Bond funds recover appeal after painful falls

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Exchange traded funds that track bond markets have endured a torrid time this year as galloping inflation has forced central banks to raise interest rates aggressively, in an effort to restore price stability.

Investors have been warned to expect more increases in interest rates in the US, UK and EU as increased volatility in global energy and food prices — resulting from Russia’s war in Ukraine — creates greater uncertainty over the future path for inflation.

Meanwhile, widespread losses have been registered across some of the world’s most popular fixed income ETFs. Bond prices, which move inversely to interest rates, have dropped as central banks have signalled that tighter monetary policy will be necessary until policymakers are confident that inflation has been brought under control.

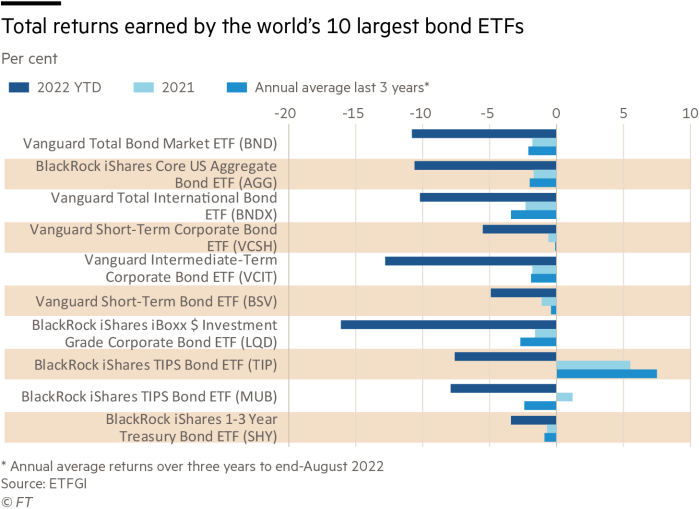

As a result, the 10 largest fixed income ETFs by assets have all delivered negative total returns in the first eight months of this year: ranging from minus 3.4 per cent for SHY — BlackRock’s $26.6bn iShares 1-3 Year Treasury Bond ETF — to minus 16.1 per cent for LQD — BlackRock’s $32.9bn iShares iBoxx $ Investment Grade Corporate Bond ETF.

The biggest ETFs in high-yield bonds and emerging market debt have also suffered significant losses by September. HYG — BlackRock’s $12.3bn iShares iBoxx $ High Yield Corporate Bond ETF — has lost 14.1 per cent this year and its direct competitor JNK — State Street’s $5.9bn SPDR Bloomberg High Yield Bond ETF — has dropped 12.8 per cent. At the same time, EEM — BlackRock’s $22.6bn iShares MSCI Emerging Markets ETF — has fallen 18.2 per cent.

But this repricing has been accompanied by shifts in positioning by large institutional investors. Many are abandoning their earlier caution and are now more willing to allocate more funds to the asset class.

A net 40 per cent of asset allocators held “underweight” bond positions in September, according to a survey by Bank of America of 212 investment managers with combined assets of $616bn. However, that was an improvement in sentiment compared with the net 80 per cent “underweight” recorded in October 2021 — the most pessimistic reading in the 20-year history of the survey.

The risk-reward balance for bond investors has improved because of the price falls, according to Amundi, the Paris based-asset manager.

“Bonds are back,” says Vincent Mortier, group chief investment officer at Amundi. “After the great repricing in the first half of the year, and as we move to an environment with a higher risk of recession, government bonds are worth looking at as yields are now more appealing.”

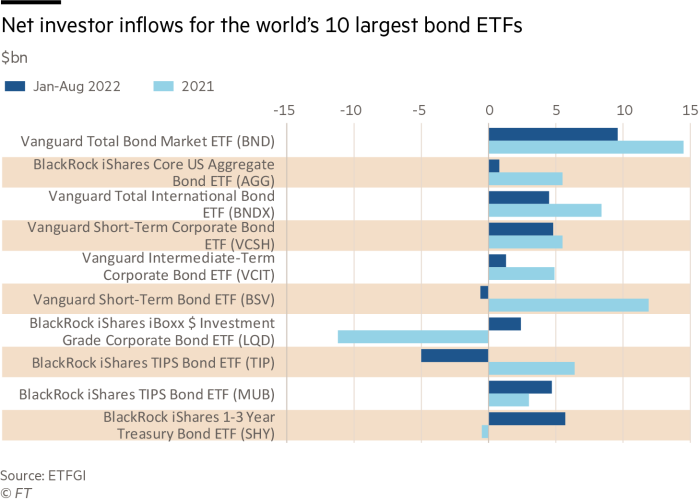

Investor appetite for government bond ETFs has strengthened, accordingly. Global net inflows were $118.4bn in the first eight months of this year — already more than double the $47.1bn gathered over the whole of 2021, according to ETFGI, a London-based consultancy.

“The US has been the main driver of the increased inflows into government bond ETFs this year, along with a notable improvement in Europe,” says Deborah Fuhr, chief executive of the ETFGI consultancy. “At the same time, continuing investor caution is evident across inflation-linked bond ETFs, high yield, and emerging market fixed income ETFs, which have all registered net global outflows so far this year.”

Michael John Lytle, the chief executive of Tabula, a London-based ETF provider, says sentiment toward credit that is investment grade and high yield improved following the weakness in the first half of 2022.

“Developments in bond markets in the first half were undoubtedly painful for fixed-income investors,” he acknowledges. “Although it is not clear where policy on interest rate rises will peak, spreads in both investment grade and high yield markets have widened and are now much more attractive.”

Fears of acute inflation remain a major problem for fixed-income investors, though. BlackRock says the threat that high inflation rates will persist is still being underestimated by investors. But the world’s largest asset manager thinks that both the US Federal Reserve and ECB will be forced to stop raising interest rates once the gravity of the damage being done to the economy and employment by monetary tightening becomes clearer.

BlackRock has a “neutral” tactical view on EU government bonds and an “underweight” on holding US Treasuries. It is recommending clients should overweight inflation-linked bonds and also investment-grade credit. “The strong balance sheets of high-quality corporate bond issuers suggest that investment-grade credit should weather weaker economic growth better than equities,” says Karim Chedid, head of investment strategy for iShares in the Emea region at BlackRock.

He adds that investors looking for income should also consider LEMB — BlackRock’s $373mn iShares JPMorgan EM Local Currency Bond ETF — which has an attractive yield.

“Local currency emerging market debt offers attractive valuations and income. Higher yields already reflect monetary policy tightening in emerging markets and compensation for inflation risks,” says Chedid.

Comments