Business is caught in political crossfire of ESG disputes

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

America is tied up in legal knots over investing based on environmental, social and governance factors.

While European governments have set formal targets for diverse boards and legislated standards for funds that seek to fight climate change, US politicians and regulators are busy engaging in political combat over the basic principles involved in abiding by ESG criteria.

Companies, investors and asset managers now find themselves in legal jeopardy from several directions, making it hard to come up with a coherent strategy or workable business plan.

On the left, federal regulators and Democratic state officials have been demanding more detailed disclosures about the environmental and social impact and filing lawsuits against those who fail to live up to their promises. In May, for example, the US Securities and Exchange Commission brought civil charges against BNY Mellon for claiming that investments had been reviewed for ESG risks and opportunities when they had not.

The SEC also has several rule proposals pending about climate disclosures and ESG-related fund names that could lead to lawsuits and enforcement action, if adopted.

But state and local officials in solidly Democratic areas are not waiting for federal action. More than 20 states and local authorities have sued big energy companies, alleging that they “misled consumers about the negative effects of . . . business practices on the climate” — a violation of state-level consumer protection laws.

An appeals court is considering whether Connecticut’s case against ExxonMobil can go forward in federal court — a decision that could affect many similar cases.

But companies and asset managers are also under fire from the opposite side of the political spectrum: from Republican officials who believe that efforts to fight climate change and improve diversity have gone too far. A posse of Republican state attorneys-general is probing whether big banks that pledge to cut their carbon footprint are violating antitrust laws. And several states including Texas and West Virginia have passed laws that prohibit state government and pension plans from doing business with, or investing in, asset managers that their secretaries of state deem to be “boycotting” fossil fuel.

More on FT.com: Best practice case studies

Read the FT Innovative Lawyers North America ‘Best practice case studies’, which showcase the standout innovations made for and by people working in the legal sector:

Private litigation is proving to be another multidimensional headache.

Conservatives have sued to prevent the Nasdaq stock exchange from requiring companies with fewer than two board members who are women or members of ethnic minorities to explain themselves. At the same time, legal complaints are coming in from consumer groups and those on the left against companies that make unjustified sustainability claims. Lawyers also predict that pension funds could be hit by lawsuits if they suffer losses while following Texas’ instructions to divest from funds or companies deemed hostile to fossil fuel — shares in BlackRock, one of the companies on the list, are down about 20 per cent in 2022 and sales would lock in that drop.

That has left many companies and their lawyers feeling paralysed by the attacks from all sides. Europeans coming to the US are particularly worried that they will be penalised for obeying strictures at home that require them to reduce their carbon emissions — nine of the 10 groups singled out for boycott by Texas are based in Europe. But the legal wrangling is affecting American fund managers, as well.

“Minefield is a good description, here, because you have to tiptoe around the issues,” says Mike McGrath, a partner at K&L Gates who represents asset managers. “It’s going to inhibit new entrants and novel strategies.”

The litigious fervour is, in some ways, typical of the way Americans have dealt with contentious issues in recent decades. A country made up of immigrants of different cultures, races and religions can try to force assimilation or find ways to balance the different points of view.

The US occasionally tries the former: think of the many German-Americans who changed their names during the first world war, or the small but vocal “English Only” movement that seeks to restrict the use of Spanish. But, most of the time, it relies on its legal system to serve as a mediator far more than most other countries.

That requires thoughtful judges to sort out competing claims — something that is only just starting to happen when it comes to ESG-related issues. A New York federal judge recently found that shoe company Allbirds’ slogan “our sheep live a good life” was too vague to be misleading. However, a court in California is allowing a lawsuit to go forward that claims the labelling on Reynolds’ “recycling bags” tricks consumers into believing that the bags themselves are recyclable.

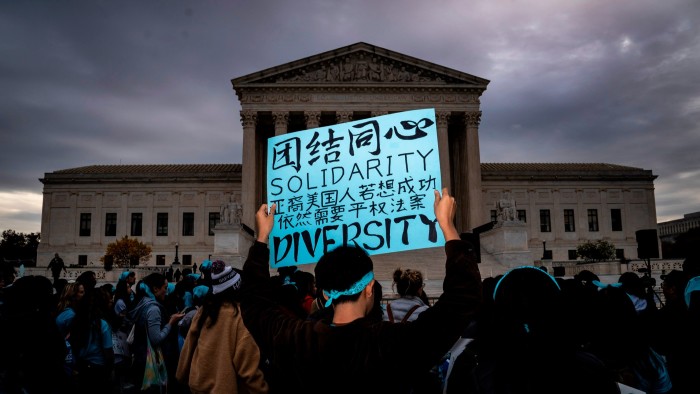

It also remains unclear whether the strong 6-3 conservative majority on the US Supreme Court will take positions that decisively shift the balance of power to those who feel companies and investment managers are focusing too much on ESG issues. The justices are currently considering a challenge to the use of race in college admissions. If, as expected, they rule against affirmative action programmes, that would strengthen the hands of conservative critics and tip some cases their way.

Eventually, lawyers predict that the litigation filings will slow and the outcomes of cases will become more predictable. “You’re definitely seeing good meritorious cases, but I wouldn’t expect a tsunami,” says Jerry Silk, a partner at Bernstein Litowitz Berger & Grossmann, which represents investors in shareholder lawsuits. “These cases really turn on the facts, on how misleading the disclosure is and how material it is.”

The writer is the FT’s US investment and industries editor

Comments