The top FT stories read by the legal world in the pandemic

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The FT has reported on the many ways law firms have tried to cut costs during the pandemic, from holding back partner profits, freezing hiring and, most recently, cuts to junior solicitor salaries.

Solicitors qualifying in September at Magic Circle firms will now earn less than 2019’s cohort — just one year after a fierce war for talent pushed pay above £100,000 for the same groups of staff.

This week, we learnt the real reasons for Andrew Tyrie suddenly quitting his job as chair of the UK’s competition watchdog, and delved further into the Wirecard scandal as EY faces tough questions over its audit of the German payments company.

In case you missed it, have a look at our FT General Counsel report published last week, highlighting the top lawyers in 27 companies globally, from multinationals to fast-growth newcomers. The role increasingly involves offering strategic advice — required more than ever, thanks to the pandemic.

The following stories are taken from our Full Disclosure newsletter, sent to FT subscribers in the industry each week, sharing what has been most popular with legal readers on FT.com.

The mystery of Andrew Tyrie’s shock departure from the Competition and Markets Authority was solved this week after it emerged he was pushed out of the watchdog following a boardroom coup.

The Conservative peer said two weeks ago that he was leaving the UK’s competition watchdog three years early to make the case more forcefully for reforms he had lobbied for, including consumer-focused changes that have so far fallen on deaf ears.

But his exit turns out to have been more contentious, with the CMA board threatening a mutiny unless he stepped aside.

Lord Tyrie — not known for taking a back seat — appears to have rubbed insiders up the wrong way with a radical agenda that included shaking up the CMA structure and pushing for beefed-up consumer champion powers. The question on everyone’s lips is where will he pop up next, and who will replace him?

This week I want to know what lessons you think lawyers have learnt from lockdown. What new ways of working are you going to keep and what can business in general take forward as we start to filter back to the office? Find me at @KateBeioley_FT.

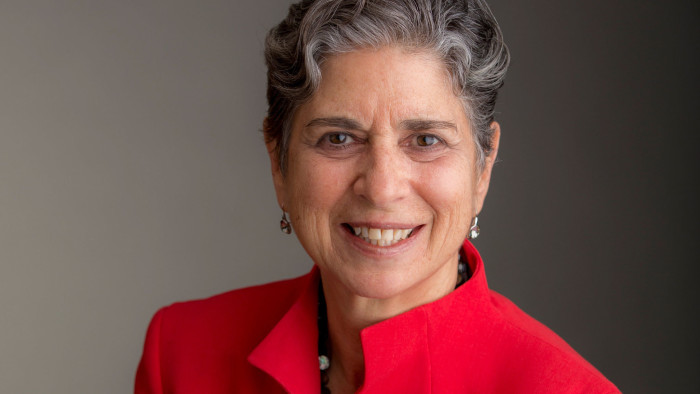

Manhattan gains a US attorney with a reputation for independence

New US attorney for the Southern District of New York Audrey Strauss has stepped into the spotlight as one of the most powerful lawyers in America, taking the helm of a string of investigations circling President Donald Trump after the dramatic ousting of Geoffrey Berman in June.

“A graduate of Columbia law school, Ms Strauss joined the southern district’s criminal division in 1972, at a time when women were scarce in the department. She rose under the tutelage of Robert Fiske, the former US attorney. She went on to help found the white-collar practice at New York law firm Fried Frank, and then served as chief counsel at Alcoa, the aluminium company.”

EY failed to check Wirecard bank statements for 3 years

EY failed for more than three years to request crucial account information from a Singapore bank where German payments company Wirecard claimed to have up to €1bn in cash — a routine procedure that could have uncovered the enormous fraud.

“People with first-hand knowledge told the Financial Times that the auditor between 2016 and 2018 did not check directly with Singapore’s OCBC Bank to confirm that the lender held large amounts of cash on behalf of Wirecard. Instead, EY relied on documents and screenshots provided by a third-party trustee and Wirecard itself.”

EY prepares for backlash over Wirecard scandal

EY briefed its partners on how to prepare for difficult conversations with clients about its audit of Wirecard.

“In its memo to senior partners, EY claimed responsibility for discovering the fraud, despite signing off Wirecard’s accounts for more than a decade in the face of growing questions about its accounting practices from journalists and certain investors.”

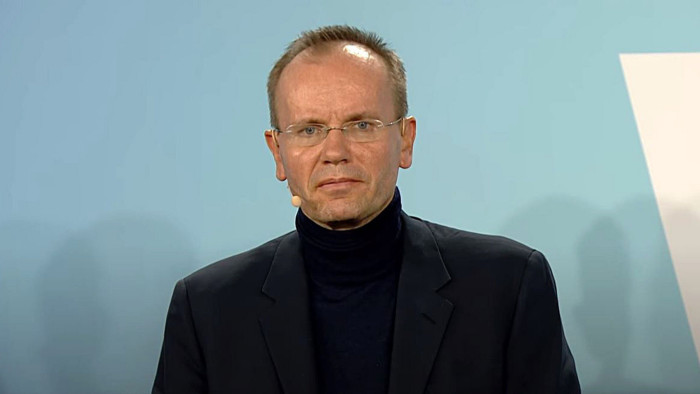

Ex-Wirecard chief Markus Braun arrested

The unravelling of German fintech Wirecard took another turn last week when its former chief executive Markus Braun was arrested on suspicion of false accounting, just two days after the company was forced to admit that €1.9bn of cash on its balance sheet probably “does not exist”.

“Until he resigned last week, Mr Braun was the longest-serving chief executive of a Dax company, and one of the richest, thanks to a 7 per cent stake in the group he ran from 2002. At its peak in the summer of 2018, Wirecard had a market value of more than €24bn.”

Tyrie was ousted in boardroom coup

The inside scoop on the dramatic exit of Competition and Markets Authority chair Andrew Tyrie, who quit the role three years early in June.

“‘[Andrew] felt he was sold a job where he could be an advocate for the consumer and when he got in there he realised he was chairman of quite a technocratic body,’ said one individual close to the agency.

Closing argument

Many people might believe there is no more comforting smell than fried chicken after an ebullient evening out. Full Disclosure is made of high class stuff, of course, but can still appreciate Alice Hancock’s dive into the rise and rise of the high street fried chicken joint. From the early days of KFC’s real Colonel Sanders, to the astronomical trade on London’s smaller outlets, this is one to make you salivate.

“The arrival of fried chicken in the UK was, in some senses, a homecoming. Its origins are ‘hotly contested’, says Emelyn Rude, a food historian at the University of Cambridge and the author of Tastes Like Chicken. But although the version we now know emerged on the plantations in America’s South during the 1700s, its ancestry can likely be traced back to the culinary traditions of Scotland, where chicken was battered and deep-fried in pig’s fat.”

Comments