Pound hits 8-month high against euro on UK economy hopes

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

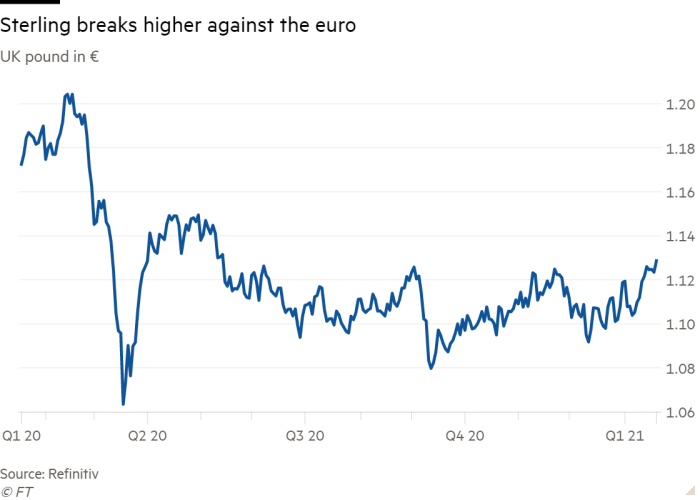

The pound has reached its highest level against the euro in eight months, as the fast pace of the UK’s Covid-19 vaccine rollout fuels hopes of an accelerated economic recovery.

Sterling, which has been rallying since the start of the year, crossed €1.13 in intraday trading on Wednesday for the first time since May 2020. By late afternoon, it gave up some gains but was still up 0.3 per cent for the day at €1.1266. It climbed 0.2 per cent against the dollar to above $1.36.

The latest catalyst came in the form of December inflation figures. A month-on-month bump in the consumer price index of 0.6 per cent was slightly more than economists were expecting, and compared with a 0.3 per cent rise in November. Higher inflation makes it less likely the Bank of England will make further cuts to interest rates that would dent the pound.

Sterling has steadily gained ground since reports of significant progress in trade talks between Brussels and the UK at the end of last year. The subsequent deal, announced on Christmas Eve, helped allay fears of an abrupt and disorderly end to the UK’s relationship with its European partners.

Charles Diebel, head of fixed income at Mediolanum Asset Management, said the recovery in the currency was “a function of avoiding the worst effects for a hard Brexit combined with a very aggressive Covid-19 vaccine plan”.

The speedy rollout of Covid jabs “hopefully means the UK recovers at a faster pace, once immunity is established, and thereby the chances of an economic recovery accelerating are higher in the UK than in Europe,” he added.

Economists say a sizeable uplift in household saving during the coronavirus crisis could mean that the recovery will get another boost when people start to spend more freely again.

“This saving is a coiled spring which will be released for the UK’s economic benefit, helping to send CPI inflation back to 2 per cent,” said Savvas Savouri, chief economist at Toscafund Asset Management.

Despite the threat to the economic recovery posed by England’s latest national lockdown, investors are betting the Bank of England will not respond by cutting rates.

For much of last year, markets were pricing in a cut from the current record low of 0.1 per cent, with a chance of negative interest rates to come later in 2021. Since then, traders have mostly unwound those wagers after vaccine breakthroughs fuelled hope of a swift growth rebound.

Comments