SuperPumped at private equity’s SuperReturn

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

One thing to start: Thank you for all the reader responses over the past few months on how we can improve this newsletter. We have taken on board the request for a bulleted summary of the main items at the top, as you can see below. Please keep the feedback coming and thank you for reading! — Arash and JFK

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

SuperReturn returns

EY’s break-up plans

Last dance: the Fed hasn’t stopped the private equity party yet

The buyouts business has a lot to worry about.

Interest rates are rising and markets are tumbling. There’s a war in Ukraine and the future of globalisation is far from certain. And as the heady deals struck during last year’s boom are at risk of becoming a “bad vintage” — the industry’s euphemism of choice — some investors have become hesitant, or unable, to pour cash into new buyout funds.

And to add to that, the Securities and Exchange Commission, the Federal Trade Commission and the Department of Justice’s antitrust unit all have private equity in their sights.

Some attendees of the industry’s biggest gathering, the SuperReturn conference held in Berlin this week, sounded as sober as you might expect.

“This is a time of reckoning for our industry,” Philipp Freise, KKR’s co-head of European private equity, said during a panel discussion, adding that he expected “much more differentiation” between good and bad deals and firms.

At least when it comes to raising megafunds with relative ease, he said, “the party is coming to an end”.

Some parties carried on, though.

SuperReturn guests were treated to an intimate Duran Duran performance in a former malt factory in the city’s Tempelhof district — followed by a DJ set from Mark Ronson. And Evercore hosted an Ibiza-themed dinner and cocktails evening at Soho House with a “summer white” dress code and a performance from Groove Armada.

There was happier talk on the sidelines. Several senior dealmakers consoled themselves that they had avoided buying into some of the past few years’ excesses, such as special purpose acquisition companies, unprofitable tech businesses and cryptocurrencies.

“We’re not heavily exposed to the greatest extremes,” one told DD’s Kaye Wiggins.

Others were getting ready to buy companies at new, cheaper prices. “I’m excited, I’m looking forward to this environment,” another buyouts executive said. “Some of the best, most interesting deals will be done in the second half of this year.”

EY: breaking up is hard to do

Most people know splitting up tends to be complicated. But if you have 13,000 partners, it’s extremely so.

That’s the conundrum EY finds itself in as it weighs breaking up its audit and advisory business.

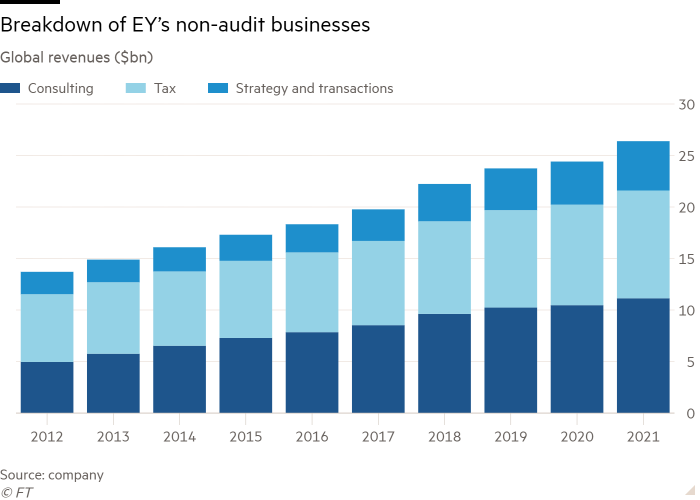

The split would liberate EY’s more exciting advisory business — which includes consulting and deal advisory — from its run-of-the-mill audit division.

If successful, clients such as Amazon and Google, which are currently off limits for advisory work because of a risk of conflict of interest, would suddenly be fair game.

Before that can happen though, EY’s global leaders have to win over the group’s member firms, spanning about 150 countries.

Here’s how it might be done: convincing the auditors — who would be left with the “boring” side of the business — is the first port of call, a senior partner at a rival Big Four firm told the FT’s Michael O’Dwyer.

Many new starters join the audit business with the hope of transferring on to more interesting projects later, so attracting talent could become a problem.

Those on the advisory side would perhaps have to take a short-term hit from having to promote a new brand that isn’t attached to a large audit practice. But the split would allow them to court large clients they’ve previously had to distance themselves from.

As with most break-ups, keeping everyone happy is going to be a challenge, but EY is hoping that if successful, it will have a first-mover advantage.

Job moves

Fashion retailer Asos has named chief commercial officer José Antonio Ramos Calamonte as its new chief executive. Jørgen Lindemann, who joined the board as a non-executive in November, will take over as chair.

Michael Schoenfeld will join Brunswick Group as a partner in the firm’s Washington DC office. Schoenfeld comes from Duke University, where he was vice-president of public affairs and government relations as well as chief communications officer.

Law firm Cleary Gottlieb has hired Nico Abel as an M&A partner in its German office. He joins from Herbert Smith Freehills.

TDR Capital has hired Rob Hattrell to run its digital strategy. He joins from eBay where he was a senior executive, according to Bloomberg.

JPMorgan has hired Gokul Mani as a regional head for equity capital markets in the Middle East, Africa and eastern Europe. He joins from the London Stock Exchange and before that Bank of America.

Law firm Paul Hastings has hired Tom Cartwright as a partner in its private equity and M&A practice in London. He joins from Morgan Lewis.

Smart reads

A billionaire’s bet Colombian tycoon Jaime Gilinski is doubling down on his bets — with support from Abu Dhabi — on local businesses even as some investors are unnerved by the prospect of a former leftist guerrilla winning the presidency, the FT reports.

Boot-Strapping Our FT colleague Cat Rutter Pooley argues how UK pharmacy chain Boots, which is being sold by its owner Walgreens, is a British symbol for how the buyout boom has gone bad.

Clean-up job Jeff Bezos is feted for everything he achieved in building Amazon. But his replacement Andy Jassy is having to tidy up the problems left behind by his mentor, The Wall Street Journal reports.

News round-up

West End landlords Shaftesbury and Capco agree £5bn merger (FT)

Veolia promises to sell UK units to appease competition watchdog (FT)

Two potential bidders for THG walk away from online retailer (FT)

Revlon files for bankruptcy after supply chain woes and competition struggles (FT) + (Lex)

Musk tells Twitter staffers company must ‘get healthy’ (FT)

Bridgewater vs Europe (FT Alphaville)

Wall Street secrets pit $75bn pension plan against trustee tasked with protecting it (BBG)

Due Diligence is written by Arash Massoudi, Kaye Wiggins and Robert Smith in London, Javier Espinoza in Brussels, James Fontanella-Khan, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde , Francesca Friday and Antoine Gara in New York. Please send feedback to due.diligence@ft.com

Comments