scope for new targets after Beijing imposed a domestic ban on cryptocurrency investments.

The pandemic provided a useful shield for the scammers to develop relationships with the women while using the excuse of travel restrictions to explain why they could not meet in person. Booming crypto prices also helped entice them into the fraud.

“It starts with an online relationship, scammers ‘fatten’ up their victims with romantic messages, grooming them on social media,” says Jan Santiago, deputy director of the US-based Global Anti-scam Organization, a non-profit group supporting victims of investment cybercrimes.

Two weeks after Qiao, a CCTV operator at a security company, met the smooth-talking stranger online, they started calling each other husband and wife, spending hours on the phone and texting throughout the day, she says. They even video-chatted, but an allegedly broken selfie camera obscured the scammer’s face.

“They wait until you’ve fallen for them with their romantic words before they start stealing your money,” she says.

It was not long before he started coaching her on how to invest in crypto, so she could live the same life that he was showing off on his social media. This took place towards the end of 2020, when Bitcoin started climbing to new highs, and even the most inexperienced investor could make easy returns.

“He told me exactly when to buy when the price was low and sell when the price was high,” says Qiao Er.

The scam perpetrated on the three victims followed the same pattern. The fraudsters told the women to buy crypto on established exchanges before asking them to transfer to fake websites that sound legitimate to the crypto newbies.

Taiwan’s National Police Agency publishes a monthly list of the allegedly fraudulent sites reported by victims, with names such as “KrakenCoin” and “Coinbase CCY” that mimic the names of real exchanges. Both sites have since shut down, which experts say is a common practice after they have been reported by victims.

The sites listed by the police have all the trappings of a legitimate trading platforms: 24/7 online customer service and charts showing live coin price fluctuations. The women could withdraw some assets into fiat currency at the start, duping them into trusting the platform.

The scammers built up a picture of the women’s finances through the online relationship, asking about their weekly salary or their car and house value. They encouraged friends and family members to join in on the scheme by promoting elaborate flash coin sales and special deals.

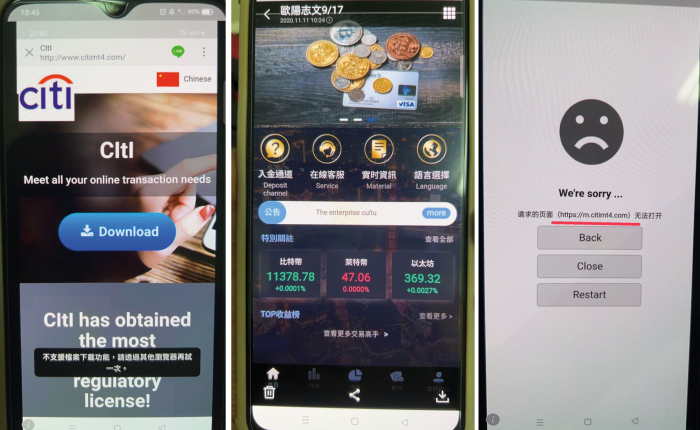

Qiao Er eventually transferred all of her savings to the website of an exchange called Citi.mt4. She said that when she tried to take some money out to pay her bills, customer service demanded a hefty tax to withdraw the money.

She says the man she’d met on Douyin suddenly turned bad-tempered, ordering her to borrow money from her family, friends, and the bank. When those avenues dried up, he pushed her to borrow against her car and then go to loan sharks.

She racked up losses totalling $88,870 before, one day, the Citimt4.com website suddenly disappeared along with the man she’d called her husband on social media for months. She reported the crime to the local police, who told her the chances of getting her money back were very low.

She showed the FT screenshots of the site, which included a banner claiming it had regulatory approval. The FT later found no trace of the site on the web. The Kaohsiung City Government Police Bureau declined to comment on Qiao Er’s case.

Liao Jiankai from Taiwan’s Criminal Investigation Bureau, whose team compiles the list, says the Citi.mt4 site had the “characteristics” of being designed by a fraud group, pointing to the fake profit figures displayed on the homepage.

He says the tactics used by Qiao Er’s scammer were typical of other cases. “At the start, the victims invest a small amount, earning returns, so they think it’s real. Then the scammers find ways to make as much money from them as possible. When the victim tries to take the money out, the website demands them to pay tax or a deposit before closing,” explains Liao.

Among the websites on the police list is Metachain — to which Monica, a 50-something Chinese-born woman living in London, transferred £1.5mn over the course of a year under the guidance of a fraudster she met on Instagram.

