The Proxies: A celebration of substantial corporate perks

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Relocation Man Award

Winner: Chris Smith, NeoGenomics

When NeoGenomics, a loss-making Florida-based cancer drugs testing company, announced its new chief executive Chris Smith in June last year, it put aside a tidy sum for his relocation: “Mr. Smith will also be eligible for relocation benefits of up to $400,000 (plus any additional amount approved by the Compensation Committee).”

Less than two months later, it casually tripled this figure: “The Amendment provides for… additional relocation benefits in the amount of $800,000.” So, $1.2mn for the U-Haul.

How did the move go? Well, an update on ‘general and administrative’ costs from February this year mentions: “$2.2 million of relocation costs for our new Chief Executive Officer”.

NeoGenomics’ latest proxy filing sheds some further light: “Mr. Smith was also entitled to a relocation benefit of up to $1.2 million, which was grossed up for tax purposes so that the economic benefit was the same as if such payment or benefits were provided on a non-taxable basis.”

Oddly, the same document says: “We do not provide significant perquisites or personal benefits to Named Executive Officers. We provide competitive relocation benefits to newly hired officers, in keeping with industry practices.”

A NeoGenomics spokesperson said: “All compensation-related decisions are evaluated by the Culture & Compensation Committee of the Board, and finalised with guidance from our compensation consultants.”

The ‘Wait, Who’s The Boss?’ Lucrative Lieutenancy Award

Winner: Sheryl Sandberg, Meta Platforms

Sheryl Sandberg stepped down as Facebook Meta’s chief operating officer last autumn, after 14 years at the coalface of internet evil as Mark Zuckerberg’s number two.

The author of Lean In, it turns out, prefers to fly in where possible, with loftier ambitions than Zuck when it came to private jet usage. In 2022, while her boss accumulated approximately $2,281,172 of private jet costs, Sandberg notched up $4,357,484. In both instances, Meta justifies their jet usage in part as a security measure. Whatever the reason, it’s a lot of flying: presumably Sandberg was undertaking an overseas farewell tour while Zuck stayed home and got jacked.

The Gordon Gekko Company Ranch Award

Winner: W.M. “Rusty” Rush, Rush Company

In his well-worn ‘Greed is good’ speech, Wall Street (1987) protagonist Gordon Gekko lambasted the excesses of “bureaucrats, with their steak lunches, their hunting and fishing trips, their corporate jets and golden parachutes”.

For W.M. “Rusty” Rush, boss of listed truck dealership Rush Enterprises, Gekko’s warning read better as a blueprint. Rush Enterprises’ latest proxy filing compensation notes include “(e) the incremental cost of personal use of the Company’s ranch totaling $97,225; (f) the incremental cost of personal use of the Company-owned aircraft totaling $354,466; (g) a cell phone allowance totaling $1,800” as part of a $10mn total compensation package. When you look at the cell phone costs, the ranch almost seems reasonable.

[Further reading: Is this the world’s most pizza-addicted man?]

The Funhouse Mirror Compensation Award

Winner: SmileDirectClub

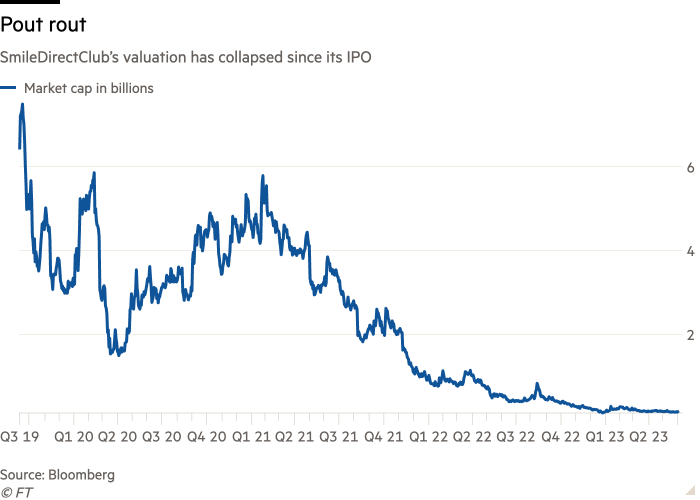

Dental company SmileDirectClub listed with a techy buzz in late 2019, but it wasn’t long before people started frowning. A month after its flotation, it was hit by allegations from shortseller Hindenberg Research (“Moving Fast and Breaking Things in People’s Mouths – 85% Downside”).

Hindenberg’s downside-crunching proved something of an underbite: shares are down more than 97 per cent since then, having started 2022 about 88 per cent under its IPO price.

The effects haven’t been too deleterious for chief executive David Katzman or his son, COO Steven Katzman, who received $6.2mn and $4.1mn respectively in compensation last year (much of it, admittedly, through stock awards).

