How passive are markets, actually?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

How much of the stock market is owned by passive investors, such as index funds? The answer is a lot more complicated than you might think, but some academics have had a good stab at finding out.

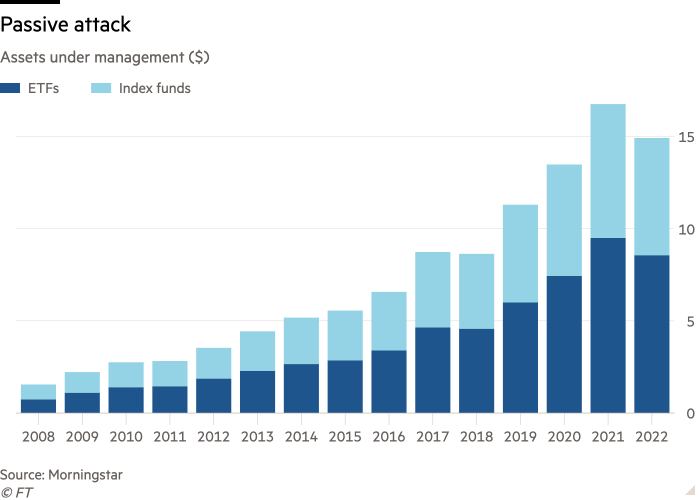

But first, let’s back up a little. The “official” number often used is the amount of money in index funds — whether traditional mutual fund structures or exchange traded funds. Morningstar estimates that was $9.5tn in ETFs and $7.3tn in index mutual funds at the end of 2021, which has since slid to $8.6tn and $6.4tn respectively by the end of July.

Of course, not all index funds invest just in stocks. The bond market has seen an explosion of index funds lately. Nor are index funds actually all truly “passive”, in that they slavishly track a plain vanilla market benchmark. ETFs especially tend to be used in very active ways, or package up active strategies.

Is a factor-tilt fund truly passive, even if the investment process is systematic? When a hedge fund bets on gold mining stocks through an ETF focused on the field, is that actually passive? Surely calling a leveraged inverse Vix-linked ETF a passive investor sounds a bit mad.

Still, the vast majority of the money is in “classic” cheap market cap-weighted passive index funds, so it is a decent shorthand for the size of the industry. Here is Morningstar’s data in chart format.

As a percentage of the overall $42tn open-ended investment fund market tracked by Morningstar, the passive share has more than doubled from 16.8 per cent in 2012 to about 35 per cent today (NB, highlighting how messy the data can be, the Investment Company Institute estimates that the global open-ended fund total is actually over $71tn, which would equate to a passive share of 23 per cent).

However, people often forget that open-ended investment funds only hold a slice of markets, and conflate passive’s mutual fund industry market share with its overall market ownership.

For example, when the passive share of the US fund industry first tipped over 50 per cent in 2019 it caused a lot wailing from people that either didn’t realise (or ignored the fact) that this was only half the equity mutual fund world — in other words, excluding investors like hedge funds, pension plans and ordinary Americans.

As a percentage of the global stock market — which Sifma estimates at $124.4tn at the end of 2021 — the $13.3tn of equity index funds and ETFs at the time accounted for about a tenth. If we zoom in on the US, the ICI estimates that passive funds held about 16 per cent of the entire US stock market.

However, the reality is that a lot of investors invest passively, but do so outside the public universe of index funds and ETFs that we can see. Many big institutional investors hand bespoke index-mimicking mandates to the likes of BlackRock, State Street or Vanguard, which don’t appear in the formal index fund data.

