Hong Kong breaks Singapore’s grip on China stock futures

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

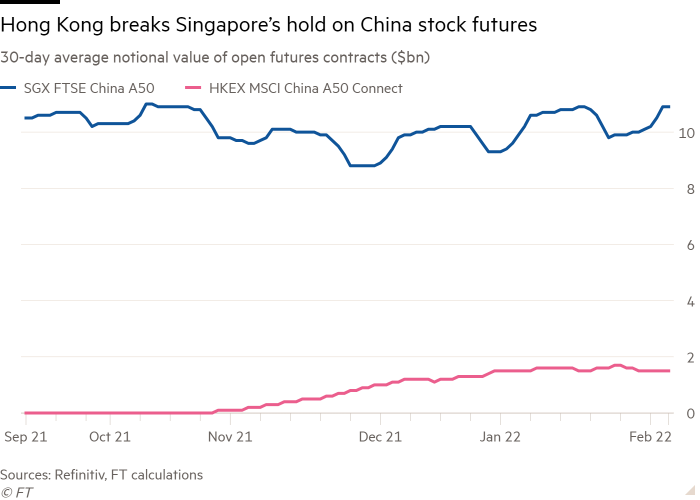

Hong Kong stock exchange has seized market share from its Singapore rival in China stock futures, opening up a winner-takes-all battle for control of how global investors hedge Chinese equities.

The fight to become the dominant pool of liquidity for so-called A-share futures not only pits Hong Kong’s share market against Singapore but also Blackrock against Chinese fund companies and the index provider FTSE Russell against MSCI, with implications for their global competitiveness.

Open interest in Hong Kong’s A-shares futures contract has risen to as much as $2bn since its October launch. The swift uptake recalls past shifts in derivative liquidity, such as the “Battle of the Bund” between Frankfurt and London in the late 1990s.

A-shares are stocks of mainland Chinese companies listed in Shanghai or Shenzhen that trade in renminbi, in contrast to H-shares, which are listed in Hong Kong and trade in freely convertible Hong Kong dollars.

BlackRock, the world’s largest provider of exchange traded funds, has built up a large pool of assets tracking the FTSE China A50, the index underlying the Singapore contract. But three mainland Chinese fund companies have already amassed $10bn in assets to track the new MSCI China A50 Connect index used by Hong Kong.

“I do think the centre of gravity is shifting,” said the head of execution for Asia at one Wall Street investment bank, arguing that the next six months would be crucial in the fight for the futures market. “Liquidity is king with respect to derivative instruments and hedging.”

Despite Hong Kong’s recent inroads, Singapore remains the biggest centre for hedging Chinese equities. Open interest in Singapore futures stands at about $13bn and liquidity has not dropped since Hong Kong’s launch, according to data from Refinitiv.

But traders said Hong Kong’s success in establishing some initial liquidity suggested the city posed a meaningful threat. HKEX has also waived its trading fee on the new futures until June. Kevin Rideout, co-head of sales and marketing at HKEX, said the exchange could extend the waiver for another six months without regulatory approval.

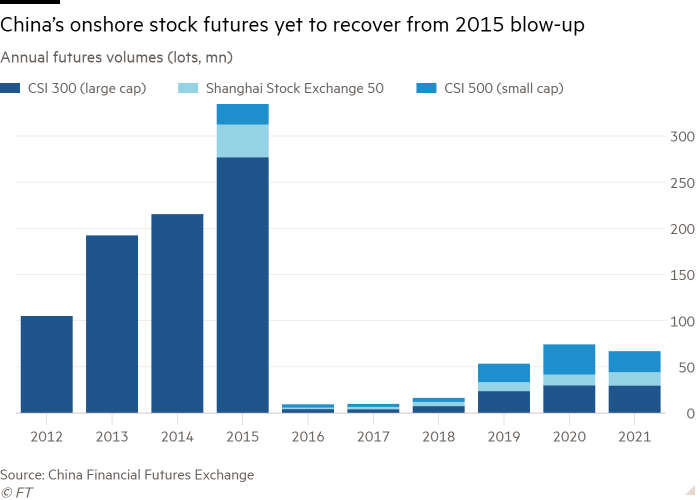

There is relentless appetite for exposure to China’s $14tn stock market. Offshore futures have become a central tool for risk management, index tracking funds and structured products after Beijing severely curtailed onshore stock futures trading in 2015.

“When more investors are holding Chinese assets, they need hedging,” said Eddie Yue, chief executive of the Hong Kong Monetary Authority, at a recent Financial Times event. “Hong Kong is the best place for risk management to take place. So we are looking at the range of derivative products we have here for that purpose.”

Strategists and traders said the differences between the indices would be one of the main factors in determining the futures contracts winner.

The FTSE product uses a more straightforward methodology, but the MSCI rival promises better representation of the overall A-share market.

The FTSE index, which consists of China’s 50 largest companies weighted by market capitalisation, is dominated by the finance and consumer sectors, with names including China Merchants Bank and Ping An Insurance as well as Kweichow Moutai, the maker of spirit baijiu.

The MSCI index also includes just 50 companies but is meant to be more representative of the wider market. “This index selects at least two stock names from all sectors,” said Kazuya Nagasawa, the head of MSCI in Asia. “It’s not just the biggest names, which leads to sector bias.”

For example, Kweichow Moutai makes up 12.7 per cent of the FTSE Russell index, but 8.3 per cent of the MSCI version and less than 6 per cent of China’s benchmark CSI 300 index.

If investors have the whole A-share market as their universe, then the more representative index would better hedge their exposure, said Jason Lui, head of East Asia strategy at BNP Paribas.

FTSE Russell is considering changes to its index, chief executive Arne Staal told the FT in November, such as weighting by sector and doubling the number of constituent stocks. BNP estimated that those moves could bring the FTSE benchmark’s performance in line with MSCI’s, potentially erasing an advantage for Hong Kong.

Michael Syn, head of equities at SGX, said no decision had been made on expanding the FTSE index or corresponding futures contract, but that “the direction of travel over time is more representation, more inclusion”.

The Singapore exchange and FTSE also have to be careful of offending Chinese regulators because abrupt changes to the futures contract could blow back into the onshore markets in Shanghai and Shenzhen. The Hong Kong stock exchange spent more than two years waiting for regulatory approval from Beijing after first announcing plans to launch MSCI-based futures in 2019.

The history of such battles for liquidity suggests one contract will prevail. In the “Battle for the Bund”, Frankfurt struggled to capture even a third of the market until gains began accelerating in 1997, sapping the London trade dry within a year. As demand for Chinese equities booms, Singapore will hope history does not recur.

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday

Comments