Stock volatility drops even as US election remains undecided

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

US stock market volatility fell on Wednesday as the chances of a sweeping win for Joe Biden in the presidential election faded, reviving a familiar prospect for investors: political gridlock in Washington.

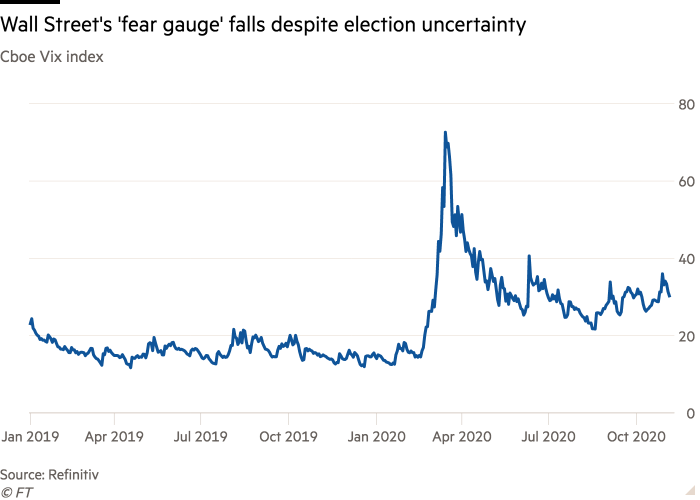

Cboe’s Vix index, which measures market volatility based on futures contracts tied to the blue-chip S&P 500 index, fell below 29 by late morning in New York as stocks rallied almost 3 per cent. The Vix had traded around 36 for much of the previous day.

The fall accompanied dimming prospects of a so-called “blue wave” victory for Mr Biden, in which he would claim the White House and his Democratic colleagues would hold a majority in both chambers of Congress. Instead, early indications on Wednesday pointed to a lead for Republicans in the Senate race, while Democrats were tipped to hold a majority in the House, and the presidential election was too close to call.

“The extreme outcomes have been taken off the table — both a blue wave and a red tide,” said Michael Mullaney, global head of research for Boston Partners.

“That means we’ll be in some sort of gridlock situation, which is what markets like,” he said. “Historically a split Congress has been the best environment for stocks, no matter who the president is.”

The falling Vix is a win for hedge funds and other investors who had disagreed with a common view among strategists and analysts in the run-up to the election that an uncertain result would trigger a jump in market volatility.

The drop for the index, which is known as Wall Street’s “fear gauge”, leaves it still above its long-term average of around 20. It has remained elevated since surging to a record high after the coronavirus crisis sent shudders through financial markets from February. But the move takes the Vix well below the smaller peaks hit in June and late October.

A divided Congress would stymie the policy agenda of either candidate. In the case of Mr Biden, it would limit his ability to deliver a big fiscal stimulus package. The former vice-president’s desire to raise corporate taxes to 28 per cent, after Mr Trump cut the rate from 35 per cent to 21 per cent in 2018, would be likely to face a rocky reception in a Republican-dominated Senate.

The drop in taxes increased corporate profits, spurring a jump in stock buybacks that has helped to boost share prices over the past two years. These repurchases increase earnings on a per-share basis, which can boost the stock price.

If the status quo continues in Congress, Quincy Krosby, chief market strategist for Prudential Financial, said Republican Senate majority leader Mitch McConnell would “make sure Biden will have to bide his time over the next four years”, adding: “For the markets, that’s good.”

Live updates

Follow the latest US election news here.

Comments