Hedge funds help China ETFs shine

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Small investors do not often get the chance to profit from the actions of professional hedge fund slickers, but in some cases they appear to be doing so in the mainland Chinese stock market.

A structural anomaly means investors using some exchange traded funds to access Shanghai and Shenzhen-listed “A shares” may be able to consistently outperform the underlying index — thanks to the desperation of hedge funds to short stocks by using a “swap enhancement” (see below).

The anomaly stems from regulations restricting securities lending, the route typically taken by hedge funds and others wanting to get short exposure to stocks, which have prompted them to rely on swap contracts.

“In the A shares market, securities lending is basically in its infancy. To all intents and purposes for overseas investors it’s not available,” said Matt Tagliani, head of product and sales strategy at Invesco, which launched two ETFs in May designed to tap into this quirk.

How the swap enhancement process works

A hedge fund agrees a swap contract with an asset owner, such as a bank. If the shares fall in value before the bank buys them back, the hedge fund gets a share of the profit. If they have risen in value, the hedge fund covers the bank’s losses, giving the hedge fund the economic experience of being short.

Given the lucrative fees involved, prime broker banks want to physically own stock so they can facilitate this trade, but they do not want the risk that comes with being structurally long the market.

“They don’t have a directional view. They want a reason to own the physical shares, not to have the market exposure,” said Matt Tagliani, head of product and sales strategy at Invesco.

Enter ETFs — banks can buy stock and sell futures contracts to synthetic ETFs, which rely on a derivatives contract to replicate the performance of underlying assets, rather than actually owning the assets themselves, as a “physical” ETF does.

“We go to the banks and say we would like to go long. They buy the inventory and sell us the return,” said Tagliani. “That gives them equal and offsetting exposures.”

Crucially, because so much of the demand for this trade is one way, prices for total return swaps get pushed below fair value, benefiting the ETF.

This “swap enhancement” is “related to the idiosyncrasies of the A shares market”, said Keshava Shastry, global head of capital markets at DWS, which also offers a synthetic China ETF.

“The banks, the prime brokers, provide the access [to hedge funds] and there is a significant cost for it. When the brokers try to hedge it they give the outperformance to those that have long exposure, basically funds like us.”

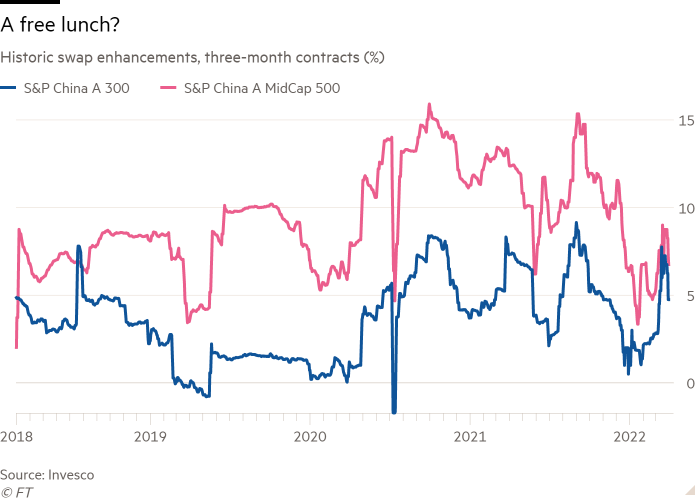

The size of this enhancement varies over time. It is currently 2.9 per cent for Invesco’s large cap S&P China A 300 Swap Ucits ETF (C300) and 8.4 per cent for its S&P China A mid-cap 500 Swap Ucits ETF (C500).

Data from Invesco show these figures averaged 3.5 per cent and 9.3 per cent respectively between the start of March 2018 and the end of March this year.

