Russia ETF prices veer sharply from underlying value

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

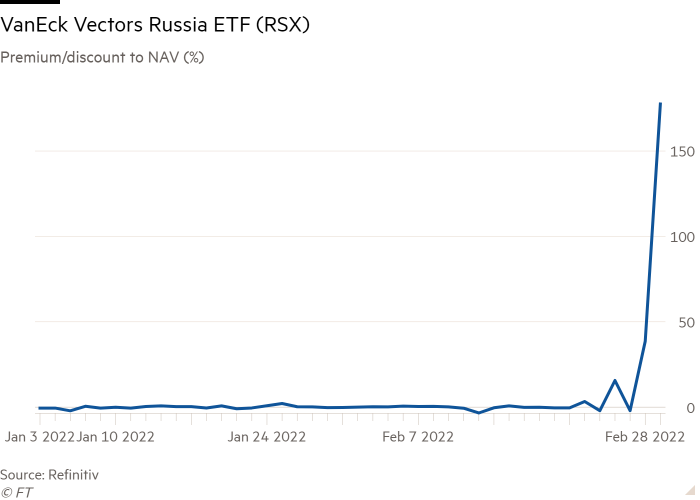

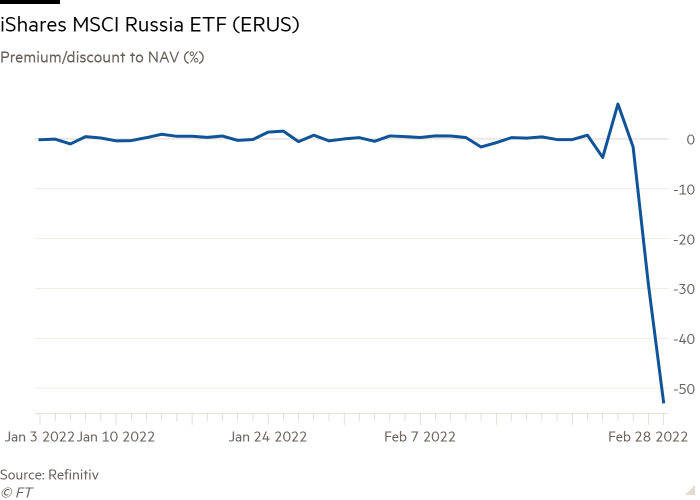

Premiums for exchange traded funds focused on Russian securities listed overseas have surged to unprecedented levels even as other Russia-focused ETFs plunge to historic discounts amid disjointed trading.

The $446mn VanEck Vectors Russia ETF (RSX) closed on Tuesday at $8.26, a 177 per cent premium to its net asset value of $2.98 a share.

Similarly the iShares MSCI Russia ADR/GDR Ucits ETF (CSRU) closed at $28, 59.7 per cent above its NAV of $17.53.

However, most Russia-focused ETFs have plunged to sharp discounts, with the $165mn iShares MSCI Russia ETF (ERUS) and iShares MSCI Eastern Europe Capped UCITS ETF (IEER) both closing at discounts of 50-60 per cent to NAV.

ETFs usually trade at prices very close to their NAV, as the creation and redemption process used to determine the number of shares in issuance produces an arbitrage mechanism that allows market makers to profit from any variation.

However, owing to the sanctions imposed on many Russian companies after the invasion of Ukraine, the closure of the Moscow stock exchange, capital controls and some ETF issuers’ unwillingness to increase their exposure to Russian securities, many Russia-focused ETFs have halted the creation process and sometimes also the redemption process, causing the arbitrage mechanism to break down.

ETFs largely or wholly investing in Russia-focused American and global depositary receipts — securities listed in the US or Europe that represent ownership of underlying shares in the company — such as RSX and CSRU have swung to wide premiums.

With the Moscow exchange remaining closed since Friday, these ADRs and GDRs have become the main means of price discovery for Russian stocks. The ETFs’ premia suggest at least some market participants believe these depositary receipts have been pushed to unrealistically low levels in the stampede to exit.

While these investors could simply buy the ADRs and GDRs, it is becoming harder to trade them and ETFs may offer greater liquidity.

With many depositary receipts now trading at pennies, some investors are clearly willing to take the risk of buying, said Dan Izzo, chief executive of ETF market maker GHCO.

“One announcement can [potentially] risk reverse everything and [the market] comes flying back, no matter how unlikely that seems,” he said. “Whatever the price of RSX is, that’s going to be where the collective market is valuing it.”

Todd Rosenbluth, head of ETFs and mutual fund research at CFRA Research, said with the creation of new units in ETFs such as ERUS having been suspended, while market makers can still redeem existing units, “there is a supply-demand imbalance that has occurred because of the lack of creation” that has produced the premia to NAV.

The contrast with ETFs investing directly in Moscow-listed Russian stocks is stark.

“These ETFs have continued to trade but the NAV is stale because it is based on prices from days ago, before the negative impact of sanctions were fully appreciated by the market,” said Rosenbluth, hence these ETFs have plunged to sharp discounts to these outdated NAVs.

BlackRock cautioned investors that ERUS “may not meet its investment objective, may experience increased tracking error, may experience significant premiums or discounts to its net asset value, and/or have bid-ask spreads wider than its historical average”.

Izzo believed traders punting on the likes of RSX and CSRU in the hope of a rally in the underlying securities were playing with fire.

“There is a very real risk and an expectation that the GDRs will be delisted, as all instruments in Europe related to Russia are being progressively removed from the market,” he said.

“Anybody who is long is risking trapping capital within this product. Your capital could be locked in deadweight for 20 years.”

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Comments