How do such pay decisions get taken? Well, funny you should ask. From its latest proxy (our emphasis):

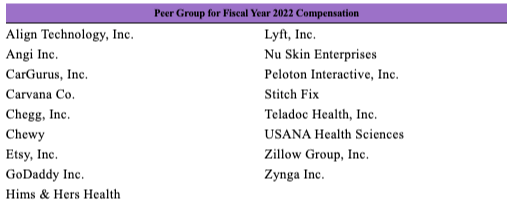

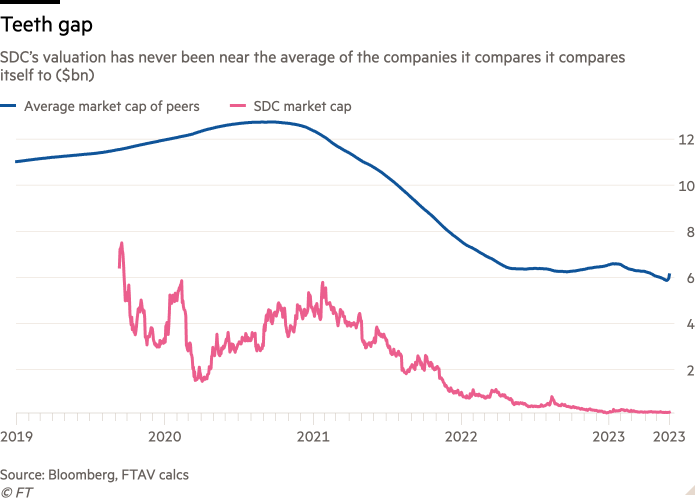

During 2021, in connection with reviewing and approving NEO compensation for 2022, the Committee reviewed a report from FW Cook benchmarking compensation for the NEOs and other executive officers, including peer group research and survey analysis… In choosing the peer group, the Committee, with the assistance of FW Cook, reviewed and approved a peer group that consisted of consumer-facing, e-commerce, disruptive businesses, with an average market cap from the prior year generally between one-fifth and five times the Company’s then-current market cap.

Here’s who they picked:

So, uh, in 2021, it seems the committee (which, incidentally, includes both Katzmen) compared SDC’s 2021 market cap with the 2020 market caps of those peers. Right. This is all a bit vague but, in case it’s of interest, here is the (mean) average size of those “peers” versus SDC’s own valuation:

If anything, the standard FT chart style flatters SDC here.

[Further reading: Anatomy of an AIG payday]

The Bananas Split Award

Winner: Greg Maffei, Liberty Media

Liberty Media’s website says it “recognizes climate change and adverse impacts on the natural world are among the most pressing challenges facing humanity today.” It adds: “Environmental sustainability has implications for markets, and our investors. Moreover, how we manage our environmental impact matters to our employees, our customers, our business partners, and our other stakeholders.”

Separately, chief executive Greg Maffei notched up $1,218,575 in aircraft spending last year. You might not immediately be able to tell this, however, because under a services agreement, the spending is split across four companies: there’s $42,948 at Liberty TripAdvisor, $272,567 at Liberty Broadband, $234,833 at Quarate Retail, and $668,227 at Liberty Media Corp.

[Further reading: Meet the bedding boss who really, really doesn’t want to live near HQ]

The Friend With Benefits Award

Winner: LiveNation senior management

It would be reasonable, looking at the 2022 compensation notes for LiveNation, to be distracted by the $600,053 chief executive Michael Rapino received for “personal security”, or his $585,2459 aircraft usage, or his $75,000 “automobile allowance”. Or the uncosted “ticket to a sporting event” he got.

Instead, we’d encourage you to look at CFO Joe Berchtold, who received $38,585 worth of “tickets to certain sporting industry events”. Or, perhaps, encourage you to become friends with general counsel Michael Rowles, who received “tickets to Live Nation events for certain friends and family members of $44,864”. That’s, what, at least three tickets? Who says lawyers can’t be cool?

The International CosPlayboy Award

Winner: Ben Kohn, Playboy

A tragedy in fifteen words: “In April 2021, we acquired an aircraft. The aircraft was then sold in September 2022.” After nearly a decade as a private company, Playboy (of “I read it for the articles” magazine fame) announced its return to public listing via a spac deal in late 2020, with shares soaring during the meme-stock mania early in 2021. Naturally, the company took the opportunity to buy a plane — after all, a playboy has to keep up appearances.

Share prices, it turns out, go both ways, and shares are down 97 per cent since their peak. So the company sold its plane. It’s a tragic tale, one as old as time, but didn’t stop boss Ben Kohn from racking up around $920k of aircraft spending during that partial year.

The proxy says: “We believe that the use of our aircraft by our executives and directors was frequently more efficient and flexible than commercial travel, and better ensured confidentiality and privacy for our business.” Tldr: #worthit.

[Further reading: There’s a new high flier at JPMorgan]

The Dunce-Proofing Award

Winner: Delek US

Delek US is a petroleum refiner. Read this: “Since the 2008 tax year, we have reimbursed our executive officers for the cost of professional preparation of their income tax returns. Because our executive officers are typically among our most highly compensated employees, their personal tax returns may be examined in connection with examinations of our tax returns. In addition, Exchange Act reporting requirements expose the executive officers’ compensation to public scrutiny. We believe that encouraging our executive officers to seek professional tax advice will mitigate the personal risks that accompany the heightened scrutiny of their compensation, provide us with a retention and recruiting tool for executive officers, and protect us from the negative publicity that could surround an executive officer’s misstatement of his or her personal income tax liabilities.”

Given former chief executive Ezra Uzi Yemin received $12.4mn in total compensation last year — most of it in salary or stock awards — we think probably he can stump up the cash for a personal accountant.

A Delek spokesperson said: “Similar to other Fortune 500 companies, we use independent compensation consultants to help us benchmark the compensation provided to senior executives. These benchmarks are used in determining the executive’s total direct compensation and are disclosed in our Form DEF 14A each year which are reviewed by proxy advisors.”

[Further reading: Oops!…I Forgot That I Paid My Sister Half a Million Dollars]

Comments