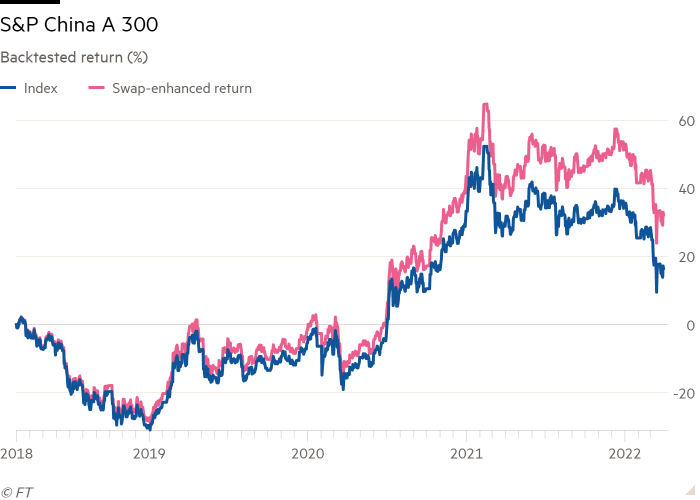

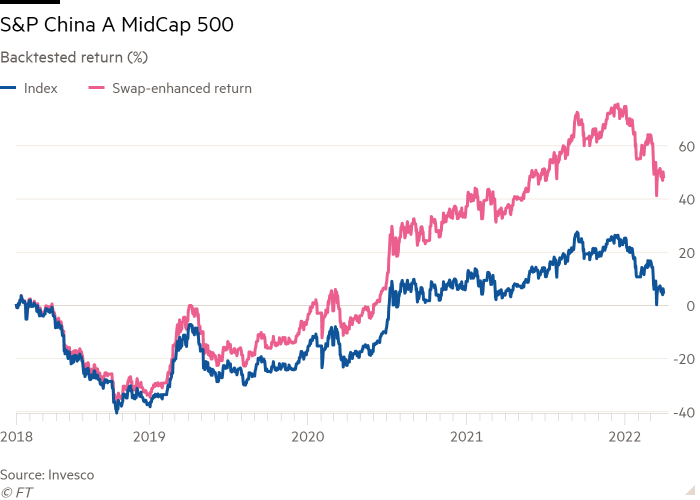

In theory, this means the large-cap ETF would have outperformed its underlying index by a cumulative 13.5 percentage points over this period, and the mid-cap peer by 41.4 per cent (before fees, which are 0.35 per cent for both).

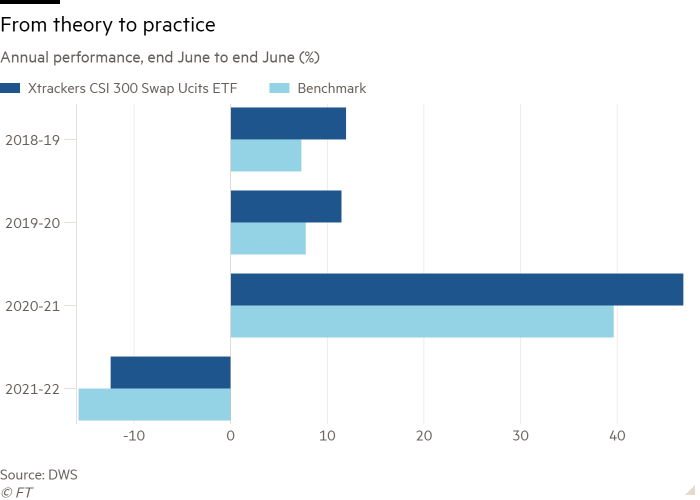

While these figures are theoretical, DWS’s experience show the outperformance is evident in practice too.

Its CSI 300 Swap Ucits ETF (XCHA) beat its benchmark by 3.3 percentage points in the year to June 30 (after fees), building on “alpha”, or excess returns above the benchmark index, of 7.2, 3.7 and 4.6 percentage points in the previous 12-month periods. Over the past four years it has returned 56.3 per cent, versus 32.7 per cent for its underlying index.

Despite this, DWS also runs a physical Xtrackers Harvest CSI 300 China A Shares ETF (ASHR) which has, unsurprisingly, marginally underperformed the same benchmark, due to its lack of uplift and 0.65 per cent fee.

Moreover, the latter has more assets, at $2.7bn versus $2.3bn for the swap-based version.

Shastry said some clients prefer a physical product, often because of their own internal risk rules. Entering into a swap contract leaves synthetic ETFs with the potential risk that a counterparty may go bust and be unable to honour its side of the deal.

The swap-based ETF is off limits to US investors. As its swap is based on the CSI 300 index, some of the underlying holdings are among the list of companies deemed to be supporting the Chinese military that are on a US sanctions list.

In contrast, the physical Xtrackers ETF has stripped out these stocks, potentially creating tracking error vis-à-vis the index but keeping the fund investable to US citizens.

Invesco has got around this problem by tracking S&P indices that are broadly similar to existing CSI benchmarks but do not include the banned companies.

Tagliani said “a lot of our clients, even outside of the US, are sensitive to that executive order”.

Exactly how long the anomaly may remain in place is uncertain, however.

Beijing appears to be edging towards permitting more shorting — in December it gave the green light to limited stock lending by onshore insurance companies to onshore investors.

Tagliani is upbeat, saying that while “there has been very slow liberalisation in trading in the Chinese market in recent years . . . realistically, we don’t see this as a near-term threat”.

Shastry agreed, saying “there is no timeline for [widespread shorting] to happen”.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Comments