FTX and the banana bend in markets

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Here we go again with two of the market themes that just keep cropping up over and over this year: the chaotic dalliance with disaster in crypto and the hunt for a more lenient stance from the US Federal Reserve.

Both are dramatic in their own ways, but the latter of the two is much more important to the health of mainstream investors’ portfolios.

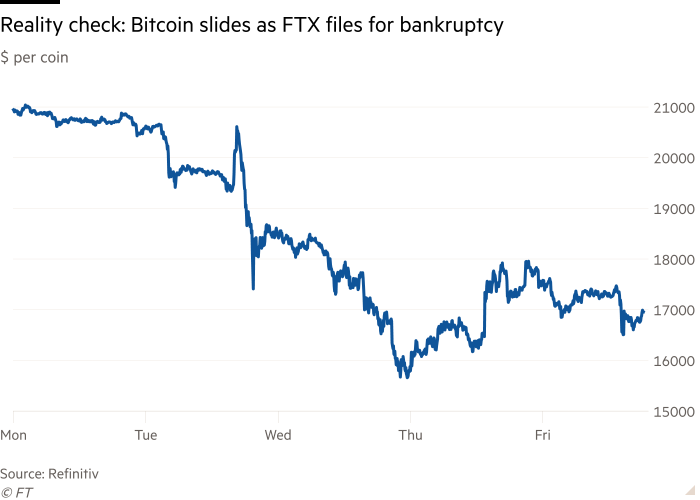

The told-you-so schadenfreude that crops up when crypto hits the skids is always tempered by the grim knowledge that some naive amateur investors are losing their life savings. Bitcoin, the biggest token of the bunch, has dropped by around 18 per cent over the course of this week.

But any new buyers who came in after it tanked 70 per cent from November to June and held on at around $20,000 a pop after that probably knew what they were getting in to. If you clung on after the crash, chances are you knew it was a punt.

Retail investors are hurt mostly through the sliding value of the coins. The professionals take the pain through their equity investments. And they have suffered a brutal collision with reality this week, after Sam Bankman-Fried’s FTX — supposedly the more reliable exchange in this freewheeling market — suffered a good old-fashioned bank run before filing for bankruptcy.

First, confidence evaporated from FTX’s native token, FTT — a fairly common occurrence with tokens based on trust and hand-wavey ambitions rather than on traditional boring stuff like revenues, dividends, interest payments and institutional resilience.

This was bad enough, but FTX rival Binance swept in and made matters worse. First by publicly stating an intention to sell its holdings of FTX’s tokens and then by offering to rescue the exchange itself before pulling out of such a deal, leaving its chief executive Changpeng Zhao as the last remaining king of crypto. SBF, as he is known, was forced to resign as chief executive.

This is all top-notch drama, and humbling for FTX’s financial backers, who sure drank the Kool-Aid. One of them, venture capital firm Sequoia, said this week it will write down its $210mn investment in FTX to zero, noting that “a liquidity crunch has created solvency risk” for the exchange.

Contrast that with Sequoia’s gushing assessment of FTX’s prospects in an extremely lengthy piece it published online less than two months ago. In a now-deleted 13,800-word profile (that’s around 16 times the length of this column), Sequoia described Bankman-Fried’s “status of legend”. His explanation of how one day you could use FTX to “buy a banana” (I’m not joking) left the Sequoia team in rapture. “I love this founder,” one said. “It was a vision about the future of money itself,” the profile explained. Now, you will struggle to retrieve your funds from FTX, let alone use it to buy fruit.

The finest comedy or drama script writers on the planet could not come up with a more ludicrous unravelling for an industry already long on absurdity. Bear in mind Bankman-Fried himself just last year told the FT he’d quite like to buy Goldman Sachs. And yet still the coins cling on. Even with all these slings and arrows, bitcoin trades at around $16500. Morgan Stanley reckons, based on when retail investors got in, and on trading psychology, many won’t sell until we sink to $10,000.

Indeed, the price of the tokens briefly picked up from its lows this week after finally, at long last, a break formed in the clouds of inflation.

Data released on Thursday showed annual US inflation running at 7.7 per cent in October. By any sensible measure, that is extremely high and well above target. But it marked the smallest 12-month increase since January.

All year, investors have searched desperately for a sign that the Fed might at least slow down its pace of interest rate rises, and finally they got one, in cold hard data.

The market reaction was absolutely explosive. The S&P 500 index gained 5.5 per cent. Stripping out the wildly volatile scenes in spring 2020, that is the biggest daily rally in more than a decade, and one of the biggest ever. The tech-heavy Nasdaq Composite closed 7.4 per cent higher.

Government bond prices shot higher, hammering yields. The yield on the two-year note fell by some 0.25 percentage points to 4.33 per cent, its largest drop since October 2008.

This is the market’s way of saying: Mission accomplished. Crisis over. Are investors getting ahead of themselves? Yes. This is just one data point, and it’s not guaranteed to push down the Fed’s end point in rate rises. But that’s how the game works. And fund managers have been holding more cash than at any point since 2001, according to data from Bank of America data, giving enormous firepower to deploy on the rebound.

“Markets finally got what they wanted,” says Emmanuel Cau, a strategist at Barclays. The reaction has been “euphoric”, and reinforces FOMO — the fear of missing out, he says.

The fact that this appears to have given a boost even to bitcoin, after a week where the market’s foundations have been found to be built on sand, tells you two things: Firstly, after some false starts, this could be the big one this time, the start of a meaningful market recovery after a terrible 12 months. Secondly, you can’t buy bananas on the blockchain, and you probably never will.

katie.martin@ft.com

Comments