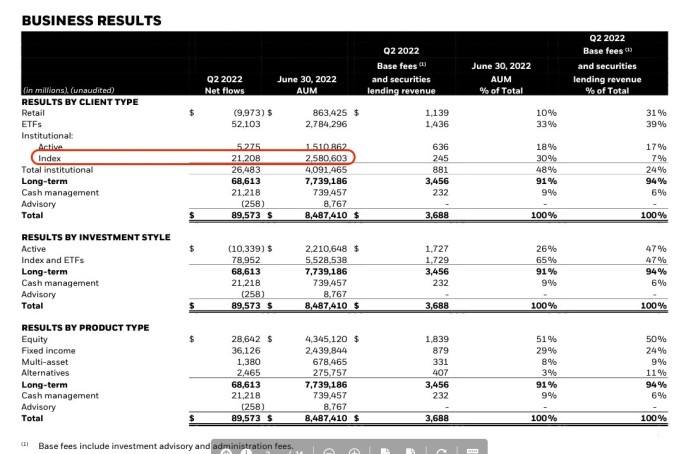

The sums can be huge. As an example, at the end of June BlackRock had $2.6tn in passive institutional mandates, almost as much as the $2.7tn it has in its industry-leading iShares ETF franchise.

That is not all. The reality is that tracking major stock market indices like the S&P 500 is so simple these days that some major institutions — for example, the larger sovereign wealth funds or pension plans — can do it in-house.

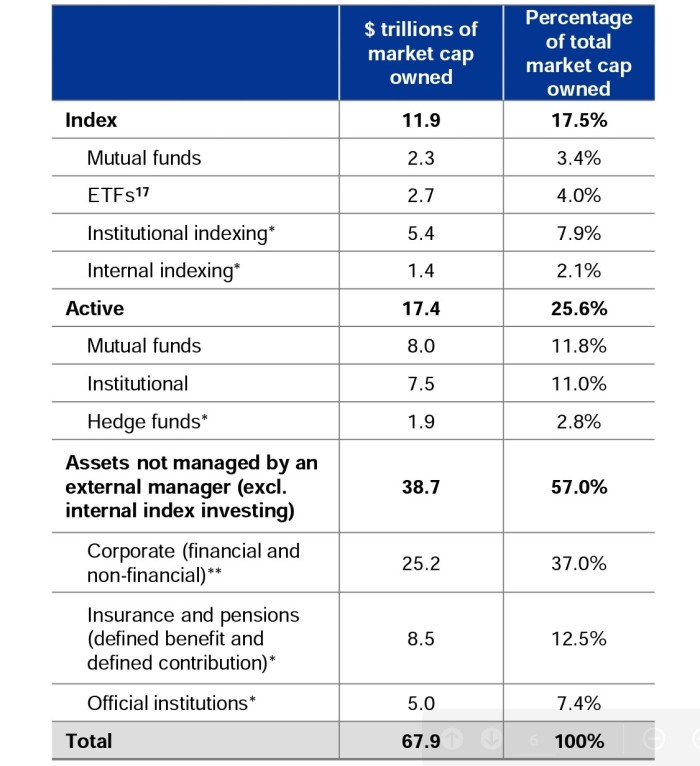

Getting a grip on the size of this “shadow indexing” is tricky, but back in October 2017 BlackRock estimated that there was another $5.4tn in institutional mandates globally, plus $1.4tn in internal index strategies.

Back then BlackRock estimated that 17.5 per cent of the global equity market was held in passive investment strategies, compared to 25.6 per cent in active ones, and the balance held directly by pension plans, insurance companies, individuals, other companies etc.

BlackRock has not publicly updated its numbers since then (presumably because of the growing backlash against index strategies). Using the growth of the public index fund universe you can extrapolate from those 2017 numbers to get a very dirty estimate for the overall passive universe today, but the reality is that there are too many assumptions to feel entirely comfortable with it.

However, a paper published in July (which we only saw recently, thanks to Wes Gray) by Alex Chinco of Baruch College and Marco Sammon of Harvard Business School has come up with a neat way to get a more rigorous estimate.

It’s a BIG one.

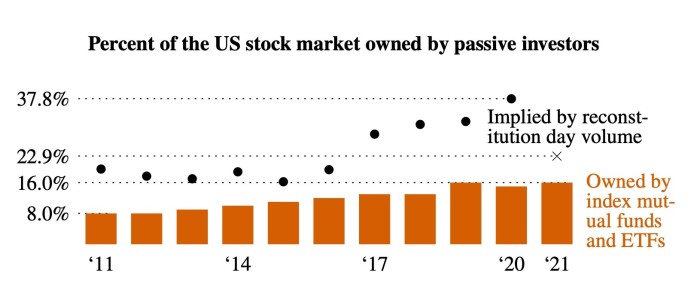

They reckon that passive investors held at least 37.8 per cent of the US stock market in 2020 — more than twice the semi-official size estimated by the Investment Company Institute (which is derived from the size of the index fund universe).

