Africa healthcare faces dialysis challenge

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In a poor farming area outside the Kenyan capital, Nairobi, Kenneth Gichungu receives treatment at the state of the art dialysis centre opened last year in the Presbyterian Church of East Africa Kikuyu Hospital. “This is much better,” says the 54-year-old tomato farmer, who suffers from chronic kidney disease. Previously, his treatment was “very cumbersome”.

He often had to spend the night in the hospital because the dialysis machines were old and unreliable. “Since last year, these new ones guarantee that any time I come, they are ready. Even the cleaning is better here. There’s definitely a difference — now, I have proper dialysis.”

The centre was built and is run by Africa Healthcare Network, which ranks 13th in the latest FT-Statista list of the fastest-growing companies in Africa. Revenues, from $700,000 in 2018, reached $5.4mn in 2021 and company executives expect them to top $15mn in 2023.

In the former dialysis ward, which was run by the hospital, the water was not of the optimal standard — a principal challenge to providing comprehensive kidney care. Also, the toilet was clogged, chairs were in a poor state after years of use and the handful of old dialysis machines struggled to provide treatment for 20 people a week. Today’s centre has 10 new machines treating a weekly average of 52 patients.

AHN, its office in Nairobi, builds and manages dialysis centres in Kenya’s hospitals — be they faith-based, such as PCEA Kikuyu, private or public — and facilitates access to treatment by the country’s nephrologists. “From the structural aspect, the planning aspect, even from the patient outcome, this is a game-changer,” says Dr Michael Karanu, PCEA Kikuyu’s head of clinical services. “I don’t think there’s any other set-up that is doing similar work in East Africa . . . it has taken us a notch higher in terms of quality of renal care.”

AHN was founded in 2015 by Nikhil Pereira, a former Morgan Stanley investment banker who had deferred his MBA studies at Harvard Business School, and nephrologist Lloyd Vincent, with help from Pereira’s father, Brian, also a doctor. Investing personal funds, they launched the business’s first dialysis centre in Rwanda: “We decided to make a for-profit that achieves social impact metrics with increased and higher quality of care, while making it affordable relative to existing operations,” explains Nikhil Pereira.

“Effectively, more affordable than the government, more affordable than private and even non-profit providers,” he adds. With an eye on expanding its business to Zambia and Botswana, AHN has more than 30 healthcare centres across Rwanda, Tanzania and Kenya — the latter its fastest-growing market.

Since 2016, the company has received financing from Asia Africa Investment and Consulting, a Japanese investment fund, as well as from the US International Development Finance Corporation.

In addition, it is finalising $25mn in financing from two major private equity funds to continue its expansion, says Nikhil Pereira.

The company, with about 400 employees, is vertically integrated — with its own supply chain, distribution networks and warehouses storing medical supplies. It is also a licensed distributor and wholesaler of medical consumables, including blood tubing lines, as well as equipment such as dialysis machines.

“We’re bringing shipping containers, we have the economies of scale, we have the leverage, we drive the prices down, which allows us to expand access to care,” says Matt Williams, the company’s chief executive, who was formerly with multinational healthcare group, DaVita. Such factors matter in an east African region that stretches from Sudan in the north to Malawi in the south, where 11 per cent of the population have kidney disease but only one in 10 patients that need dialysis has access to it.

Most of AHN’s centres are in operation in countries where there is a national health insurance scheme.

In Kenya, for example, the average price per dialysis session costs the equivalent of $70 in local currency. With patients going twice a week, such costs amount to a fortune in a country with a gross domestic product of approximately $2,000 per head, according to the World Bank.

The National Health Insurance Fund (NHIF), Kenya’s state system, reimburses AHN for all of it. Although there are presidential promises of universal healthcare, NHIF currently only covers roughly 20 per cent of Kenya’s population of 55mn.

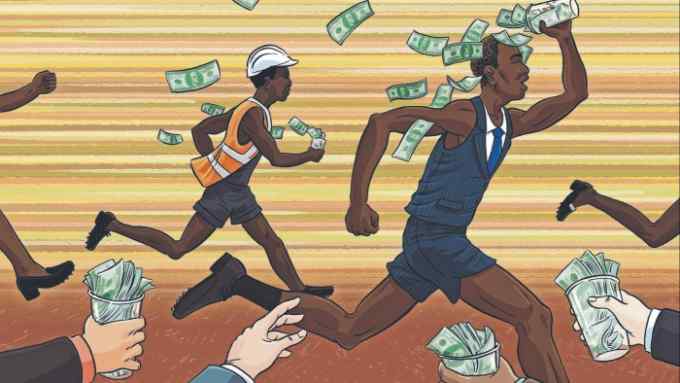

As Africa’s population continues to grow, so the need for dialysis expands with it. AHN expects 20 per cent year-on-year growth in the number of patients. And these rising demographics present an opportunity for private providers partly because most African healthcare systems are developing from a low base.

Increased urbanisation and improvements in education are further factors leading to new business opportunities in African healthcare. Revenue in the sector is projected to reach $673mn in 2023. With an annual growth rate of almost 13 per cent, the projected market volume is expected to near $1.1bn by 2027, according to data provider Statista.

Private services are needed as, left to themselves, African hospitals rarely profit from dialysis care, says Williams. “It is really hard operationally. Their machines break down, the water systems are not optimal, they can’t afford staff nurses, they don’t have good supply chains, they can’t get all the products they need.

“So, we basically say to them: ‘give us space, electricity and water, we’ll do everything else and we’re gonna give you a revenue share’. We handle all that hard stuff, we service all of our own machines, all of our systems. And, from day one, they’re making money off it.”

Comments