Shale oil producers blame export ban for low US crude price

Simply sign up to the US trade myFT Digest -- delivered directly to your inbox.

US shale oil producers are becoming increasingly concerned about the gap that has opened up between domestic and internationally traded crude prices, which they say is exacerbating the problems they face.

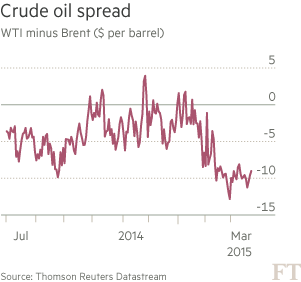

The spread between West Texas Intermediate and internationally traded Brent has widened sharply since January, and was about $9 on Friday, representing a discount of about 16 per cent for US crude.

Producers campaigning against US restrictions on crude exports say the regulations are responsible for part of that gap.

Ryan Lance, chief executive of ConocoPhillips, the largest US exploration and production company, told a Senate energy committee hearing last week that the discount for US oil magnified the impact of the fall in crude prices since last summer.

“We are at a competitive disadvantage,” he said. “Our overseas competitors . . . are developing around the world at higher price than we’re getting for the product that is of similar quality.”

Mr Lance said most US shale oil production would be uneconomic at an oil price of $40 per barrel. WTI ended Friday at about $46 per barrel.

Other companies have raised similar concerns. Scott Sheffield, chief executive of Pioneer Natural Resources, another large shale producer, earlier this month told the energy committee of the House of Representatives that US companies were disadvantaged compared with foreign producers because they could not receive global prices.

He added: “If current trends continue and the export ban is not lifted, US shale oil production will flatten or decline by disproportionate volumes versus our overseas competitors.”

Producers have raised concerns about the faster-than-usual build-up of crude in US inventories. Storage tanks have been filling up at the rate of about 1.2m barrels per day over the past four weeks, and crude inventories are now at their highest relative to demand from refiners since the mid-1980s.

US crude production has so far continued to grow in spite of the slump in activity, with rigs drilling for oil in the US down 49 per cent since October according to Baker Hughes, the oilfield services company. The Energy Information Administration’s weekly data show US crude production rising to 9.42m barrels per day this month.

US crude exports have been rising, and reached a record 442,00 b/d in December, with the great majority of that going to Canada, but still account for less than 5 per cent of production.

Several analysts have argued that liberalising crude exports would help US producers.

IHS, a research company, last week published a study backed by leading companies arguing that liberalisation would increase investment and employment in US oil production and related services.

Daniel Yergin, vice-chairman of IHS, said more US shale oil developments were on the margin of being economically viable as a result of the drop in crude prices of more than 50 per cent since last summer.

“At the current level of prices, the export ban is an even more urgent problem,” Mr Yergin said. “A smaller price discount is much more destructive.”

Robin West of the Center for Strategic and International Studies said the regulations were “helping Opec to smother US production, which is bad for our economy as well as our energy security”.

However, US refiners, which benefit from lower domestic crude prices, have argued against liberalisation.

The American Fuel and Petrochemical Manufacturers, a group that represent refiners, said export controls should be relaxed only as part of a broader move to free up oil transport.

Charles Drevna, the AFPM’s president, said: “I’d like to be in the meeting where an elected official can say they’ve voted for something that makes it less expensive for foreigners to buy US crude than for Americans.”

He added that as recently as January WTI crude had briefly traded above the Brent price.

“Let’s not base policy on a snapshot in time,” he said.

Export restrictions are not the only reason that WTI diverges from Brent crude: transport costs and other factors can also be important. Light Louisiana Sweet, oil on the Gulf of Mexico coast often used as a benchmark for crude that could be exported if restrictions were eased, was $53.44 per barrel on Friday, about $2 less than Brent, according to Argus, the price reporting service.

Crude at the Magellan East Houston terminal, also close to the coast, was $49.53 per barrel, about $6 less than Brent, according to Platts, another reporting service.

Comments