A former business owner, Monica started investing in 2021, when soaring bitcoin prices helped the scammers persuade their victims that they could get rich quick. “I never met this person, so I was suspicious when he told me to invest. But he kept telling me that he was coming to London when the pandemic was over,” says Monica, not her real name.

Monica reported the alleged crime to the London Metropolitan Police but is holding out little hope that the UK authorities can help. In an email communication seen by the FT, Monica was told by the police that “it is incredibly hard to detect [the crimes] due to the fact that they are conducted remotely”.

The Financial Times approached Metachain’s customer service for comment on the allegation that it was a fraudulent crypto exchange. The customer service replied “do not worry, we’re registered in Hong Kong so you can invest with us” before blocking any further communication.

Michael Tang, a New York-based lawyer representing Chinese clients living in the US, says the tactics to manipulate Monica into investing are typical of techniques first honed by criminal gangs in China.

Leaked Chinese-language handbooks for scammers underscore how they play with human psychology to trick victims. One guidebook, which euphemistically refers to the victims as “customers”, advises scammers to ease them into making crypto investments by pretending it is a game they can play together. “Tell the customer you’re bored, that you want to play a game with them that can earn them some money,” it advises.

Beijing started to crack down on crypto frauds in 2017, eventually taking the radical step of outlawing cryptocurrencies altogether. Chinese police began rounding up criminal gangs and warning citizens about crypto frauds. The campaign forced many gangs to flee to new hide-outs in south-east Asia, where they targeted victims outside mainland China. Tang says he’s seen a significant rise in ethnic Chinese victims in the US seeking his help to report their cases to the FBI in the past year.

The gangs use technological shields to evade the authorities, cycling through sim cards and websites to evade detection.

The Federal Trade Commission says that, in the past five years, people have reported losing $1.3bn to romance scams, exceeding other frauds. In 2021, reported losses hit a record $547mn, an 80 per cent increase from the previous year. Experts say the huge deluge of cases has overwhelmed crime-busting agencies. With few official resources available at their disposal, the victims often have to take matters into their own hands.

Kelly Wang, a New York nurse, lost $231,000 after a fraudster posing as a successful Taiwanese businessman duped her into investing in a crypto scheme.

She decided to confront the scammer, a man she had spent months talking to over WhatsApp messages and on the phone. Then she discovered that her scammer was also a victim of fraud, just as she was.

Large workforces are required to carry out the frauds — from website engineers to 24-7 customer service staff.

When Wang confronted her fraudster on WhatsApp, he begged her for help, claiming to be held against his will in Cambodia and asking her for money to help him escape.

The FT saw the WhatsApp messages he sent but could not authenticate the claims he made. However, his story aligns with evidence of large Chinese-run scamming factories raided by Cambodian police. Wang reported the crime to the FBI.

One popular destination for migrating scammers is Sihanoukville in south-western Cambodia, also known as the “Macau of south-east Asia”, where a thriving casino industry is largely run by Chinese entrepreneurs.

In 2018, the Preah Sihanouk provincial governor Yun Min warned that Chinese investment had “created opportunities for the Chinese mafia” — including kidnapping, resulting in “insecurity” for the region.

The problem has become so endemic that Chinese authorities have issued warnings about trafficking groups that entice victims to come to Cambodia with the promise of fat salaries. The authorities advise citizens “who want to work in Cambodia to follow formal channels and not believe in false adverts for high-paying jobs”.

In September 2021, a joint Cambodian-Chinese police task force busted a 200-person scamming complex in the capital of Phnom Penh. Local media reported that most of the detained individuals were from China’s Yunnan province.

Experts say these high-profile raids have not eradicated the problem: the scammers’ tactics have become more sophisticated in recent months, targeting less visible corners of the digital assets market.

Back in Kaohsiung, Qiao Er’s psychological wounds are slowly healing. The crypto fraud sparked an avalanche of debt that turned her life upside down.

She was asked to leave her job at the security company after creditors started hounding her at work. The scheme wrecked her relationship with family members who had lent her money. She had a brief period of sleeping rough after being kicked out of her family home.

But Qiao Er is rebuilding her life: she has found a new job and a boss who cares for his employees. She has joined a support group with other Taiwanese victims, who share their experiences. She has blocked all private messages from unknown accounts, adding a digital protective layer against scammers prowling social media for new victims.

“I’m building back my confidence,” she says, adding that she is speaking out so that others can learn from her experience. “There are people who have it far worse than me.”

This article is part of FT Wealth, a section providing in-depth coverage of philanthropy, entrepreneurs, family offices, as well as alternative and impact investment

Comments