How will Russia’s invasion of Ukraine hit the global economy?

Simply sign up to the Global Economy myFT Digest -- delivered directly to your inbox.

A conflict that could develop into Europe’s biggest since the second world war has shattered hopes of a strong global economic recovery from coronavirus at least in the short term.

Russia’s invasion of Ukraine on Thursday shook financial markets and the increased geopolitical tensions are set to exacerbate high inflation and supply chain bottlenecks.

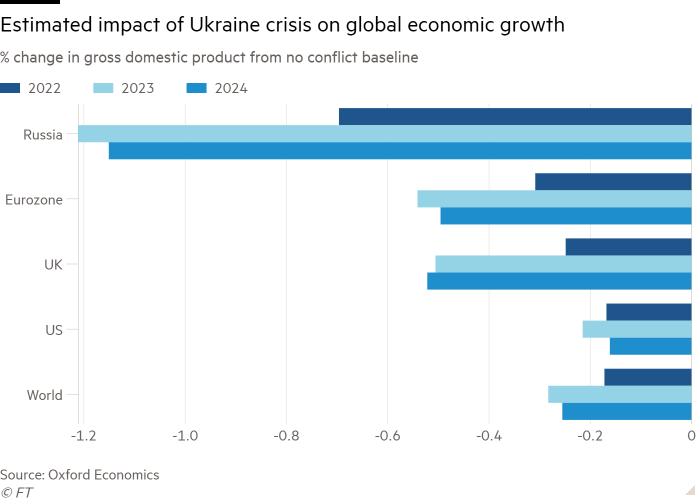

The direct impacts of lower trade with Russia, economic sanctions levied on Moscow by the US and EU, and financial contagion are likely to be outweighed by the indirect consequences from the effect on business and consumer confidence and commodity markets, economists said.

These repercussions could range from relatively limited to extremely serious. If energy prices continued to soar, for example, it could easily tip the global economy into a second recession in three years.

Economists said the following issues are the big ones to watch.

How bad does the war get?

Russian president Vladimir Putin’s desired endgame is unclear. Analysts are considering several scenarios that range from a change of government in Kyiv to a Moscow-friendly regime to a wholesale attempt to redraw the international boundaries of Europe and beyond.

Holger Schmieding, chief economist at Berenberg Bank, said the first thing to consider was “how bad does the war get?” — which would determine the likely response in financial and energy markets in the days to come.

The wider global response will be just as crucial, said other economists. Tim Ash, economist at BlueBay Asset Management, singled out China, which has signalled its willingness to help Russia manage the financial fallout from its military actions.

Beijing’s response would be vital in terms of the wider consequences, which could range from the malign — for example, more tension over its own relationship with Taiwan — to more benign diplomatic outcomes.

“Either [China] sees it as an opportunity to go into Taiwan, or as an opportunity to improve relations with the US,” he said.

Are markets able to withstand the geopolitical shock?

Leading global financial markets were sharply down on Thursday but the outcome could have been more extreme, suggesting they were surprised by Putin’s actions but do not yet think the most severe market shocks, akin to a financial crisis, are likely. This leaves open the possibility that they have further to fall, with consequences for corporate and household wealth, consumption and global confidence.

Neil Shearing, chief economist at Capital Economics, noted that, while there was a sell-off in equities, bond yields declined and credit spreads have not widened much, suggesting the market reaction was orderly and not indicative yet of expectations of a wider war across Europe.

The avoidance of a market meltdown was not global and many emerging economies were hit with much sharper swings. Kevin Daly, portfolio manager at Aberdeen Asset Management, noted steep sell-offs in Ghana, Turkey, Egypt and Pakistan, citing a flight to safety from financially vulnerable countries.

Randy Kroszner, deputy dean at the University of Chicago Booth School of Business and a former Federal Reserve governor, said recession risks would show up in the difference in yields of investment-grade compared with non-investment-grade debt, which had not widened extensively on Thursday.

He added that the yields on sovereign debt of countries geographically close to the crisis would offer a good indicator of whether markets began to fear a wider conflict.

How badly could confidence be hit?

