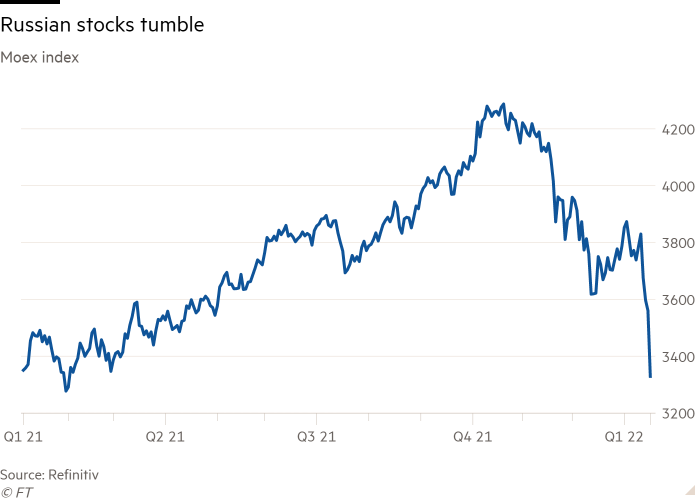

Russian stocks take biggest tumble since March 2020

Simply sign up to the Russian business & finance myFT Digest -- delivered directly to your inbox.

Russian stocks tumbled on Tuesday by their most in nearly two years and the rouble came under further selling pressure on mounting fears Moscow may be planning a renewed invasion of Ukraine.

The Moex index fell by 6.5 per cent, taking its losses to about 13 per cent over the past four trading sessions, while Russian government debt continued to slide. The dollar-denominated RTS index fell 7.3 per cent, hitting its lowest level since late 2020.

“We are seeing dislocations in the pricing of rock solid fundamental stocks, as certain western investors are exiting Russia at ‘any price’. The pain looks to continue into the days to come,” said Luis Saenz, head of international distribution at Sinara Financial Corporation.

The rouble fell by 0.9 per cent on Tuesday to 76.7 to the dollar, close to a nine-month low.

Though President Vladimir Putin denies he is planning to attack Ukraine, he has threatened an unspecified “military-technical response” if the west does not meet sweeping Russian security demands.

The US and EU have threatened to impose strong sanctions in response to any attack, which could include moves to cut Russian banks off from the global financial system and restricting the oil and gas exports that provide half of the Kremlin’s budget revenue. Talks in Geneva and Brussels to discuss Russia’s grievances with Nato hit a “dead end” last week.

“I would be surprised if this turns into a full-fledged conflict, but that’s not what the market seems to think,” said Richard House, head of emerging market debt at Allianz Global Investors. “If it does, financial sanctions would follow pretty quickly.”

Shares in giant state-run lender Sberbank, which is often seen as a proxy for the Russian state, fell 8.5 per cent on Tuesday to a three-month low.

The volatility sent yields on Russia’s 10-year rouble-denominated bonds, known as OFZs, to their highest level since early 2016, prompting the finance ministry to cancel a weekly rouble bond auction scheduled for Wednesday. Russia’s dollar-denominated bonds have also been under pressure, with one maturing in 2047 trading with a yield of around 4.5 per cent, from about 3.6 per cent at the end of 2021.

For foreign holders of Russia’s bonds, the greatest threat was US-imposed sanctions that would prevent trading of existing debt in the secondary market, according to House. This in turn would mean Russian bonds would probably be ejected from indices tracked by hundreds of billions of dollars.

“That would be a situation where you have a lot of forced sellers and not many buyers,” he added.

The sell-off in Russian assets was likely to continue as long as geopolitical tensions over Ukraine persist and investors dump emerging market assets in countries with high interest rates and inflation, analysts at Alfa-Bank wrote.

Elsewhere in emerging markets, Turkish stocks sustained a fresh blow ahead of a central bank meeting later this week. The benchmark Bist 100 stock index dropped 5.1 per cent, with the lira falling about 1.5 per cent against the US dollar.

The Turkish central bank, which announces its latest policy decision on Thursday, is expected to keep interest rates on hold despite consumer prices surging 36 per cent in December, compared with the same month in 2020. President Recep Tayyip Erdogan has pursued an unorthodox policy of pushing the country’s central bank to cut interest rates despite calls from analysts and economists to raise them to fight high inflation.

Comments