One in 20 ETFs axed in 2020 after failing to build scale

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

More than one in 20 exchange traded funds were axed last year as surging inflows failed to lift all boats, but issuers’ enthusiasm for new launches remained undimmed.

The accelerating rate of fund closures reflects a greater willingness among asset managers to scrap funds that fail to reach profitable scale, as well as a rash of merger and acquisition activity that led some investment houses to prune overlapping products.

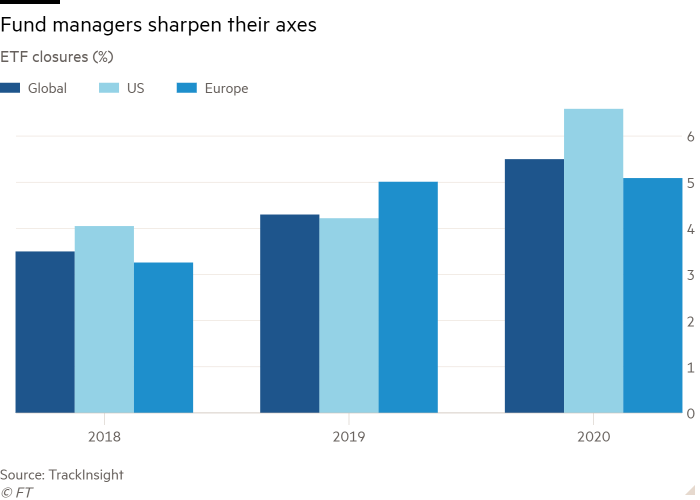

Worldwide, a record 297 ETFs were shuttered during 2020, according to data from TrackInsight. This also represented a record in percentage terms, with 5.5 per cent of ETFs being wound up last year, up from 4.3 per cent in 2019 and 3.5 per cent in 2018.

“Put another way, more than one in 20 ETFs closed in 2020, due to poor performance or lack of investor interest,” said Anaëlle Ubaldino, a quantitative financial adviser at Koris International, a French investment advisory firm linked to TrackInsight.

The closures came during a year in which global ETF assets jumped 25 per cent to a record $7.6tn due to a combination of strong inflows and rising markets. New launches comfortably outpaced closures, with the number of ETFs rising by 318 to 6,518 last year, according to TrackInsight.

Ms Ubaldino said a prime driver of the closures was a spate of industry takeovers, with fund groups often absorbing newly acquired ETFs into their pre-existing range.

Invesco was prominent, taking the axe to 45 ETFs, partly as a result of its takeovers of US peer OppenheimerFunds and the ETF arm of Guggenheim Investments in May 2019 and April 2018 respectively.

“Invesco has tidied up its line up after a raft of acquisitions,” said Ben Johnson, director of global ETF research at Morningstar. “There were a lot of redundant products across the ranges the firm acquired, and also a number of products it rolled out organically that failed to gain traction.”

A further 48 ETFs operated by ComStage, a platform run by Germany’s Commerzbank, were closed after the operation was bought by Lyxor the ETF arm of French rival Société Générale, with most being absorbed into Lxyor funds.

The mergers were designed to create “larger and more liquid investment opportunities,” Lyxor said.

The other main motivation for closing funds was to liquidate sub-size vehicles that failed to attract enough assets to be viable.

“There is the challenge of margin pressure and trying to cut costs in running businesses,” said Deborah Fuhr, co-founder of ETFGI, a consultancy.

“If an ETF hasn’t raised significant enough assets to cover its costs, then you are basically funding that ETF from some other area of your business,” added Ms Fuhr, who said ETFs typically needed about $50m-$100m of assets in order to be profitable.

Mr Johnson likened the approach of some ETF providers to a spaghetti cannon: spraying out a torrent of funds to see what sticks, with the failure rate increasing in recent years as the lack of unclaimed “white space” in an increasingly mature industry has led to the creation of ever more niche and esoteric products, such as restaurant, whisky and even Nashville-themed ETFs.

The past year also saw the closure of a number of factor-based, or smart beta ETFs, as well a liquid alternative funds, such as long-short equity products, in part due to poor performance.

Industry heavyweights BlackRock iShares and Vanguard closed comparatively few ETFs, with many of the products they did delist being currency hedged products.

Mr Johnson believed asset managers had overestimated retail demand for funds that allowed US-based investors to buy European or Japanese equities without being exposed to the euro or yen.

The TrackInsight data only cover ETFs themselves, not other exchange traded products such as those trading in oil futures — sometimes referred to as ETFs — that collapsed when crude prices briefly plummeted into negative territory in April.

Click here to visit the ETF Hub

Comments