Crucial for the global economy will be whether households and businesses become significantly more cautious, spending less and saving more in response to Russia’s actions.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said slower growth was inevitable. “Consumer sentiment everywhere will weaken further . . . That has to mean slower economic growth than would otherwise have been expected in Europe, the US and most emerging markets,” he added.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “Depending on how long this crisis continues there could be a significant loss of confidence among businesses and consumers.”

Economists also warned about the pressures on businesses exposed to supply chains in which Russia plays a crucial but little-known role, such as the production of critical raw materials. The country supplies about 40 per cent of the world’s palladium, a key component of catalytic converters in petrol-powered vehicles as well as electronic devices.

How do energy concerns affect the wider inflation picture?

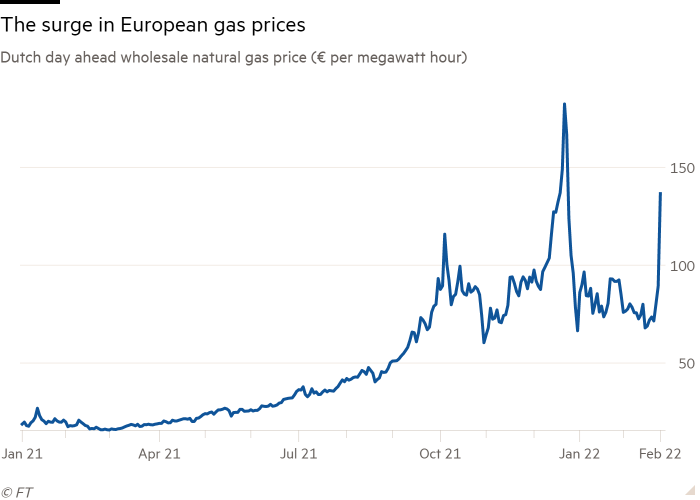

Europe is highly dependent on gas from Russia and cannot quickly find alternative supplies if pipelines are cut. With a mild winter coming to an end and storage levels across Europe higher than had been expected by some energy analysts, the issue of gas supplies has become less acute but will return later in the year if the crisis continues.

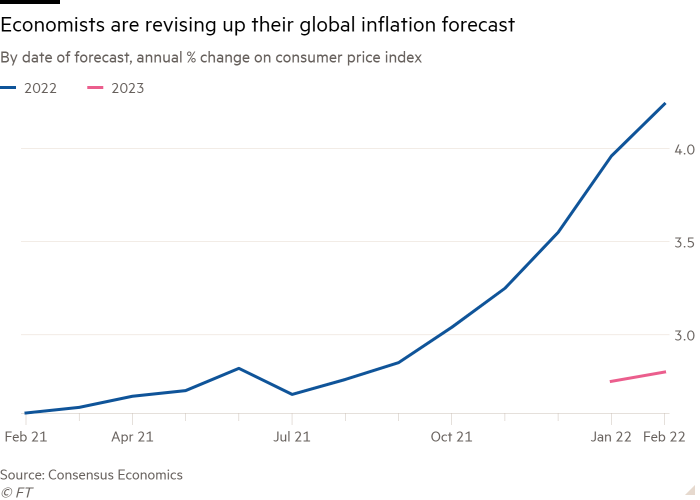

The more immediate concern is the impact of the crisis on the price of oil, gas and other commodities. A sharp rise would add to inflation and hit consumers.

“Our modelling suggests that in a worst-case scenario oil prices could rise to $120-140 a barrel,” said Capital Economics’ Shearing. “If sustained through the rest of this year, and we see a corresponding increase in European natural gas prices, that would add about 2 percentage points to advanced economy inflation — more in Europe, less in the US. So that’s an additional squeeze on real incomes.”

Pantheon’s Shepherdson said the US would be relatively insulated overall, although the continued rise in prices would hit shale oil and gas producers but hit the pockets of American energy consumers.

This may add to pressure on central banks to boost interest rates. Already, the US Federal Reserve last month signalled it would begin raising rates from March to control rampant inflation. Fed chair Jay Powell last month declined to say how many rate rises there would be this year.

Krishna Guha, vice-chair of Evercore ISI, said the invasion “complicates the ability of central banks on both sides of the Atlantic to engineer a soft landing from the pandemic inflation surge”, and expected financial markets to scale back their expectations that central banks would raise interest rates.

Comments