Watchmakers turn to new product ranges

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Luxury fashion brands have been diversifying into other categories, such as jewellery, sunglasses and shoes, for a long time. In contrast, haute horlogerie brands have, until recently, focused on watches alone.

However, all that has changed. Trailblazing companies have begun to offer other products, including leather accessories and sports equipment, in their efforts to gain marketshare and greater attention.

Carlo Croco founded Hublot in 1980, but the brand was reinvented when Jean-Claude Biver became chief executive in 2004. Seen as a progressive leader, he quickly side-stepped the longstanding rules regarding diversification.

Mr Biver introduced the Art of Fusion as Hublot’s chief creative concept, starting with the Big Bang watch in 2005. The concept broke with tradition by using what were then unusual watchmaking materials, such as ceramic, rubber and carbon fibre.

The brand has since branched out to produce winter sports- and music-related products under the Big Bang sub-brand, which includes sunglasses, sleds, bikes and headphones.

Mr Biver denies the move is about sales. “We are certainly not targeting revenue growth, which should of course come first,” he says, “and 99 per cent comes from our core business, which is exclusive and prestigious watches.”

Instead, he thinks the company is increasing the sympathy and desirability of the brand while creating “buzz” that gets noticed.

Like Mr Biver, Max Büsser, chief executive of MB&F (Maximilian Büsser and Friends), has no qualms about pushing the boundaries. In 2006, he presented Horological Machine No. 1, described by Mr Büsser as “a machine that just happened to tell time” but was designed to be worn like a watch. It was unlike anything the sector had seen.

Mr Büsser says MB&F “feels like an alien” in the watchmaking world, so in 2012 he opened the MAD gallery in Geneva as a place to showcase watches and for artists and designers to display their wares.

“My only hope was not to lose too much money in the venture,” he says.

The gallery is also a sort of laboratory. Last year at watch fairs, MB&F presented the Music Machine – a musical box in the shape of a spaceship, in collaboration with Reuge, a 150-year old Swiss mechanical musical box company.

Mr Büsser says the idea came about because one of Reuge’s musical boxes was in the gallery.

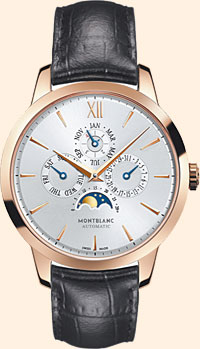

Meanwhile, Montblanc, a luxury pen company established in 1906, has reversed the process. It entered the luxury watch market in 1997, building a manufacturing centre in Le Locle, Switzerland.

Montblanc was already a successful lifestyle company, also offering leather goods. Jérôme Lambert, chief executive, says the progression into watches made sense, because Montblanc had worked with the precise mechanics of pens for more than a century.

“I love to see people opening their eyes to the reality of watchmaking at Montblanc,” says Mr Lambert. “That is our mission.”

Mr Lambert says customers demanded the move, but adds that having several categories of products has had a positive effect.

Thomas Chauvet, a luxury analyst at Citigroup, puts it more bluntly: “Following years of strong price inflation and expansion into haute horlogerie, Montblanc and a few other watchmakers have been trying to enlarge their customer base by introducing more affordable products.

“This segment of the market has grown strongly over the past year, including in China, and could partly offset current weakness at the [luxury] end.”

With the purchase of a factory in Villeret, Switzerland in 2007, Montblanc continued to build on its manufacturing capabilities and started producing its own movements. To mark the 90th anniversary of its Meisterstück flagship line of pens this year, the company has produced a perpetual calendar, priced in stainless steel at $12,800.

While most watch companies are based in Switzerland, a company called Shinola wants to make the US a viable watchmaking centre. It launched as a watchmaker in Detroit in 2011 with a social mission to bring quality manufacturing to the US and create jobs.

Watches are assembled by hand in its factory, but Shinola is design driven, also offering leather goods, bicycles, art books, and even footballs. “Watches are arguably the most complicated product to craft,” says Steve Bock, chief executive.

“If we can make quality watches that meet the highest standards, our craftspeople have the ability to design and build anything,” he adds.

Shinola was conceived of as a lifestyle company that would aim to provide a variety of products. Mr Bock also points out that with a small, but growing, brand it is important to hedge against market volatility.

“Diversification is obviously a critical necessity,” he says. “The greater the diversification, the greater the ability to absorb downturns in a particular segment or niche.”

Most luxury watch brands still take great pride in retaining an insular product line. However, companies that have had the temerity to create alternative products are opening the industry to new and creativity possibilities.

Comments