Hunt for answer to bond blues turns to active ETFs

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The crushing of global interest rates to historically low levels has delivered big gains for bond investors and crowns a four-decade run of solid returns. From here, the picture looks tougher and that may mean investors need to take a more active approach to managing their portfolios.

A universe where bonds provide little to no interest fails in providing a fixed income beyond the current rate of inflation. It also limits the prospect of capital appreciation for portfolios. And that’s the good news. Far more daunting is the likelihood that investment in government and other high-quality bonds over time registers negative returns once the global economy negotiates the pandemic.

Sure, central banks will try to limit a sharp rise in yields on bonds, but a potentially more inflationary future explains why many current investment strategists favour a greater shift towards owning equities, commodities and alternative assets such as infrastructure. Plenty think bond returns are set for a repeat of their modest run returns in the decades before 1981. Returns fell in real terms during the postwar period, hurt by a combination of yields being low and rising inflation.

That does not mean investors can, or will, turn their backs on fixed income, which in the US constitutes a $45tn market of outstanding debt, and continues growing. Investment mandates in bonds are well-established and, more importantly, there are ways to mitigate the pain of low yields given the diverse and broad scope of fixed income instruments.

While a company trades under one equity market listing, bonds are a more diverse story. Debt is sold with different maturities and yields and across a variety of sectors. These range from sovereign borrowers and corporations to the bundling of mortgages, car loans and credit cards, among others. That provides a savvy bond investor with a broad menu to help them navigate swings in market interest rates and the economy.

Into this mix comes the rise of an unlikely product: exchange traded funds for bonds, a low-cost way to invest in a basket of assets by tracking an index. This could have a big impact.

At the recent Morningstar Investment Conference, BlackRock chief executive Larry Fink said: “We’re seeing more and more active investors using ETFs for active management. They go in and out of passive exposures through ETFs, and the biggest transformation of that is in fixed income. The fixed income market will be substantially more of an ETF market in the future.”

In recent years, more money has been flowing into ETFs that track various baskets of US bonds than equities. The process of buying and selling an ETF is smoother and faster than transacting in cash bonds and that has transformed fixed income trading in recent years.

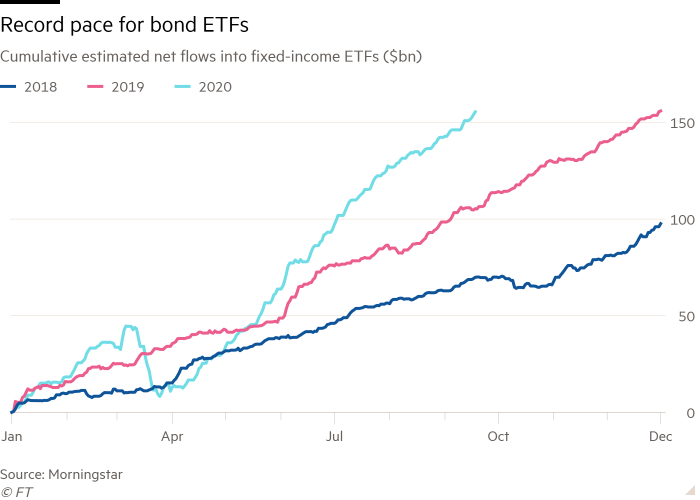

Currently, actively managed bond ETFs represent nearly one-tenth of the $1tn market, according to ETF.com. Among net inflows this year of $152bn into fixed income ETFs, 13.4 per cent — or $20.4bn — has been garnered by the actively managed bond sector.

When market turmoil hit in March, as Covid-19 started to spread, corporate credit ETFs were quicker to reflect the downward pressure on prices compared with cash bonds. As part of its measures to steady financial markets, the US Federal Reserve announced that it would buy investment-grade credit ETFs. The backing of the central bank and better financial market conditions have spurred record inflows into bond ETFs for the year to date and robust returns.

But now that the juice has been squeezed from bonds and driven yields towards the floor, the case for looking at actively managed fixed income ETFs has renewed impetus.

“The near-zero yield environment has awakened investors,” said Jerome Schneider, head of short-term portfolio management and funding at Pimco. Among the benefits of active ETFs is the “ability to maintain diversification and a freedom to pick sectors such as structured products and mortgages”. “You are trading a bit more and relying less on a buy-and-hold approach,” he says.

An unappreciated aspect of a bond index is that hefty levels of debt belonging to one sector or company have a heavier weighting in the benchmark. Mark Dowding, chief investment officer at BlueBay Asset Management, says: “Passively tracking a flawed benchmark offering ultra-low yields is just less attractive than it once was.”

At Wisdom Tree, the fixed income ETF, the AGGY, largely tracks the leading broad US bond index, which is dominated by government bonds. However, it boosts the weighting of smaller sectors beyond Treasuries in order to generate higher returns.

Expect a growing menu of actively managed ETFs in a yield-constrained world as more investors toggle in and out of bonds. And while advocates of a more active approach in fixed income are talking a good game and make a reasoned case, they need to demonstrate their prowess in the coming years. When rates are so low, investors are counting on finding strategies that beat simply sticking with an index.

michael.mackenzie@ft.com

Comments