ESG outperformance looks set to end, study suggests

Simply sign up to the ESG investing myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Investors who believe that investing sustainably will also deliver higher returns over the long run should be prepared for an imminent change in that narrative, academic research suggests.

Abraham Lioui, professor of finance at Edhec Business School and an expert in the strategy of investing according to good environmental, social and governance principles, believes he and his co-authors have found signs that the ESG market is reaching maturity and could become a victim of its own success.

“We are going to the zone where the positive impact of the ESG buzz on prices is coming to the end of its cycle,” Lioui said. “Soon we will be at the stage where the relationship between ESG and performance will be negative as it [logically] should be.”

The ESG buzz Lioui refers to has resulted in exponential growth in ESG and impact investing, partly due to a huge rise in passive investment that has been buoyed by mounting evidence over the past few years that a corporate focus on material ESG issues leads to improved returns.

A meta-analysis by NYU Stern of almost 250 studies published between 2016 and 2020 found only 8 per cent discovered a negative correlation between ESG and financial performance at a corporate level.

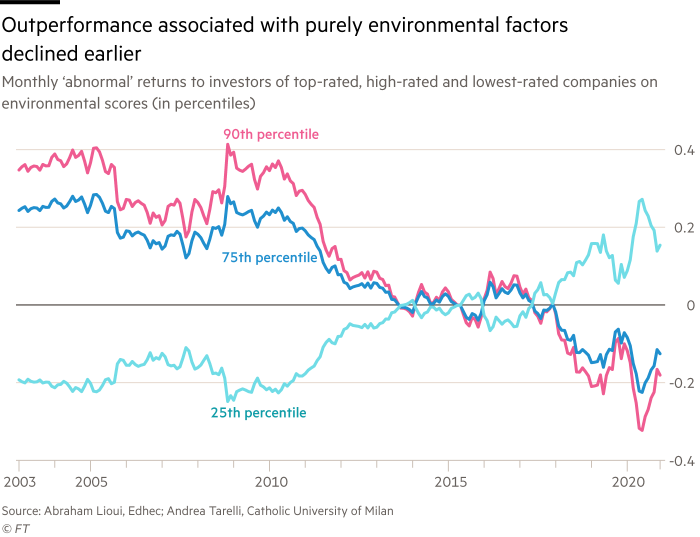

Lioui and his fellow academics also found that according to most data sets, the accumulated alpha, or outperformance, for the E and S pillars of ESG was above 1 percentage point per year, supporting the thesis that companies can do well by doing good. “However, we identify a downward sloping pattern in this outperformance,” the paper said.

The academics looked at three ESG ratings providers to inform their analysis, which provided a range of results. But if data from specialist provider Refinitiv Asset4 can be relied upon it shows that we are already at an inflection point for ESG outperformance and that investors hoping to gain a climate premium from investing in companies with high environmental ranking lost that strategy as a route to outperformance more than two years ago (as shown in the charts).

Figures from KLD, another data provider, paint a similar picture, in terms of returns from ESG, but those from MSCI do not show any recent declines in alpha for high-rated ESG companies.

“It should not be a surprise if, in the long term, ESG investing does come at some cost to investors,” said Greg Davies head of behavioural science at Oxford Risk.

He said that while early investors have been able to benefit from the rise in interest in ESG, companies were likely to incur costs by trying to improve environmental and social scores, leading to less profitability in the long term.

In addition, ESG’s popularity was likely to drive up the prices of companies with better scores, without bringing any changes in their profitability.

“Paying a higher price for the same profits means lower investor returns. This is true of any assets that are ‘popular’,” Davies said.

Kenneth Lamont, senior fund analyst for passive fund research at Morningstar Europe, agreed.

“The results of the paper suggest that as assets have piled into stocks with the strongest ESG credentials, the expected outperformance of these stocks have dwindled away in recent years,” he said. “To many in the financial industry this news won’t come as a surprise, as an ESG label doesn’t exempt stocks from the fundamental laws of the market.”

However, he cautioned that while the paper made some interesting observations, he added: “In practical terms, because ESG funds offer exposure to existing well-documented factors — for example they are known to favour high-quality stocks — they may reasonably be expected to outperform the market over long periods”.

Davies said that the hopes of long-term outperformance might be unimportant to ESG investors. He pointed out that behavioural studies Oxford Risk had conducted into investor preferences for sustainable investing showed many investors were not only prepared to trade-off financial outcomes for social impact, but even desired this.

“ESG coming at some cost need not eliminate the demand for responsible investing, as long as the industry is open about this and designs its products and marketing based on an understanding of real investor preferences,” said Davies.

Click here to visit the ETF Hub

Comments