As the chart indicates, Chinco and Sammon get their estimate from crunching the data on the trading spikes triggered by regular rejigging of big indices like the S&P 500, the Russell 1000 and the Russell 2000.

When a company is added or ditched from an index, most index-replicating investors rebalance immediately prior to the close of trading on the day the change comes into effect. From the spurt of trading on regular index “reconstitution” days the economists came up with an estimate for the total amount of money that replicates the indices they looked at. It’s not perfect, but it should be a decent way of gauging the heft of all de facto index-mimicking strategies.

Yet the two economists reckon that even their 37.8 per cent estimate is “almost certainly too low”, as not all passive investors slavishly rebalance on index rebalancing days, and they didn’t look at other popular indices, like the Nasdaq.

To ensure that the trading volume we analyze comes from index rebalancing, we narrowly focus on just the trading volume experienced by adds and drops right at market close on reconstitution days. But not all passive investors are strict end-of-day indexers. In principle, some passive investors could rebalance more slowly. And our approach does not reflect the holdings of these more relaxed passive investors. This is one reason why 37.8% is a lower bound.

Another reason is that it only reflects the holdings of strict end-of-day indexers who are benchmarked to either the S&P 500, the Russell 1000, or the Russell 2000. While these are important indexes, they are not the only indexes. The holdings of a strict end-of-day indexer who is benchmarked to the Nasdaq 100, for example, is not captured by our 37.8% headline number

This meshes with BlackRock’s own 2017 estimates, which indicated that institutional and internal indexing was more than twice the size of the “public” index fund universe.

How big a problem is the fact that passive investing is even bigger than commonly thought?

Chinco and Sammon think it is a big deal that the traditional data on passive ownership is likely off by a factor of two, arguing that “the size of this blind spot poses a real problem for anyone trying to use these models to make policy decisions”.

A host of people will probably agree, having gnashed their teeth at the irresistible growth of passive investing in recent years. Back in 2017 Elliott Management’s Paul Singer memorably described it as “a blob” that was “in danger of devouring capitalism”. Here’s an excerpt from his letter to investors dealing with the phenomenon:

There is nothing ethically wrong or indefensible in running a mega-shop focusing on passive investing, nor do passive investors have an obligation to overcome or counteract the adverse trends that have been discussed in this piece (although they should care). We believe, however, that there is a fallacy of composition and that what may have been a clever idea in its infancy has grown into a blob which is destructive to the growth-creating and consensus-building prospects of free-market capitalism. This “overgrowth” is a drag on the power of capitalism to adapt, to continually strive for excellence, efficiency and creativity and to deliver goods and services for citizens in the manner in which it has done for the last couple of centuries. In effect, therefore, it is dangerous, ultimately divisive and may be an important reason the pro-freedom or pro-capitalism consensus dissipates over time.

Is it really that dangerous though? Setting aside issues around the mounting concentration of corporate power, the fact is that passive investing is much bigger than commonly thought, and yet there is to our eyes very little evidence that the overall efficiency of markets has deteriorated as a result. That it’s harder and harder to beat the averages implies that markets are getting more efficient overall, not less.

Sure, the rise of passive investing is unquestionably having an impact on financial markets. How could it not? But is it really that much more malign than other forms of investing? That seems questionable, when stacked up against the benefits for investors everywhere.

The harsh reality is that the investment industry as a whole makes a staggering amount of money — listed US asset managers had an average profit margin of almost 26 per cent in 2021, more than twice the S&P 500’s average — and yet do a bad job on average. Despite the march of passive over the decades, there are still more mutual and hedge fund managers than ever before, many of which in practice do little more than extract rents from the financial system.

But this is clearly such a monumental shift that someone should really write a book about it. Oh wait . . .

Comments