Robinhood soars after retail traders flock to shares

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Robinhood, the trading app used by many retail investors to drive the furious rally in “meme stocks” early this year, has gained characteristics of a meme stock itself.

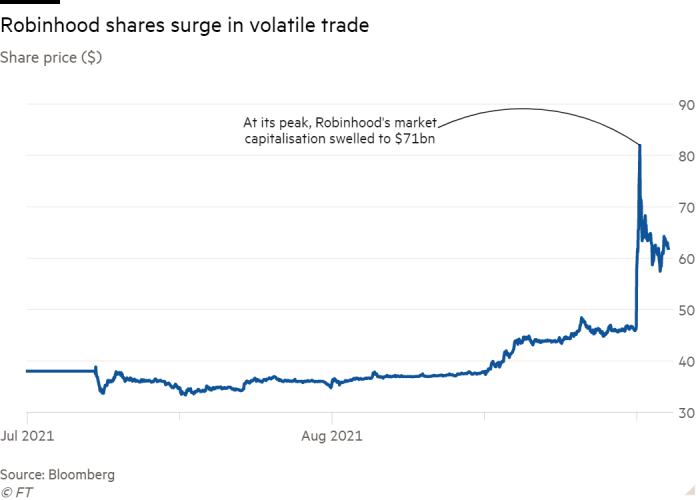

Shares of the brokerage rose 50 per cent to close at $70.39 on Wednesday, giving it a market capitalisation of $58.9bn. The volatility prompted multiple trading halts on the Nasdaq exchange, with Robinhood earlier in the day having surged as much as 82 per cent.

The rise came less than a week after Robinhood listed in a disappointing initial public offering. This week’s reversal reflected the embrace of the stock by retail investors on social media and the new availability of options contracts tied to the company’s shares, traders and analysts said.

By 4pm in New York, more than 171m shares had changed hands.

Robinhood’s commission-free transactions attracted legions of retail investors with time and money to spare during the pandemic. The California-based company’s app was a central venue for trading so-called meme stocks earlier this year, as customers organised on social media platforms such as Reddit to bid up stocks such as the distressed theatre chain AMC and the video game retailer GameStop.

But the company also angered many customers in January when it curbed trading in several heavily shorted stocks to meet a margin requirement from its clearinghouse. Some day traders relished the company’s rocky debut on the stock market last week, when it fell 8.4 per cent in one of the worst performances for a flotation of its size.

Momentum picked up in recent days as some big-name investors bought into the stock, including Cathie Wood, who manages the investment fund Ark Invest.

Since the IPO, investor sentiment in Robinhood shares has brightened on social media sites such as Reddit, according to retail investor sentiment tracker Breakout Point. Mentions of its ticker on Reddit surged on Wednesday morning.

Retail investors on Reddit began rallying around the goal of a $60 share price — up from $35.15 on Friday — and there was “considerable cheering for Cathie” Wood, said Ivan Cosovic, founder of Breakout Point.

“It was a very hated IPO in the retail world, but Cathie bought and some retail investors on the sidelines decided to give it a try,” he added. “The rest is Fomo,” or “fear of missing out”.

Data provider Vanda Research noted retail traders had begun to turn heavily towards the stock on Tuesday, helping send the shares up 24 per cent to close above its listing price for the first time.

Options trading in Robinhood’s shares also began on Wednesday, according to Chris Murphy, co-head of derivative strategy at trading company Susquehanna International Group. The derivatives, which allow traders to speculate on the potential moves in a stock, have become particularly popular with retail investors in the past 18 months.

Dealers selling bullish call options to investors would typically buy Robinhood stock to hedge their risk, pushing the market in an upward direction.

The gain on Wednesday lifted Robinhood’s market valuation above hundreds of blue-chip US companies including carmaker Ford, foods company Kraft Heinz and asset manager T Rowe Price.

When asked on the morning of the IPO if he thought Robinhood would become a meme stock, co-founder Vlad Tenev said: “I don’t know if people have understood the ramifications of what high retail participation in the markets means, but I think fundamentally it’s a very good thing and we are excited to be a part of it.”

An earlier version of this article incorrectly stated that options trading began on Tuesday

Comments